Economy

India's 'Atmanirbhar' Stock Rally: How Retail Money Keeps FII Impact Limited

R Jagannathan

Feb 07, 2024, 11:59 AM | Updated 08:34 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

The still booming stock markets in India, despite adverse global developments, are another symbol of India’s growing 'atmanirbharta' in domestic investment capital.

Foreign institutional investors (FIIs) held over 18 per cent of National Stock Exchange-listed entities as of December 2023; domestic institutional investors (DIIs), which include mutual funds and insurance companies, hold nearly 16 per cent.

A report in The Economic Times based on data from Primeinfobase.com says that DIIs could overtake FIIs pretty soon, given the kind of domestic inflows into mutual funds and pension funds.

In December 2023, mutual fund systematic investment plans (SIPs) hit a new high of Rs 17,610 crore, which is an accretion rate of more than $2 billion a month. Total SIP inflows in the nine months to December in fiscal 2023-24 hit Rs 141,923 crore, which means the 2022-23 figure of Rs 155,972 crore for 12 months will be crossed in January itself, with two more months to go.

At a run rate of Rs 1.8-2 lakh crore or thereabouts annually, we are talking about domestic SIP-based investments of $22-24 billion. And this does not include direct retail and high-net-worth investor contributions.

Over the last four calendar years, from 2020 to 2023 (plus a little over a month of 2024), DII investments (says The Economic Times report) were more than double that of FIIs at Rs 549,759 crore — which implies that this rally in stocks is largely domestically driven. Indian patient money is trumping skittish foreign money, where FIIs pulled out funds from India in two of the last four calendar years.

This is not to suggest that the stock market rally can continue endlessly on domestic steam alone, for ultimately the prices have to reflect corporate performance fundamentals, but it is difficult to foresee any drastic crash based purely on domestic economic or political issues.

So who or what can play party poopers?

First, if the 2024 elections throw up any surprises — ie, an unexpectedly poor showing by the BJP — the market could correct sharply.

Second, and this is the bigger worry, if the wars in Ukraine and west Asia get worse, all bets are off. Already the war in west Asia has dragged in the Houthis of Yemen, the Hezbollah from Lebanon, and even Iran and the US.

As for the Ukraine war, it is becoming increasingly clear that Ukraine cannot win. But if the West decides to widen the war by bringing NATO in directly in order to avoid a Ukrainian rout, the markets could be unforgiving.

But one thing is clear. India’s growth story will now be increasingly driven by Indian risk capital as the growing investor class is taking to long-term stock investing in a disciplined manner. The market is no longer hostage to the opportunistic inflows and outflows of skittish foreign investors.

The retail investor has grown smarter and is no longer seeing the stock market as merely a get-rich-quick avenue.

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

Jagannathan is Editorial Director, Swarajya. He tweets at @TheJaggi.

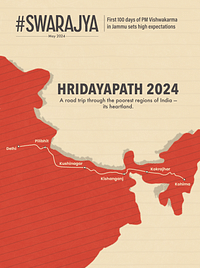

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.