How Indian Should Air India Be? A Few Questions For RSS Chief To Ponder

Air India is not a strategic asset worth fretting about, Mr Bhagwat. It can serve Indians without being owned by Indians.

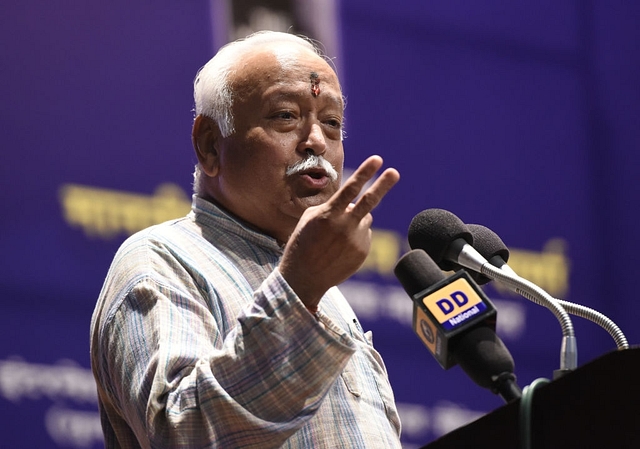

Rashtriya Swayamsevak Sangh (RSS) chief Mohan Bhagwat said on Monday (16 April) that he would like an Indian to own and run Air India. On the face of it, there is nothing wrong with this nationalist statement, for every country has a right to decide what assets it will not sell to companies domiciled elsewhere. The US has in the past blocked the sale of companies it considered strategic, including Unocal by a Chinese company in 2005, and Qualcomm by a Singapore-domiciled firm Broadcom last month.

During an event at the Bombay Stock Exchange, Bhagwat was quoted as saying: “if Air India has not been run properly, then give it to those who would be able to run it properly. He should be an Indian as you should not let your skies be controlled by someone else. Look at Germany or Russia – they don’t allow a majority shareholding in the company, they don’t allow more than 39-49 per cent. Even if someone gets the majority stake, the countries have the power to confiscate the shares and sell them.”

In a sense, the government’s norms for the sale of Air India already limits foreign shareholdings to 49 per cent even though the total divestment will be upto 76 per cent. So, Bhagwat has no reason to think Air India is passing fully to foreign hands; 51 per cent of the ownership will remain Indian for the foreseeable future, assuming the privatisation bid succeeds.

However, it is worth asking a few questions. What exactly is Air India? Is it the brand name? Is it the airline’s employees and its assets minus liabilities? Or a composite of all three?

If the assets and liabilities are sold and the brand name retained in government hands, would Air India remain Indian? If the brand name is sold to, say, an Indian airline company – say Go Air – for Rs 100 crore, would it then satisfy the Bhagwat norm of Air India remaining in Indian hands and owned by an Indian?

If the net worth of Air India, including its loans, is negative, what is the advantage in keeping the airline Indian? The airline has not made a net profit for more than a decade, despite a procession of chief executive officers coming and going.

And are Air India’s problems merely due to bad management or is the current ownership structure itself doomed to produce failure? With netas and babus meddling with it constantly – the airline went into a tailspin when Praful Patel was civil aviation minister – how can merely the insertion of a better management team work wonders?

Bhagwat could also consider another point: is Infosys, run by Indians, and owned substantially by foreigners, an Indian company? Or HDFC Bank? ‘

One answer could be this: yes, they are Indian as long as the top management is headquartered in India, the jobs are largely Indian, and the customer footprint is largely in India, even if dividends are sent to diverse owners abroad. At dividend yields of less than 3 per cent, this is one of the lowest cost at which Indian companies can service capital. With this definition, both HDFC Bank and Infosys are Indian companies, though the latter is substantially a north American company earning the bulk of its revenues there. But as India starts investing more in technology, this skew will be reduced over the coming decades. In fact, both HDFC Bank and Infosys could be acquiring large companies abroad in future.

Coming back to Air India and Bhagwat, perhaps the question the RSS chief should be asking is a simple one: what is so strategic about an airline that only bleeds the taxpayer dry? One non-economic argument trotted out is that in times of crisis, like the evacuation of Indians from war-torn Gulf, it is easier for the government to commandeer Air India and its fleet at a moment’s notice.

There are two problems with this argument: one, it makes no sense to leave paying customers high and dry just because you have a geopolitical crisis and need a part of Air India’s fleet for the evacuation. In any event, in the case of such emergencies, every national government has the power to ask any domestic airline to divert resources to protect its nationals’ lives. The pain can be distributed across airlines instead of just the taxpayer-owned airline.

The airline industry is a thin-margin business, and it makes no sense to own Air India just for vanity purposes.

There is, however, a case for not handing over the brand name to a foreign company. Why not sell the airline minus the brand name? Air India can then be the name of the VIP aircraft, just like the US President’s Air Force One, meant to carry the country’s top political managers or the President and Vice-President on their official tours.

It is unlikely that a foreign airline or even a domestic partner will want the brand name more than the assets – airport slots, landing rights, ground handling facilities, and the aircraft – since this would allow them to seamlessly merge the airline with their own global operations to tap synergies.

Bhagwat should not worry. Air India is not a strategic asset worth fretting about. It can serve Indians without being owned by Indians.