Six Reasons Why SEBI Is Right In Extending Trading Hours In Agricultural Commodities

Some traders and representatives in the agriculture sector have protested vehemently against SEBI’s move to extend trading time. We assess their arguments.

On 30 November this year, the Securities and Exchange Board of India (SEBI) came out with a circular revising the hours of trading in agricultural derivatives to between 9 am and 9 pm. Till now, the trading hours were 9 am to 5 pm.

SEBI had already allowed trading in agri-processed commodities from 9 am to 9 pm, while in metals, trading continues up to 11.30 pm when it is United States daylight saving, and 11.55 pm if it is not the daylight saving period.

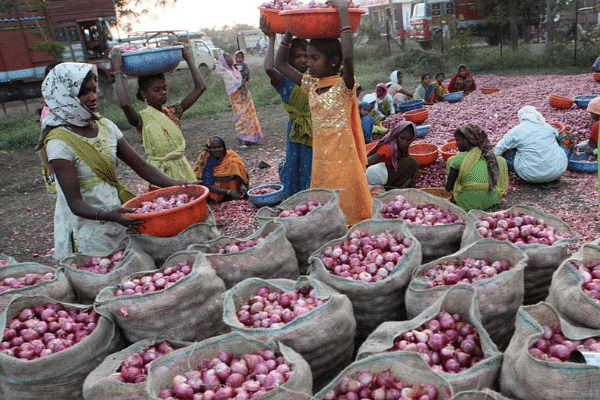

Usually, SEBI’s decisions are received with a mixed reaction. This decision, too, met with the same fate, though those against the move seemed to have got more mileage. Before we go into the merits of SEBI’s decision, let us look at the commodities that are being traded.

Commodities are actively traded on three exchanges, Multi Commodity Exchange (MCX), National Commodities and Derivatives Exchange (NCDEX), National Multi Commodity Exchange (NMCE), Hapur Commodity Exchange, and Indian Commodity Exchange Limited (ICEX).

A slew of commodities is being traded on these three exchanges with the total turnover in October being 8.7 per cent higher, at Rs 6.89 lakh crore, compared to the same period a year ago. In 2017-18 fiscal, turnover on commodity exchanges dropped nearly 8 per cent to Rs 60.22 lakh crore.

This being the scenario, SEBI seems to be sincere in its efforts to try and find out if extending the trading time can help. But some of the traders and representatives in the sector have protested vehemently against the move. They have come up with a couple of arguments to make their case.

One, they say farmers cannot be expected to be trading from 9 am to 9 pm as it would affect their routine. Two, traders say that when the spot market, which is the reference that derivatives markets draw up on, is closed, how can the futures market function? Third, by keeping open their offices and terminals till 9 pm, they would stand to incur more overheads. Fourth, participation of small traders, who interact more with farmers, will not be possible when they close their shop by 6 pm. Fifth, those who are against the move say it would lead to speculation. And sixth, it will benefit foreign entities more.

How far are these arguments valid? First, let us see about the argument that the farmer’s routine will be affected. Say, a farmer works from morning to evening and most probably gets rest from around 5 pm. When the farmer is engaged in farm work from morning to evening and is holding a produce that he expects to fetch a good price for, isn’t it prudent that the farmer sell that at leisure. More so, in the evening when he has no worry about tending his farm?

Also, farmers don’t simply land up in the market with their produce until and unless they have liquidity problems. With mobile phones coming in handy, farmers usually call up one of the traders at the mandi or terminal market. If the prices are up to his expectations, he takes a decision to sell. Remember, today’s farmer has access to all tools of price information, and he is fully aware of the price he should get.

Second, the argument that there is no reference point when the spot market is closed doesn’t cut it. This is because in most terminal markets, farmers wind up their sales by 11 am. However, the electronic National Agriculture Market concept is catching up. Once the infrastructure is in place and the current teething problems are overcome, farmers should and could have more choices even in the timing of their sale.

Third, traders say they will have to incur additional overhead costs by keeping their terminals or centres open till 9 pm. True, but seen the other way around, wouldn’t they get additional business if they are open for four more hours and ensure they make optimal use of their resources?

Five, the view that this move will lead to speculation is laughable. Is trading in derivatives and options speculation, though armed with data that indicate the possible direction the price of commodities will take?

Also, markets in the US become fully functional around 7.30 pm Indian time. Indian commodity price trend now reflects prices abroad, and in case of some agricultural produce, it even rules higher. In such circumstances, shouldn’t a grower or farmer be given an opportunity to get more for his produce?

The sixth argument that foreign entities will benefit isn’t valid. Foreign entities could be looking to buy from here. For example, India is the leading exporter in castor oil. So, based on the higher demand for oil, if someone looks to hedge his bet on castor seed, is there anything wrong? And wouldn’t farmers be assured of a higher price going forward?

Leaving all that aside, how many farmers are really active in the derivatives market? Pointing fingers at farmers for one’s own laziness or laidback attitude won’t do. On the other hand, SEBI’s contention that it will benefit farmer producer organisations seems valid.

What the SEBI has done is not anything new. The Indian commodities sector has been already trading in metals until almost midnight and in agri-processed commodities till 9 pm. Now, agricultural commodities join the list.

Products are processed from produce. A produce will certainly gain if the products of user industries rise. It also points to higher demand. Why should a farmer be denied of a higher price if he were to get it by the extension of trading hours?

On its part, SEBI should be open to the views and suggestions put forward by the traders. If indeed trading suffers on account of extended timing, it can take remedial measures, going for a case-by-case examination. Until then, it would be better to let SEBI have its way.