The economics of Moore’s law: A test and a corollary

A TEST AND A COROLLARY

The Moore’s Law compatibility test can safely predict the future Superpower of the world. However, it throws up a surprise. The Chinese economy remains fundamentally incompatible with Moore’s Law and therefore cannot expect to topple the U.S. from its position of dominance. As for India, the less said, the better.

My previous post on Centre Right India titled “Moore’s Law and the Unravelling of the Soviet Empire” was based on the premise that the Soviet Union collapsed due to its dysfunctional economy. After all, the cold war had ended without a single shot being fired, it certainly was not a military defeat. Was the political system to blame? Well, China has carried on for two decades since then with pretty much the same political set-up, and that country has gone from strength to strength. Without doubt, the Soviet Union imploded because its economy had become a can of worms, unable to provide for its people and simultaneously service that vast military machine its superpower status compelled it to maintain.

To be sure, the failures of the Soviet economy had many dimensions to it, but I chose to single out one aspect for particular attention. Given the way its economy functioned, the Soviet system could not have capitalised on the extraordinary opportunities thrown up by the advances in computing technology. And this inability would have accentuated and accelerated the process of falling behind, or failing to keep up with the West, leading eventually to that fateful day in 1989 when Mikhail Gorbachev threw in the towel.

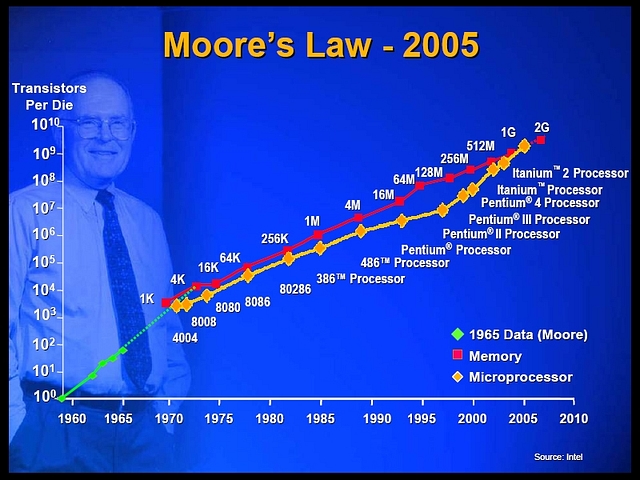

One response was that I was guilty of exaggerating the role of a free market in facilitating Moore’s Law because this is essentially a scientific phenomenon. Chip-makers in the West poured resources into research, and set ambitious targets for their scientists to deliver, because they knew the relevant law predicted a doubling of transistors on integrated circuits every two years. Had the law coincidentally predicted a doubling every three year, somewhat fewer resources would have been thrown at it, and we would have had a self-fulfilling prophecy. The idea is not without merit. Performance is often driven by expectation. As the Wikipedia entry on Moore’s Law says, “His prediction has proven to be uncannily accurate, in part because the law is now used in the semiconductor industry to guide long-term planning and to set targets for research and development.”

The science vs. the economics

But matters cannot rest here. The question must be asked, how much of the continuing relevance of Moore’s law is science, and how much is economics?

At one end is Andy Bryant, Intel’s chief administrative officer, who says Gordon Moore’s original article was actually an economics paper rather than a technical treatise. A 2009 article in the Financial Times titled Moore’s Law Hits Economic Limits

quotes him as saying:

“Moore’s Law is really not about the science, it’s about the business model that the science drives. What Gordon said was the model is driven by the cost reductions that are allowed – the science takes the technology into more and more devices and the volume will explode because the cost comes down, so it is an economic model.”

However, my own impression (admittedly, based on cursory research) is that Gordon Moore himself formulated the idea essentially in the form of science, although he did foresee commercial possibilities from falling prices. That explains why it was published in the Electronics Magazine of April 19, 1965 with the very unexciting title “Cramming more components onto integrated circuits“. (Surely, that can’t be an economics paper!) Besides, his original prediction was modest, that the trend would continue “for at least ten years”.

It now seems reasonable to believe that in the early years the doubling of transistors on ICs that did take place every two years was essentially the realisation of a scientific prospect or possibility. However, around the time that the law had held true for a decade or so—having given birth to an eco-system plugged into the current capabilities of the chip and, equally, into the expectations of further improvements to come—progress ceased to be driven by scientific possibility alone. Instead, it had come to be propelled in equal measure by its commercial possibilities. From this point onwards, Moore’s law would be science as well as economics.

Processing power could grow exponentially, and continue doing so for over four decades now, because at every point along the way, it was reinforced by continuing demand for more of it. And, an important reason why demand would hold up was that in a competitive environment, even as the performance increased by leaps and bounds, prices fell dramatically. The leading manufacturers operated under conditions where they had full freedom to pursue economies of scale. This brought down their costs, and a rigorously competitive climate ensured that the savings were actually passed on to consumers. This was one side of the picture.

The other side is the fact that even as the price-performance equation was improving, the broader free-market allowed different parts of the economy to take advantage of these developments. Businesses in the U.S. were able to make use of the enhanced processing power to increase automation levels, cutting down on labour, bringing down costs, and driving up productivity. In an August, 1999 column in the New York Times (Foreign Affairs: An American in Paris), journalist and author Thomas Friedman puts it bluntly, “U.S. firms are quick to absorb new, more productive technologies because they can easily absorb the cost of the new investment by laying off the workers who used to perform that task.”

What’s more, entirely new sectors and new businesses sprang up in the economy that depended on, and owed their existence to, the newly available computing power. For instance, it stands to reason that demand for processing power (and the wider cause of Moore’s Law) would have received a shot in the arm beginning in the early nineties with the viral spread of the internet and all the new series of activities spawned by it.

Therefore, the idea that something like Moore’s Law could have held the fort in a kind of scientific bubble, insulated from the wider world outside, can be safely dismissed. I would lay my bets on the contrary idea that the wider free market and a free people were critical enabling factors, without which this law would have run aground a long time ago. That’s why the law never quite took off in the Soviet Union. But then, the Soviet Union is history and it matters little what happened there.

Moore’s Law and India

Of much greater relevance to us in India is the question: Would Moore’s law have worked any better in India? (The question assumes that we have the resources and the scientific capability at our disposal.)

My own sense says it would not have. Maybe, it would have worked in the first decade or so when the progression was driven totally by science, but not beyond. When the science alone had ceased to be enough, and when it was time for the economics to kick in, India would have fallen as short as the former Soviet Union.

The first question is of demand. Remember, demand for processing power was driven as much by the ever-improving performance as by falling prices. And prices could decline because manufacturers had the full freedom to pursue economies of scale, including cutting back on labour as productivity increased. This was not a freedom that businesses in India had. The Industrial Disputes Act of 1947 which continues to be in force even now, gives companies little flexibility in the matter of laying off workers.

Secondly, the demand for chips from other sectors keen to improve their productivity would not arise because our official policy was that in a country with huge unemployment, computers would exacerbate the problem and therefore it was actively discouraged. The idea that the increased efficiency would eventually create far more employment remained unacknowledged even as an academic possibility, such was the strength of this conviction.

The third question is about competition. India in those days operated under a system of licenses and quotas, all in the greater cause of “planned” economic development. We did not have competition. What we did have were cosy monopolies and oligopolies, many of them state-owned.

Finally, the idea of manufacturers lowering prices to pass on the benefits of reduced costs to their consumers. In India? Surely, that’s a joke! Hark back to the mindset that prevailed in those bleak days. The government’s response to falling costs in the microprocessor industry would have been a hike in taxes, justified in the name of mopping up resources for its myriad welfare schemes, and because processors were used only by “rich” industrialists, therefore taxing it would not burden the “common” man at all. On the other side, manufacturers sheltered from competition would also be inclined to pocket the extra profits. As a result, processor prices in India would remain unaffordable because taxes would pile up, and with user industries denied freedom to derive benefits in full measure (what use of labour-saving technology when you can’t let go of labour), demand would remain depressed.

And there you have it. Even before it could begin to lay golden eggs, the goose gets killed. That explains why the IT revolution, when it did come to India, came by way of firms operating in India but supplying to the U.S. market, where businesses with full freedom to reduce costs happened to reduce it even further by shipping jobs overseas.

The Moore’s Law Test

At this point, we have the outlines of what I shall call the Moore’s Law test, more precisely, the Moore’s Law compatibility test. It’s a test to determine whether a country has in it the stuff to become the leading superpower of the world, and whether it can take the mantle of leadership away from the United States any time soon. The Moore’s Law Test is a simple question. Given the scientific talent, is the economy of the country capable of replicating and sustaining the performance of Moore’s law? The question makes sense on two counts.

Firstly, the example of the Soviet Union showed that you can have some of the best scientists working at the best research institutions, but beyond a point, if the science does not have the economics keeping pace with it, sooner or later it’s all bound to come unstuck.

Secondly, the lesson from America’s continuing dominance is that to be a military superpower over the long haul, you need be a first-class economy. An essential ingredient of economic might is technological leadership which, incidentally, the U.S. has maintained all along. And yes, let’s get this straight, second place is just not good enough. Because, a globalised world is an intensely competitive place, and competition rewards winners disproportionately. For example, Usain Bolt won the last Olympic gold medal in the 100 metres sprint, but how many of us know (or care) who won the silver medal? Look further into how much Bolt earns in a year and compare it to the earnings of whoever was second, and you have acquired an insight into the economics of “the first place vs. the second place”.

China’s impending superpowerdom is overstated

As the candidate-in-waiting to take over from the U.S., let’s apply the Moore’s Law Test to China first. China’s economy has come a longer way on the road to reforms than India’s. It’s therefore likely that this country will offer a favourable environment to its chip-manufacturers, giving them the freedom to upscale production and downscale labour, as the situation may warrant. Moreover, user industries, particularly those in the SEZs or catering to the export market (constituting about 40 percent of its economy), are likely to have the freedom to take full advantage of faster and cheaper processors to increase productivity. At this point, the Chinese would appear to have the stuff that we are in search of, a broad measure of economic freedom (at least for select parts of its economy).

It leads to the follow-up question, could the internet have come up in China? This question that makes sense when you consider that demand for processing power in the last two decades has been led by the explosive growth in internet traffic. And this is where it all goes wrong for China. After all, the internet is a product of a free market and a free people. The Chinese may have freer markets these days, but they are far from being a free people. At the moment, it’s all very well to be the fastest growing economy and a rising superpower as you play catch-up. But, if China truly aspires to become the top dog, its government will soon have to concede to its people a broad measure of political freedom as well. For now, that looks unlikely.

Why India sucks

Like China, India’s economy too has come a long way since the license/quota/permit days. But have we travelled the full distance as yet? Trade barriers have come down (or were forced down) but we continue to be protectionist in our mindset. Our instinct is to preserve the status-quo, never mind the many inefficiencies it forces us to endure. We are still deeply suspicious of the future especially when, in order to realise its promise and potential, we are called upon to do something unpleasant now. We continue to be distrustful of new technologies and processes that have an initial adverse impact on employment. We have trouble “allowing” Walmart or any other retailing giants into our markets because we “fear” the consequences for small retailers.

Putting it all together, it may be said, a country lacking in a broad measure of economic freedom is unlikely to be the leading superpower anytime soon. On this count, we are well behind China.

What about the internet? Could this—the product of a free market and free people—have come up in India? No doubt, as a people we have more freedom than the Chinese, but a closer look reveals that these extra freedoms are mostly of the kind that allows us to stand up in a public square and hurl abuses at the government without having to fear arrest and torture. When it comes to political freedoms with economic underpinnings (or even freedoms involving questions of faith and morality), we continue to be deprived. Here’s a stray example. After six decades of freedom, our private radio stations are still not “permitted” to broadcast news. In fact, we “allowed” private radio stations to come up only in the last decade or so.

As for the internet, considering that so much of the early traffic on the web was driven by pornography, it’s fair to say that in India where successive governments believed in upholding public morality, and in claiming to know exceedingly well what is good and what is bad for its people, the internet would never have got off the ground. Throw in the internal security angle for extra measure, and the whole thing would have been buried for good.

The Moore’s Law test for India, then, is an even more resounding no. We are well behind China, and that is where we are likely to remain for the foreseeable future.

A corollary to Moore’s Law

I now come to a corollary to Moore’s Law which derives from its economic and commercial underpinnings. In any economy, government control over sectors where the potential for growth is linear may be successful or unsuccessful depending on the quality of the effort. In sectors where the inherent potential for growth is exponential, it is always a failure. There’s a simple explanation for this. The “planning” mindset is essentially rooted in reason. It’s a rational approach that tends to be most comfortable with incremental achievements while being dismissive, distrustful, or simply incapable of appreciating, the exponential possibilities.

It means that government intervention can work reasonably well when it comes to improving literacy rates or providing health care to people as was done in the former Soviet Union or in present-day Cuba. When it comes to the viral spread of internet, cable television, air travel, the mobile phone, the automobile revolution—for that matter the doubling of transistors on an IC every two years for four decades—government control produces below-par performance. That’s why central planning which had so much going for it in theory was a failure everywhere notwithstanding the occasional early achievements. Some of these countries did well in the “linear” sectors but all of them failed miserably in the “exponential” sectors (typically, the emerging technology-driven sectors).

Today, most Cubans don’t have access to cable television, mobile phones, cars, the internet, even to personal computers. I am not surprised.

To conclude, some predictions

In his op-ed column titled “Obama in his Labyrinth” (NYT, 23 Nov. 2009), the journalist Roger Cohen writes, “The great battle of the 21st century is going to be between free-market democracies and free-market authoritarian systems.” Cohen is spot-on, but here’s what he has left unsaid. The free-market authoritarian system is also, by definition, a limited free market in that it ceases to be free the moment markets enter domains considered sensitive by the ruling elites. Consequently, the free-market authoritarian system will never have a free market for ideas. And it will not have a fully free market for those means of communications that can potentially spread ideas unwelcome to the ruling establishment. As the Moore’s Law Test would tell us, without these freedoms, there’s little chance of a country ever taking over the economic (and therefore military) leadership of the world.

At the moment, the rapidly growing Chinese economy looks like a giant cannon that keeps on firing ever larger and heavier cannon-balls. The impact, no doubt, is greater than before, but it cannot be sustained for long. How long can you keep shipping out 80 million cheap t-shirts to buy one Boeing airliner? Evidently, the smarter way is to pack more punch in each cannonball.

It implies that China’s present leadership—and its existing economic and political system—will be adequate only till the time there remains some residual purpose in making larger cannonballs. Beyond this point, I suspect their economy will be found severely wanting. Therefore, if the Chinese leadership has real ambitions for its people, and not just for their own hold on power, they will have to move towards a system compatible with Moore’s Law, with all its economic and (unwelcome) political connotations.

For America’s leadership then, there is both reassurance and a word of caution. The reassurance is that the threat from the Chinese juggernaut is overblown and that rather than panic, they only need to sit tight and hold on. The caution stems from the temptation to tinker with their economic system in ways that would make it “fairer” but also less compatible with Moore’s Law. Needless to add, Americans would be doing themselves (and the world) a huge favour if they choose to vote out their current President, Barack Obama. Because, if an American President has trouble figuring out the economic rationale for outsourcing, it’s better he tries his luck in Greece.

Let me now sum it all up in a couple of sentences. For the Chinese leadership, I am predicting a rude awakening one of these days. As for India’s leadership, it’s been well said ignorance is bliss.

(Author’s note: In Moore’s Law and the Unravelling of the Soviet Empire, I had erroneously stated that Moore’s Law is about the doubling of processing power every two years. As a matter of fact, the Law postulates a doubling in the number of transistors on an Integrated Circuit (IC) every two years. Apparently, since the transistors also improve in performance, in practice, processing power has doubled faster, once in eighteen months. I am grateful to a twitter user for pointing out the error.)