Companies Act Violations Not ‘Crimes’ Anymore: Finally An Administration That Is Not Afraid To Be Seen Standing With Wealth Creators

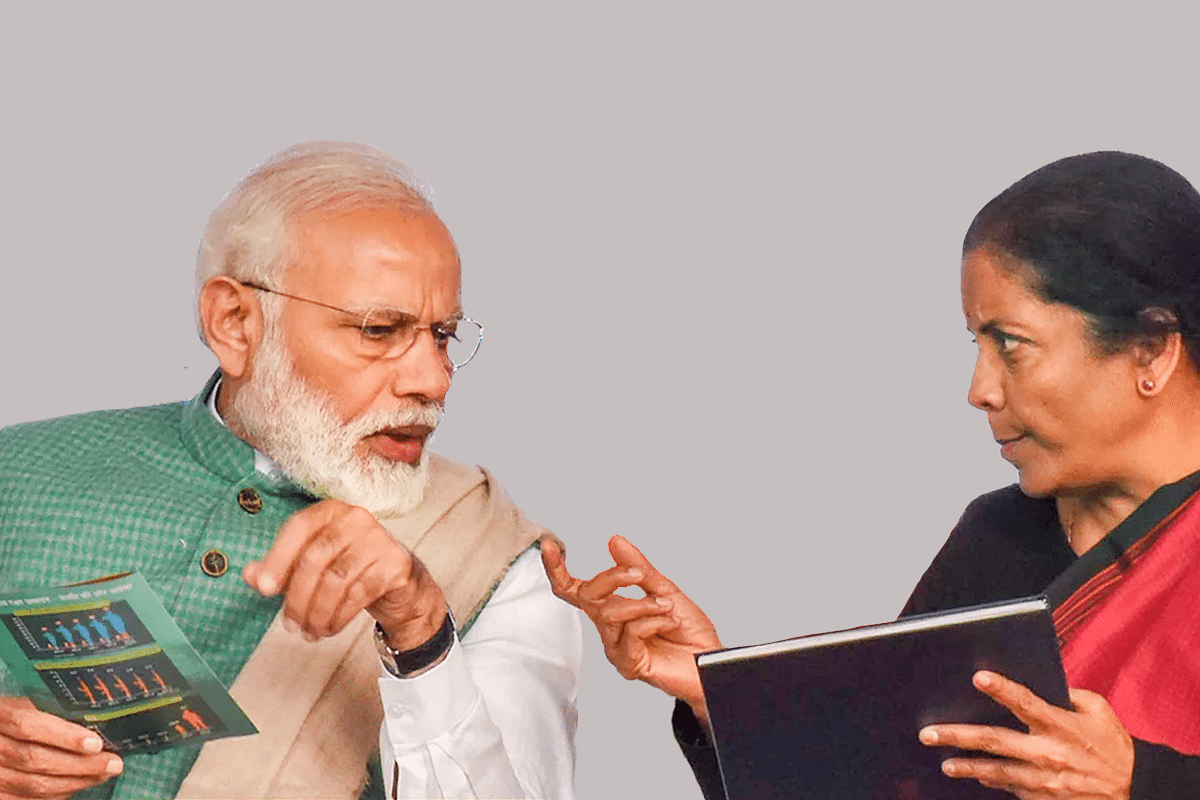

This government is introducing laws to support wealth creators, enabling businesses through improvements in ease of doing business and simultaneously improving the ease of living in India.

One of the most important lessons in the study of policies is that it is mostly a continuous attempt of intervention with the objective of achieving a desired outcome. That is, they are (or rather they should be) geared towards a single objective which makes them comprehensive and helps in efficiently achieving the desired objective.

A similar such attempt has been underway since the last five-and-a-half years now as government continues to make changes in laws to ensure they are compatible with its vision of celebrating wealth creators, enabling businesses through improvements in ease of doing business and simultaneously improving the ease of living in India.

The recent attempt to decriminalise offences under the Companies Act is yet another endeavour in that direction.

The opportunity to make such changes was present with the United Progressive Alliance (UPA) when it brought in the Companies Act, which mandated corporate social responsibility (CSR) thereby adding yet another hidden tax on doing business.

The CSR requirements are yet to be removed and a reluctance of India’s industry leaders to request for the same could be a major reason why the provision remains.

Indeed, it would make very bad public relation news for anyone who wants the CSR provision to be gone, but the objection is towards making it mandatory and companies can continue to contribute to society even without this requirement.

However, getting rid of CSR may appear to be a dream at the moment.

Similarly, while the UPA brought the new Companies Act, it did not include the section on bankruptcy making it virtually incomplete. It was only after the Insolvency and Bankruptcy Code that relevant provisions were made for ensuring exit of promoters to recover the dues of banks.

The fact that several offences under the Company’s Act were criminal in nature shows how despite several reforms, the administration continued to view businesses through suspicion.

This despite the fact that one of India’s fastest increase in per-capita income and reduction in poverty coincided with the opening up of our economy reflects the misguided view which prevailed for decades.

It was only recently that the government started to openly embrace wealth creators and even taxpayers as it acknowledged their role as equal stakeholders in India’s growth story.

While the super-rich surcharges are an area of concern and hopefully, government will eventually rectify it, we must appreciate the mindset change at the highest level of policymakers.

Even on taxation, in general the trend over last six years has been to reduce tax rates while improving compliance, and therefore, we have legitimate reasons to believe that tax rationalisation is well on the cards over the next couple of years.

The recent changes to decriminalise violations in companies act are indeed a historic moment, where government recognises the possibility of genuine mistake.

This is the first step towards a system of simple rules and regulations, which are also underway as government removes redundant laws to simplify the governance paradigm.

While tax issues continue to be an area where more can be done, we must acknowledge the first-ever sincere and sustained attempt by the government to embrace wealth creators.

As long as this attempt continues, we will see a lot of the legacy issues, including of high tax rates get resolved sooner rather than later.