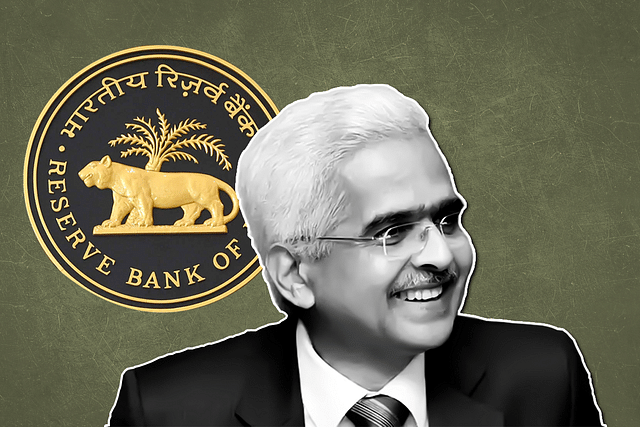

Did RBI Governor Shaktikanta Das Just Tell Us That The MPC Can Take A Walk?

Das has sent a subtle message to both the MPC, which he heads, and the markets: if the economy needs it, the RBI can act independently of the MPC.

The MPC can take a walk.

Among the Narendra Modi government’s major appointments, the anointment of Shaktikanta Das as Governor of the Reserve Bank of India (RBI) in December 2018 was perhaps a truly inspired choice. The man has delivered in spades, proving once again that success at the top job in Mint Street depends on keeping the lines of communication open with North Block, even while pursuing sensible monetary and prudential policies.

Relations between Mint Street and North Block have never been as smooth, which is why there is strong policy coherence in the way the monetary and fiscal authorities are responding to the current economic challenges.

Two predecessors of Das were not very useful to the economy – Raghuram Rajan because of his openly political approach to the job, and Urjit Patel because of his doctrinaire approach to monetary policy and issues of central bank’s independence. As a former insider to North Block, Das has eschewed both approaches and done an extraordinarily credible job as Governor. He has neither sacrificed independence, nor pretended that the central bank can act entirely on its own in the name of independence.

The sixth bi-monthly monetary policy statement, released yesterday (6 February) after three days of discussions in the Monetary Policy Committee (MPC), resulted in the maintenance of status quo on rates due to elevated retail inflation, but Das surprised the markets by proving that he can deal with growth issues without being hamstrung by the MPC’s own inflation mandate.

Among other things, he eased the cash reserve ratio (CRR) for incremental lending for retail housing, automobile purchases and micro, small and medium enterprises (MSMEs) until 31 July. He said the RBI would offer long-term repos for one and three-year tenors upto a value of Rs 100,000 crore, and eased norms for the reclassification of near-bad loans to the MSME and commercial real estate sectors.

The elimination of CRR for incremental loans to housing, cars and MSMEs will automatically lower banks’ cost of funds, which implies that while the MPC may set the formal repo rate, the RBI can do its own thing and ensure that rates fall in spite of the MPC.

Governor Das, in his post-MPC statement, made it clear that the RBI’s actions need not mirror the consensus within the MPC, which has a narrowly-focused anti-inflation mandate.

He said: “While this decision (ie, the MPC’s move to keep rates steady) may be on expected lines and perhaps widely discounted, it is important not to discount the RBI! It has to be kept in mind that the central bank has several instruments at its command that it can deploy to address the challenges that the Indian economy currently faces in terms of the sluggishness in the growth momentum. Consequently, even though the present monetary policy decision is constrained by elevated inflation pressures, there are other ways in which the RBI can strive to revive growth.”

This is great, and precisely what is needed. The MPC’s inflation mandate can often be inimical to growth when the headline Consumer Prices Index (CPI) rate is outside the tolerance limit (ie, the 2-to-6 per cent band). Right now, CPI inflation is at 7.4 per cent, even though the spike has been caused almost exclusively by food inflation, especially the price hike in onion.

Das has done well to read the RBI’s mandate more widely than just beating back inflation. He correctly saw his job as not just paying lip-service to inflation, but also to reviving growth at a time when the Finance Ministry has been in overdrive on the same front. A pure anti-inflation stance would have undermined what the fiscal side is trying to do to revive growth. The RBI is thus in sync with the limited fiscal easing announced in the recent Union Budget.

Das also made it a point to underline the differences between how the RBI saw its challenges as opposed to that of the MPC. He pointed out that the MPC’s rate cuts between February 2019 and December were transmitted well by the money and bond markets, but this was not quite the case with the credit markets.

He said: “I want to use the backdrop of the MPC’s deliberations to explain how the RBI envisages the impact of the monetary policy decision on reviving growth while ensuing price stability. It is necessary to recognise that the transmission of policy rate reductions has been sizable across various money and bond market segments. As against the cumulative reduction in the policy repo rate by 135 bps (100 basis points make one per cent) since February 2019, transmission to various money and corporate debt market segments ranged from 146 bps (overnight call money market) to 190 bps (3-month commercial papers of non-banking finance companies). Transmission through the longer end of government securities market was at 73 bps (five-year government securities) and 76 bps (10-year government securities).”

On the other hand, “transmission to the credit market is gradually improving. The one-year median marginal cost of funds-based lending rate (MCLR) has declined by 55 bps during February 2019 and January 2020. The weighted average lending rate (WALR) on fresh rupee loans sanctioned by banks has declined by 69 bps and the WALR on outstanding rupee loans by 13 bps during February-December 2019.”

The huge gap between monetary transmission levels in the wholesale bond and money markets as opposed to the retail and corporate credit markets is what prompted Das to boost the latter by bringing down banks’ overall cost of funds through CRR forbearance.

Das has sent a subtle message to both the MPC, which he heads, and the markets: if the economy needs it, the RBI can act independently of the MPC. The MPC can take a walk.