Economics of Disruption: Demonetisation Is The Beginning Of Something Big

If it is possible to run the economy electronically it then becomes easier to downsize government, remove some of those positions where bureaucrats wield rent-seeking, discretionary powers.

The aftershocks of the demonetisation of 8 November are obviously still reverberating, as there is still a lot of pain for the average citizen. Even if you ignore motivated breast-beating from the usual suspects, which can be discounted, it is likely that many at the bottom of the pyramid are suffering from the liquidity crunch. Much activity has been disrupted. But it is still likely that a majority supports the (laudable) aims behind the move, even though the implementation could have been a lot smoother, especially if there had been a focus on Rs 100 notes, rather than the relatively hard-to-handle Rs 2,000 notes.

I too have personally dealt with some pain, standing in moderately long lines, and going futilely from shop to shop trying to get change for a Rs 2,000 note. But something that I heard in one of those bank lines startled me. I was chatting with an old neighbour of mine while in line, and I remarked on the hassle, and he said, “But it’s better than war”. He is a highly educated retiree, and has been through every war from 1948 to 1965 to 1971 to Kargil, and so I take him at face value.

This is, in a sense, the Moral Equivalent of War. I’m reluctant to say that because when Jimmy Carter used the phrase, he was pilloried for his timidity, and the fact that the acronym is MEOW. But we are at war, and the barbarians are inside, outside, and at the gates.

War is just about the only thing that brings fractious and centrifugal Indians together: and then we deliver. I too have seen the fortitude of Indians during the 1971 war and the privations it brought us. We suffer; but we survive; and we are ready to sacrifice for the larger interests of the nation. I was reminded of the story I read about an old soldier, all of whose three sons have been killed in battle, the youngest just last month, and how even in his grief, he didn’t waver in his love for his country.

That is how we are, those outside the charmed circles of the blasé Lutyens crowd who have no time for such old-fashioned ideas such as patriotism, but who owe their wealth and their livelihoods to the simple faith of such people. The Lutyens types have cynically fed us a mythology that they, the benevolent, would bring us the Millennium, the City on the Hill, and we have been misled by their siren song. Instead, all they have given us is misgovernance, corruption, and wholesale national failure.

But we have tolerated them all these years. This tolerance of the Indian public is a wonder, but it is beginning to come to an end, as a young and aggressive population is beginning to ask why it is that every country is bypassing us. They are finding answers on social media: the Indian #deepstate of the JNU-media-Dynasty-crony capitalism variety is finally being laid bare in all its nakedness: these are thieves, hypocrites, amoral sociopaths.

And then comes Prime Minister Narendra Modi with an appeal to the public, going over the heads of the gatekeeper media: he acknowledges that there will be pain. But he asks them to suffer the pain for just 50 days, and by and large, the public is responding. In a way this is like that old imperialist Churchill promising his countrymen nothing but “blood, toil, tears and sweat”. And the Brits responded. Similarly, I get the feeling that Indians are responding to Modi. We’re willing, within limits, to “[take] one for the Gipper”, to use a Reaganesque phrase.

This has startled the Western media. Except for the fringe types, even hardened anti-India campaigners such as The Economist and The Financial Times have been circumspect in their coverage. One of them wondered that “there has been no violence”. Yes, in the West there probably would have been blood on the streets, as we saw in London a couple of years ago, and in the US, during the Rodney King protests of a while ago. The journos couldn’t believe that such a radical change had gone without bloodshed. But they mustn’t judge us by their own standards: there is Indian Exceptionalism. We are not like them.

The other reason the Westerners were hedging (I read Kenneth Rogoff’s noncommittal comment too) is that this exercise is so mammoth, so unprecedented, so audacious that nobody knows what the outcome will be. It is like a Manhattan Project to make the atomic bomb, or Kennedy’s celebrated ‘Man-on-the-moon’ project. They would not dare try something like this in their economies today. But we can, because complexity is our métier. We can organise an immense exercise like the Kumbha Mela, although we cannot stand in line at a railway counter.

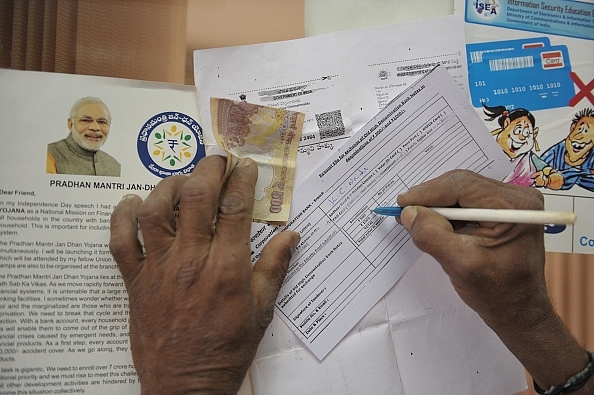

And this is not a one-off, whimsical act as some of the polemicists in India claim. There is a context: first, the JAM trinity for financial inclusion: Jan Dhan Yojana, Aadhar, and mobile. Second, the voluntary disclosure scheme for unreported income that ended in September and saw the declaration of some Rs 65,000 crore. Third, demonetisation. And fourth, yet to come, Goods and Service Tax (GST).

If you put all these together, it is a revolution, and a disruption, a point of inflexion, the beginning of something big. You have the possibility of bringing out into the open the 25 per cent of the economy that has been under-reported, untaxed and secreted under mattresses. This itself will improve efficiency and circulation as the funds can be recycled by banks (though hopefully not in the way they funded crony capitalists in the good old UPA1 and UPA2 days). Not to mention the increased tax revenues.

But more than that, it is a tsunami that should enable India to leapfrog a generation of fintech. With the UPI (Universal Payment Interface) that has been rolled out, it has become possible to move anybody with a smartphone to make e-payments. UPI allows anyone to transfer funds or make merchant payments securely, with 2-factor authentication, without having to reveal their bank routing code or account number, but by simply using an alias such as suresh27@hdfcbank: easy to remember. This is not an e-wallet: transactions are happening in your real bank account, but it’s much easier than registering a payee and so on.

If I understand correctly, this is similar to M-Pesa (except that is a mobile wallet) in that it allows for very small transactions (say, Rs 10) with no transaction fee at all, and it can happen 24x7 using the IMPS (Immediate Payment Sevice) interface that already exists.

If this can be done seamlessly and with guaranteed security, then India would have leapfrogged from cash directly to e-payments in one fell swoop, avoiding the intermediate stages of cheques and credit cards. Just as we leapt from landline to cellular without laying all the expensive copper wire, this would mean we have suddenly become the largest electronic money economy in the world, as our scale is virtually unmatched. This will have significant benefits in lowered transaction costs as well as an audit trail: it makes large-scale corruption harder to pull off, because you never know what the computer is storing away and when the Enforcement Directorate will come down on you like a tonne of bricks.

Now add the next shoe to drop, so to speak, as GST kicks in, and hopefully makes our physical infrastructure also less cumbersome. Suddenly, the mile-long queues at state checkpoints disappear, and it no longer takes a week to ship goods from your factory to the nearest port. Efficiency again.

The sum of all this can transform the Indian economy. If it is possible to run the economy electronically (assuming there’s sufficient cybersecurity so that our friendly neighbourhood snoops aren’t sucking all our data out) it then becomes easier to downsize government, remove some of those positions where bureaucrats wield rent-seeking, discretionary powers. Black money generation will diminish.

Corruption and black money will never go away entirely. They will be with us always, like death and taxes. But their effect on the real economy can be reduced. And that would also lead to a reduction in the power of politicians to act in arbitrary ways: whatever they do would lead to an audit trail in the money flow. An analogy is the railway reservation system: the moment it was automated, the entire class of intermediary touts disappeared, because frankly, people are scared of what computers may know about them. It deters them.

It is a huge disruption, in the normal sense of the term. In terms of Clayton Christensen’s disruptive innovation, “incumbent”, i.e. Lutyens-type babus and netas are being replaced by the “insurgent”. Prime Minister’s ideas that are turning the incumbents’ world upside down. The consumers of their efforts, the public, that had remained quiescent despite the widespread loot of their money by the incumbents, will simply switch to the better offering from the insurgent.

Christensen’s idea of the “failure of leading firms” predicts precisely this: the complacent incumbent will be blindsided by the insurgent, who has no customer base to lose, but has a superior product. This happened in the 2014 election, and we all know what happened: the customer base switched to the insurgent.

Thus, I believe the Prime Minister can pull this gargantuan effort off, with our support. He has no choice, really: this is one of those things where you can’t make a graceful U-turn; the train is moving, and you can’t stop it or get off it. And given his character, once he makes up his mind, it is unlikely he’ll change it. Thus, like it or not, demonetisation is a reality, and although we will not know the full results for a while, I think it is a tremendous step forward, coupled with the other steps I mentioned. There will be pain: GDP may shrink by as much as a point, says HSBC, but the upside is high.

At a time when China is slowing, and many are nervous about Donald Trump’s intentions, this move by India could not be more brave or intrepid. It is a risk-the-mandate bet, and I believe it will work, and that it is the beginning of a new, cleaner, more assertive India.