Fiscal Consolidation: The Real Story

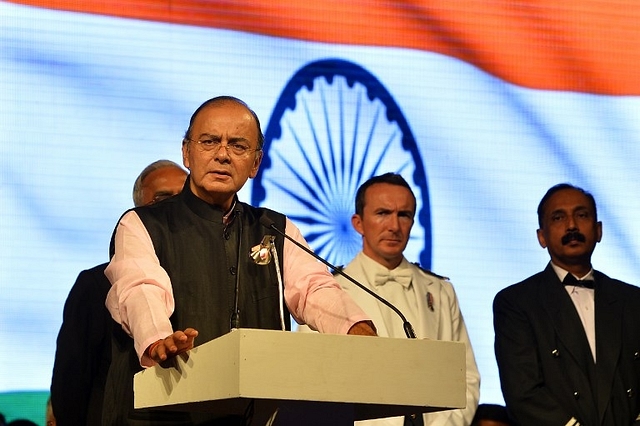

There’s more than meets the eye in the numbers that Finance Minister Arun Jaitley is tom-tomming.

The Narendra Modi government has been doing a lot of chest-thumping about having managed to contain the fiscal deficit at 4 per cent of gross domestic product (GDP) in 2014-15, bettering the “challenging” target of 4.1 per cent of GDP set in that year’s budget.

Official data showed that fiscal deficit stood at Rs 5,01,880 crore in 2014-15, 98 per cent of the revised estimate. The Finance Ministry has claimed that this was possible because of prudent fiscal policies. “The government is firmly committed to the path of fiscal consolidation and this is a step forward,” an official statement from the ministry said.

What the low fiscal deficit numbers will do is boost the chances of a ratings upgrade by global rating agencies. It also makes a compelling case for a rate cut by the Reserve Bank of India in its June 2 monetary policy, given that inflation too is down at 4.85 per cent in April.

But look behind the figures and there is a different story.

First, the expenditure story. The reduction in the fiscal deficit is partly due to fall in global crude oil bill which brought down the the oil subsidy outgo. Initially budgeted for Rs 63,000 crore, it came down by around Rs 20,000 crore (according to rough estimates) thanks to this. But there does not seem to have any been deliberate change in expenditure patterns.

Plan expenditure at the end of 2014-15 stood at Rs 4.35 lakh crore as against revised estimate of Rs 4.75 lakh crore. This meant there is a huge compression of developmental expenditure of nearly Rs 40,000 crore. The revised estimate itself was pruned from its original budget estimate of Rs 5.75 lakh crore in Finance Minister Arun Jaitley’s maiden budget in July 2014.

Non-plan expenditure was Rs 11.91 lakh crore (99.8 per cent of revised estimates). This meant that despite cut in oil subsidy, government’s non-productive and even wasteful expenditure has gone up despite the so-called 10 per cent mandatory cut on travel by bureaucrats and official spending on parties. This is not a good sign for the economy.

The fiscal deficit reflects the size of government borrowings and if these borrowings are utilized for capital expenditure, it is good for the economy. However, if the bulk of borrowings go in for non-productive expenditure, the result is just the opposite.

Releasing its assessment on one year of the Modi government, rating agency Crisil highlights the government’s inability to pump-prime the economy through increased government spending. Fiscal profligacy of the past and inflationary concerns precluded such steps as public spending was restrained by legislative mandate to bring down fiscal deficit in time bound manner. Lowering fiscal deficit is good but the manner in which the cut has happened in the last few years by pruning public expenditure is not good for the long-term health of the economy, Crisil chief economist D.K. Joshi said. The NDA government seems to have done this, like previous governments.

The revenue story is also not that great. The better fiscal deficit number is certainly not due to pick up in the economy leading to improved revenues. This is evident from the fact that tax mop up, at Rs 12.45 lakh crore, was less than revised target of Rs 12.51 lakh crore. Preliminary data released show direct tax collections were around 6.96 lakh crore, which is Rs 9,000 crore short of the target of Rs 7.05 lakh crore. Indirect tax collections at Rs 5.46 lakh crore, exceeded the revised target of Rs 5.42 lakh crore by Rs 4,000 crore. The indirect tax collections benefitted by the increase in excise duty on petroleum products in the face of falling global crude oil prices.

The data has hence not revealed the full picture, says senior NIPFP economist N.R. Bhanumurthi.“We only know the denominator [revenue collections]. We have no indication of the numerator [the plan expenditure under various heads].” There is, therefore, a question mark about the quality of fiscal deficit containment, he said.

The 3.9 per cent of GDP fiscal deficit target for 2015-16 also appears difficult, if crude oil prices shoot up beyond $65 a barrel. The economy needs to pick up and this requires huge public spending.

Previous Finance Minister P. Chidambaram too had cut plan expenditure by a whopping 1 per cent of GDP at Rs 92,000 crore in 2013-14. In his zeal to prune fiscal deficit, he derailed economic growth. Jaitley too seems to have followed the same path in the last financial year and one only hopes he does not repeat this in the current fiscal.