From Broad To Specific: A Look At The Objectives Of The Kamath Committee For Loan Restructuring

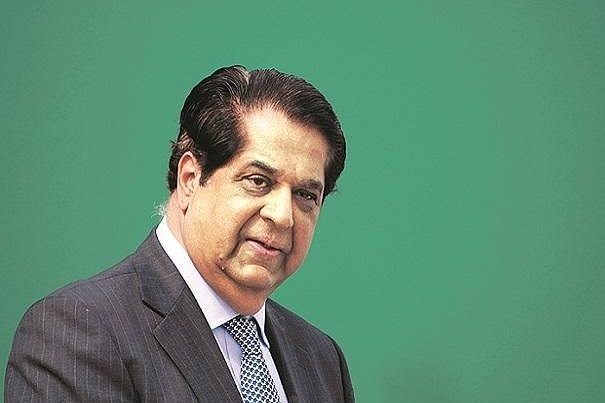

It is a tough task to take on the economic challenges induced by the pandemic, but the expert committee headed by K V Kamath will play a key role in putting the economy back on growth trajectory.

With the end of the moratorium period of loans, one of the viable alternatives to tackle Covid-19 induced economic stress of trade and industry is to restructure ongoing loan facilities as a comprehensive one-time relief package.

It will also require combining it with reasonable additional credit facilities to allow cash flows to restart economic activities. Reserve Bank of India (RBI) rightly extended the available restructuring scheme of MSME (micro small and medium enterprises) sector until March 2021. Since the Covid-19 stress is omnipresent in the economy with collateral damage across sectors, the task is assigned to an expert committee (EC) headed by K V Kamath.

The EC is drafted to arrive at financial parameters to be factored in the resolution plans, with sector specific benchmark ranges for such parameters.

It will also undertake the process validation for the resolution plans to be implemented under this framework, without going into the commercial aspects, in respect of all accounts with aggregate exposure of Rs 1,500 crore and above at the time of invocation.

It is a tough task to work out standard terms and conditions for restructuring credit facilities amid such divergent borrower base of the banking system.

The degree of stress, the individual needs, the working capital cycle, nascent stage of demand for products/services, constraints of labour and supply-chain disruptions in near term and many other factors can complicate the effort to standardise norms.

- The Resolution Plans:

The expert panel and implementing banks are equally well conversant with the experience of restructuring of loans. What is unique at this point of time is the degree of uncertainty about how the pandemic is going to pan out exacerbating the woes.

The usual tenets of restructuring a loan facility call, among others, looking more focused at:

(i) The integrity and continuing relationship of the borrower — the past track record

(ii) The genuineness of reasons that calls for restructuring

(iii) How and when these constraints could be addressed by the borrower to restore normalcy

(iv) Viability of the business — post restructuring

(v) Scope of output

(vi) Expected revenue generation and future pattern of cash flows to service the loans within the time frame

(vii) The buffer to provide for unexpected developments in implementing resolution plan

(viii) The projected financial data linked to the viability

(ix) Scope of additional capital infusion by the borrower

(x) The duration within which the borrower unit starts generating profits after restructuring terms are implemented and many other interdependent factors.

The most challenging part is to convert the broad identified financial parameters into sector specific metrics to make it into a reference document for banks.

- Attitude towards resolution:

Going beyond the financial parameters, the objective of the one-time loan restructuring value proposition is much broader and will have far-reaching ramifications on the revival of the economy.

No economic unit hit by the Covid-19 stress should be deprived of the relief.

The attitude of the EC has to be broad enough to accommodate borrowers keeping their genuine constraints in view. Any conservative approach will have a collateral damage much larger than the cost of spill over of relief, even if flowing to ineligible borrowers.

Fears of ever greening, ineligible borrowers seeking wrongful relief, disproportionate relief flowing to some sectors could be the possible aberrations.

They should not be allowed to overwhelm the very larger purpose of the scheme. In a catastrophic situation, many non-financial factors need to be visualised and 30 days time need to be utilised well in shaping the set of parameters of the resolution scheme.

3. Ending the forbearance:

Any one time loan restructuring scheme designed to serve a particular purpose — now to address Covid-19 stress has to be phased out and integrated with the mainstream lending operations within a time frame.

The EC has to consider the expected fund flows of the borrower to match repayment to eventually phase out the facility. It may be different for different sectors.

Even initial repayment holiday need to be considered to ensure that the borrower is able to use the restructured loan relief to stand back on its feet.

One-size fits all frame work may lead to not only difficulty in implementing the scheme by banks but can result in higher delinquency at a later date adding to the asset quality woes.

Hence the three reinforcing pillars of the resolution scheme –

(i) The main structure – existing and additional loan amount, if any, rate of interest, holiday period, total time period, sector specific terms, value of collaterals, etc forming the main body of the resolution scheme.

(ii) Its monitoring mechanism and making provision for intermittent mid course handholding and finally

(iii) Deciding the mode of phasing out based on waterfall mechanism to ensure that its repayment should not affect the mainstream operations or it should not dry out working capital of the unit.

The acid test of the EC lies in using its experience and vision in articulating the main frame of the resolution structure that should be,

(a) Implementable by the bank within the time lines

(b) The measure of relief should enable the unit to not only kick start economic activities but should get back to the normal state of operations

(c) Be able to link repayment with the incremental rise in earnings in a phased manner – time lines should be enough to honour the repayment commitments.

Balancing these factors will be highly challenging but by doing so, the EC will be playing a defining role in putting back the economy on growth trajectory. It can set an international benchmark in carving out relief to address economic stress arising from the pandemic.

(*The author is Adjunct Professor, Institute of Insurance and Risk Management – IIRM, Hyderabad. The views are his own)