Global Semiconductor Shortage: What Makes US Vulnerable To China And Taiwan

The US remains the global leader in semiconductor design and research & development, yet the majority of chip manufacturing is now happening in Asia.

For 2019-30, the projections hint at greater manufacturing share for China, Taiwan, South Korea, and Singapore while predicting a decline in the US global share.

In the last week of February 2021, President Joe Biden signed an executive order directing the administration to address the worrying shortfall in semiconductor production that impacted operations at some auto plants.

The order was mainly focused on reviewing the United States supply chains for semiconductors, ensuring they were secure and reliable, especially as tensions with China mount.

However, while the executive order from the White House did not explicitly name China, it did highlight the growing global problem of chip shortage, in the wake of Covid-19. Given the shortage in chips, automakers in several parts of the US were forced to cut jobs and workers’ hours, further denting an economy battered by the pandemic.

Consequently, General Motors Co. was forced to halt production at its three North American plants, and Ford Motor Co. was staring at a 20 per cent drop in short-term output. For the auto industry alone, the chip shortage could result in a $61 billion hole.

Biden’s 100-day review of the US supply chains also covered semiconductors, large capacity batteries, pharmaceuticals, critical minerals, and also strategic minerals like ‘rare earths’ used in rechargeable batteries for electric and hybrid cars, advanced ceramics, computing devices, and many other electronics.

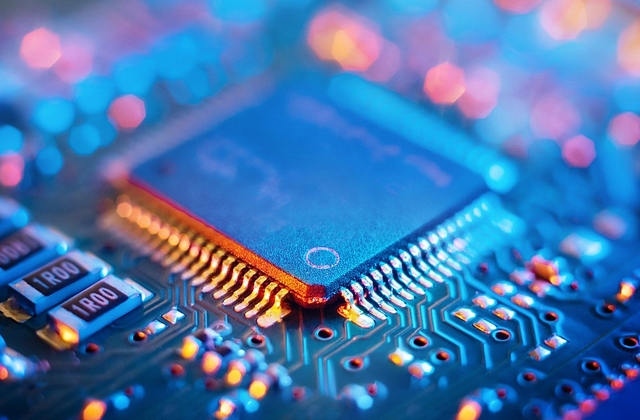

What makes semiconductors so critical is their indispensability to most routine devices. Also referred to as integrated circuits (ICs) or microchips, these are made of pure elements, mostly silicon or germanium. They are critical to the manufacturing of electronic devices that include smartphones, radios, TVs, computers, and so forth.

In terms of global semiconductor sales, the industry went from $150 billion in 1999 to $250 billion in 2010 and $468.8 billion in 2018. However, the outlook for 2019 was negative for the first time in ten years.

By 2019, semiconductors worth $136 billion were being used for communication devices, $117.3 billion for computing devices, $54.7 billion for consumer devices like routers, switches, etc, $50.2 billion for cars, $48.9 billion for industrial equipment, and merely $5.2 billion for government purposes.

Globally, communication and computing devices drive more than 60 per cent of the semiconductor demand. However, the pandemic induced a shortfall in semiconductor manufacturing, and complemented by the growing tensions between the US and China, it exposed the faultlines in the global supply chains and manufacturing in the West.

In 2020, the demand for these communication and computing devices went up as more people began working for home. What complicated matters were the drastic cuts implemented by auto and electronics manufacturers in the early days of the pandemic, anticipating lower demand, and then a sudden spike in demand within months leaving chip manufacturers with more demand for the supply.

Thus, Biden’s executive order went beyond the auto industry, given the chip shortage could have a domino effect on the electronics industry, especially when 5G-ready smartphones are pushing up demand for semiconductors. Also, they are critical to emerging markets that include artificial intelligence, quantum computing, wireless networks, smart cities, and so on.

However, for the US, trying to play the catch-up game with its partners in Asia, the problems are plenty, most importantly, the lower production capability.

Today, US chip companies rely upon international partners to meet their demands. According to the report of the Semiconductor Industry Association on State of the US Semiconductor Industry, the US remains the global leader in semiconductor design and research & development, yet the majority of chip manufacturing is now happening in Asia.

For 2019, in terms of the market share for global sales, the US led with 47 per cent followed by South Korea with 19 per cent while only 10 per cent sales came from Europe, 6 per cent from Taiwan, home to Taiwan Semiconductor Manufacturing Company (TSMC), and 5 per cent from China. However, only 12 percent of the chips are manufactured within the US.

However, the US only leads in logic and analog semiconductors. For memory and discreet semiconductors, the US market share is only 23 per cent for both. For memory semiconductors, South Korea leads with a 65 per cent market share, and for discreet semiconductors, Europe has the greatest market share at 42 per cent.

The challenge for the US, within its limited manufacturing capability, is that of chip design innovation which depends on the most advanced fabrication technologies available. The most advanced semiconductor fabrication technologies and facilities, known as fabs, are termed as 5 nanometers, referring to the process and not any feature. The smaller the nanometer reading, the more transistors per square millimeter, and the more advanced the fabrication process.

Already, Taiwan and Samsung in South Korea are developing 3-nanometer fabs. TSMC, in late 2020, announced that production at its new 3-nanometer fab in Taipei would begin in the first half of 2022. However, within the US, Intel has announced that its 7-nanometer fab will not start manufacturing until early 2023, leaving the US languishing in the race to create the most advanced chips.

Faced with a constant threat from Beijing, Taiwan, as a potential choke point in a US-China conflict, represents another problem for Biden and the industries in the United States.

However, there is some hope for the US here. In May 2020, TSMC announced it was planning to invest $12 billion in a fabrication plant in Arizona. However, in an operational capacity, it would be smaller than its Taiwan and China facilities.

The production in this plant is expected to start from 2024, with a focus on 5-nanometer fabs, and 3-nanometer fabs in the future to cater to Apple’s and Intel’s growing requirements. Samsung too is expected to invest $10 billion for a fabrication plant in Texas.

However, the US would have to do far more than a few scattered success stories to catch up with its counterparts in Asia when it comes to semiconductor manufacturing. In 2019, all six new semiconductor fabs opened outside the US, with four in China.

For 2019-30, the projections hint at greater manufacturing share for China, Taiwan, South Korea, and Singapore while predicting a decline in the US global share.

Biden’s executive order to review the supply chains is a small step in the right direction, but what the US needs right now is a giant leap to be ‘aatmanirbhar’ in the realm of semiconductors.