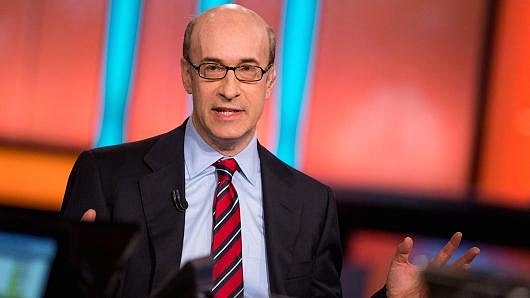

High Priest Of Less-Cash Economy, Ken Rogoff, Is Also Surprised That Damage From DeMo Wasn’t More

“You would expect economic activity, particularly in the informal economy to contract a lot. But the Indian people seem to have been incredibly creative,” he said.

Kenneth Rogoff, a professor of economics at Harvard University, is one of the foremost advocates of less-cash economy. Last year, he supported Prime Minister Narendra Modi’s decision to demonetise Rs 500 and Rs 1,000 currency notes. Writing in a blog few days after Modi made the announcement, Rogoff termed it “a bold, audacious move to radically alter the mindset of an economy where less than two per cent of citizens pay income tax, and where official corruption is endemic.’

However, he didn’t approve of the way the demoetisation (DeMo) exercise was carried out. He commented that while Modi’s motivation for demonetisation was absolutely right (attacking black money, counterfeiting), but given the lower levels of financial inclusion, the short term pain may be high.

Rogoff in his book The Curse Of Cash has called for the elimination of high denomination notes (like $100 bills) in view of their large role in illegal trades and the underground economy. But his limits his advice only to advanced economies and recommends that the exercise be carried out only gradually. So, its no surprise that evaluating Modi’s decision, Rogoff was apprehsensive about the way the whole idea was executed. In an interview to Economic Times, he said, “My book states several times if you are developing economy. This really is not something for you.” However, Rogoff did concede that DeMo could yield greater long-term benefits than what was envisaged in advanced economies, given that only 2-3 per cent of Indians pay tax.

Now, a year later, in an interview to BloombergQuint, Rogoff has stated that it was really a surprise that the damage was not much more. “...You would expect economic activity, particularly in the informal economy to contract a lot. But the Indian people seem to have been incredibly creative,” he said.

Commenting on the political benefits of DeMo, Rogoff said that it turned out to be a bigger political success than what he might have imagined. “If the Prime Minister continues to capitalise on that to try to root out corruption, to try to make the Indian economy more efficient, it could end up being judged a success,” Rogoff added.

Almost 99 per cent of the demonetised currency notes have come back to the banking system. However, Rogoff doesn’t seem to think this is a big deal. The real test, he said, lay in restricting ‘the use of cash in the future; make it more difficult to buy a house or an apartment (with cash) and to make it more difficult to avoid taxes.’

The Harvard professor said that he viewed DeMo as a part of “a larger set of changes to try and modernise the Indian economy, to try to reduce the size of the informal sector, and to try and create a greater federal India.” He thinks that it’s still too early to give a final verdict on the success and failure of the move. “I think it would be at least 3 years before we have any idea of how this has gone.”

“But no people don’t change their habits overnight. This has shaken up the system. It has had a psychological impact. But no, it’s not going to that rapidly accelerate things,” he added.