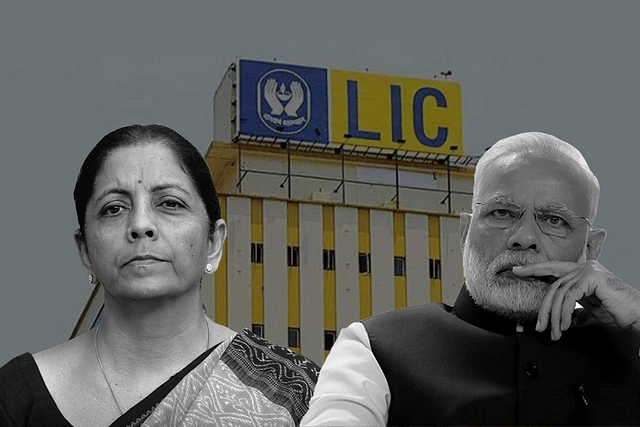

How Government Can Meet Its Highest-Ever Disinvestment Target If Listing Of LIC Doesn’t Go Through This Financial Year

To meet the record disinvestment target, here’s what the government can do if LIC listing does not happen this financial year.

The 2020-21 Union Budget presented by Finance Minister Nirmala Sitharaman on 1 February 2020 had a couple of surprises on disinvestment.

First, the target for 2020-21 was pegged at Rs 210,000 crore, the highest ever. For comparison, the 2019-20 target was Rs 105,000 crore which is likely to be missed by over Rs 50,000 crore if we go by the revised estimates for 2019-20.

The second surprise (which in some ways is related to the first one) is the announcement that the government intends to list Life Insurance Corporation of India (LIC) in 2020-21. Many analysts have speculated that LIC’s expected valuation is likely to be upwards of Rs 8 lakh crore. A 10 per cent stake sale will net Rs 80,000 crore for the government.

There is a very good case for listing LIC on the bourses.

With the financialisation of the economy over the last few years, the few listed life insurers like HDFC Life, SBI Life and ICICI Prudential have done well on the markets and are quoting at lofty valuations with price to earnings multiples of over 50.

LIC is the market leader with 70 per cent market share. While it may not command the valuation multiple of its private sector competitors, it will be a sought after stock due to its sheer size.

Secondly, it is better to list it now when it still has a strong market share. The case of Bharat Sanchar Nigam Limited (BSNL) is well known, wherein it lost share to aggressive private players and is now a basket case.

Thirdly, listing LIC will also bring in a certain amount of discipline to its investment practices because it will be scrutinised more closely by the markets.

However, listing LIC is not without its challenges.

First the law needs to be amended to facilitate listing . As per the LIC Act, 95 per cent of the surplus goes to the policyholders and only 5 per cent is retained by the shareholder (government of India). Also the policyholders get a sovereign guarantee. Both of these need to be clarified before LIC can be listed.

The second challenge will be to convince the unions. Like the public sector banks, LIC workforce is unionised and will resist any stake sale. This cold be overcome by offering sweeteners like stock options or shares at a discount.

The third challenge will be the size of the initial public offering (IPO) itself. An IPO of Rs 80,000 crore (10 per cent stake sale at a conservative valuation of Rs 800,000 crore) is unheard of in Indian markets. The ability of the stock market to absorb such a large share sale is debatable.

That said, the critical piece is the change in statute books and clarity regarding future profit distribution and sovereign guarantee to policyholders. It is doubtful if these changes can be done in the next seven-eight months so that an IPO can be concluded before March 2021 .

Alternatives:

What are the options for the government in case it is unable to go through with the IPO of LIC before March 2021. Can it manage a possible Rs 80,000 shortfall in disinvestment receipts? The analysis below shows that with some careful planning and proactive steps, the disinvestment target is achievable, even if the LIC IPO is pushed out to 2021-22 because of the challenges mentioned above.

1) Accelerate sale of stakes held by SUUTI in Axis Bank, L&T and ITC. The government should be able to realise approximately Rs 31,000 crore from this, based on closing stock prices on 4 February 2020 .

2) Sell the residual stake of 29 per cent in Hindustan Zinc to Vedanta who already control over 60 per cent of this company. Hindustan Zinc (HZL) was privatised by the National Democratic Alliance government led by Atal Bihari Vajpayee in 2002. With a current market capitalisation of Rs 85,000 crore, the government should be able to get Rs 25,000 crore.

If a control premium is negotiated, it could yield more. However, this is stuck in a legal challenge in the Supreme Court. The government should move to get the case heard on priority in Supreme Court and then go ahead with the sale. Similarly, 49 per cent residual stake sale in BALCO can also be explored.

3) Privatisation of Bharat Petroleum, Shipping Corporation of India, Container Corporation of India and Air India. The expected realisation of these will be around Rs 82,000 crore.

The transactions listed above will lead to receipts of around Rs 140,000 crore leaving a balance of Rs 70,000 crore which will need to come from stake sales in other listed PSUs like Oil and Natural Gas Corporation, Coal India etc.

This too is doable if the government moves quickly to put in the rules/guidelines for those companies where the government holding can go below 50 per cent but will still retain PSU status.

The disinvestment targets for 2019-20 set out in the budget are very aggressive but still achievable. While pursuing the LIC disinvestment, the government should have a backup plan of achieving the target in case the IPO of LIC slips to the next financial year.

The backup plan would entail selling the residual stakes in companies like ITC, Axis Bank and Hindustan Zinc, completing the privatisations already lined up and minority stake sale through follow on offers in large listed PSUs like Coal India, Indian Oil and NTPC.

For this the government needs to be ready with all approvals and appoint bankers and advisers before the start of next the financial year.

Also Read: To Reap Big On LIC Share Sale, Govt Has To Stop Using It To Bail Out Failed Public Sector IPOs