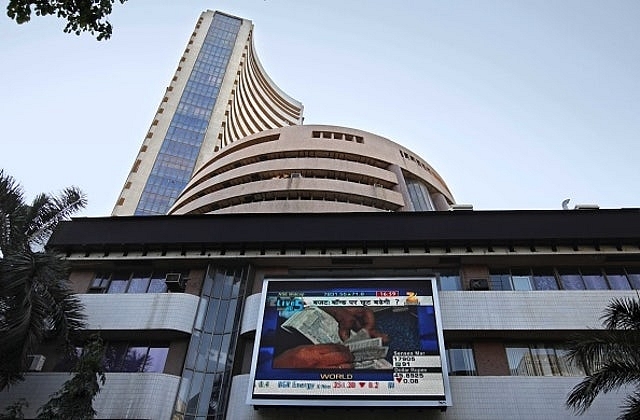

Huge Inflows Into IPOs, SIPs Suggest Indian Appetite For Equity Is Soaring

India is awash with long-term retail investment funds, and this suggests that liquidity will drive stocks as much as fundamentals in the foreseeable future.

The stock markets received a temporary shock this week after the Reserve Bank of India (RBI) informed banks that they must provide 50 per cent against loans outstanding against defaulter companies whose cases are being referred to the bankruptcy court, the National Company Law Tribunal.

Since banks and financial services companies are such a large part of the equity indices (they account for over 31 per cent of the Nifty 50), the markets tanked on Monday. There are still fears that the indices could go down for a while, especially with uncertainties over the goods and services tax (GST) looming ahead.

However, there is a counter-view to this scenario. The markets are not only driven by fundamentals, but liquidity. The more the money chasing stocks, the higher the chances of the markets staying buoyant, never mind the occasional bad news flowing in.

There seems to be no shortage of money entering stocks, and, no, it isn’t only the foreign institutional investors (FIIs) putting their dollars into rupee stocks.

The fundamental change that has occurred in the Indian markets of late is that domestic money has become robust enough to provide a second leg for stock market movements.

So, while the FIIs have pumped in nearly $9 billion into equity in the year to date, there is a lot of domestic money heating up the bourses as well.

Consider the massive subscriptions to three recent IPOs.

D-Mart, which had Rs 1,326 crore worth of shares on offer, got subscriptions that were 105 times as much: Rs 1.38 lakh crore.

Hudco, a placid government-owned company, wanted to raise Rs 1,210 crore; it got 80 times as much.

CDSL, a depositary initially floated by the Bombay Stock Exchange, came in with a modest request for Rs 524 crore; it got more than Rs 26,000 crore in subscriptions.

The point is simple: there is a lot of domestic money sloshing about in the system seeking higher returns from stock investments. India’s risk appetite has gone up. This augurs well for future IPOs, and the secondary market for stocks.

The domestic stock chase is being enabled not only by individuals investing directly in IPOs and stocks, but also indirectly through the mutual funds route.

Individuals have become smarter, and they are not trying to do the stock-picking themselves, or trying to time the market for purchases. They are leaving it to the pros, and are now big believers in SIPs – systematic investment plans. They invest a little amount every month, never mind whether the market is up or down.

At last count, monthly inflows into mutual fund SIPs were running upwards of Rs 4,500 crore. This implies that more than Rs 50,000 crore could come in from retail investors over the next 12 months, and this is over and above what they invest directly in stocks or IPOs.

And we are not counting the money being invested by domestic financial institutions like insurance companies or the EPFO, the Employees’ Provident Fund Organisation. EPFO may invest upto Rs 20,000 crore in equity this year. LIC could invest upto Rs 50,000-60,000 crore.

India is awash with long-term retail investment funds, and this suggests that liquidity will drive stocks as much as fundamentals in the foreseeable future. So, tighten your seatbelts for a roller-coaster. The ride ain’t over yet.