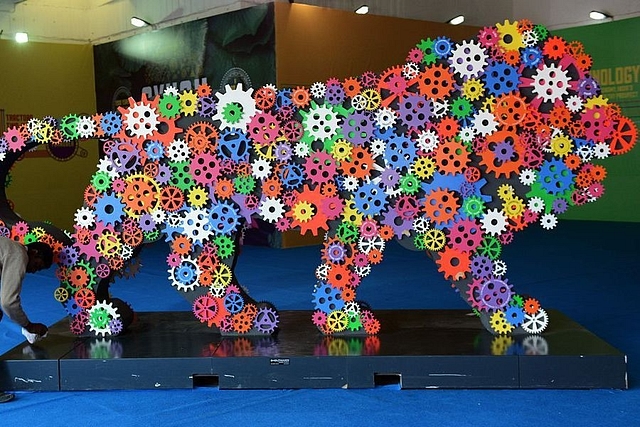

Make In India: Leveraging The ‘Missing Middle’ With Right Policies In Place

The success of East Asian economies, and of China, in accelerating their growth was largely because of a competitive currency and relaxation of labour norms that weakened the bargaining power of its workers.

With a vast domestic market like India, an extensive network of ports and a vast coastline, India is the perfect destination for manufacturing. With the right policies in place we may witness the start of India’s industrial revolution.

India’s growth trajectory has surprised many because of its direct transition from an agriculture-based economy to a service-driven economy. A consequence of this transition is the lack of expansion in low-skilled employment opportunities in the manufacturing sector, which has restricted the surplus labour in the agriculture sector from moving towards more productive sectors.

It is important to recognize that not all those employed in the agricultural sector are farmers. Nonetheless, few would question the genuine need to shift surplus labour from the agricultural sector to the manufacturing sector. This would require labour intensive, low-skilled manufacturing units to mushroom across the country. It has been argued that tweaking labour laws would be critical in catalysing investments in this sector. However, undertaking labour reforms is politically difficult given the fact that labour is on the concurrent list.

The success of the East Asian economies, and of China, in accelerating their growth was largely because of a competitive currency and relaxation of labour norms that weakened the bargaining power of its workers. Implementing a similar model in India will not be possible given the domestic and geopolitical environment.

What is worth observing is that despite the decline in global trade, countries like Vietnam and Bangladesh have managed to perform significantly better than India in terms of their exports. A major reason behind this is their market access policies. For example, Bangladesh enjoys duty free access for ready-made garments to European Union (EU) under the Generalized Scheme of Preferences. Therefore, Bangladesh has a clear competitive edge over India in terms of garments exports to the EU.

There are many such products where India is extremely competitive but due to lack of favourable trade treaties we’re unable to capitalize on our domestic competitiveness. Therefore, the need of the hour is for greater diplomatic push for such bilateral trade agreements. Critical sectors such as textiles, which tend to be labour intensive, would benefit from such interventions.

Additionally, the recent global trade war offers India a unique opportunity to benefit from shifts in the global supply chain. India’s vast coastline and recent investments in development of ports, roadways and rail network will be a critical factor for such a shift.

Approximately 200 firms are looking to shift their manufacturing base due to the current trade war and we should have a policy that enables and encourages them to shift to India. Rigid local sourcing norms have often been cited as a major reason why firms are reluctant to invest in India (labour norms are an additional factor). Single-window clearances and relaxation on local sourcing norms for a couple of years should be explored in order to make India an integral part of the global value chain.

By actively facilitating the entrance of such firms, the government will send a very strong signal to the global investor community, and this, combined with successive reforms, will ensure sustained high inflow of foreign direct investments (FDI) for the next couple of years.

To their credit, the government recently relaxed the local sourcing norms for FDI in single brand retail. It was an excellent decision but the government needs to take a step further and relax these norms across a wide array of sectors. It is important to realize that India is a capital-deficit country, and the recent budget does indicate an acknowledgement of the same by the government.

Additionally, there’s a need to evaluate the factors that cause growth in the manufacturing sector. Evidence over the last three decades suggest that manufacturing activity tends to significantly pick up whenever there’s a prolonged moderation in real interest rates.

Intuitively, it makes sense given that low cost of capital is likely to have a positive impact on investments. The government recently reduced the interest rates on small savings deposits by 10 basis points but that’s far too less. The high rate of interest offered under the program make monetary transmission tricky and therefore the time has come to ensure that interest rates offered under such programs are linked to the repo rate.

Another factor that requires immediate attention is the corporate taxation rates. The budget has reduced the corporate tax rates for around 99.3 per cent of firms; however, it has still left 0.7 per cent of firms outside the reduced tax net. The problem with this is that it ignores the fact that India, at present, has one of the highest corporate tax rates in the world. This was adequately highlighted by the High-Level Advisory Group (HLAG) headed by Dr Surjit Bhalla.

Passing on the benefits of tax cuts would be instrumental in ensuring that firms retain a major proportion of their earnings. At present, the corporate tax for most firms is at 25 per cent (for the 0.7 per cent firms it’s at 30 per cent). Then there’s an additional surcharge that’s levied. There’s an additional 15 per cent dividend distribution tax and beyond that, there’s an additional 10 per cent tax the moment dividend income exceeds 10 lakh rupees for an individual. At a time when we’re looking to attract investments and integrate India with the global value chain, we cannot have such an absurd taxation policy.

When it comes to investments, retained earnings are the first source of finance for firms and therefore ensuring higher retained earnings by reducing our corporate tax rates will kick-start the investment cycle and help certain firms deleverage over the next couple of years.

With a vast domestic market like India, an extensive network of ports and a vast coastline, India is the perfect destination for a manufacturing. With the right policies in place we may witness the start of India’s industrial revolution.