Turning The Epidemic Into An Epic Opportunity

Risk aversion and caution will not save policymakers from political and economic consequences.

They might as well be bold because the status quo of caution and risk aversion appears to have a much higher chance of failure.

This piece has five messages.

One is that the best way to attract businesses is not to repel them explicitly.

Second, it makes the case for a bold but transparent fiscal support.

Third, it offers suggestions on how that money could be spent and four, it reminds experts that doomsday scenarios for India are not pre-ordained.

Finally, it says that is important that the government channels the Covid crisis to usher in a decade of better growth than the previous one.

At the time of writing this (7:32 PM, Singapore time on 24 April 2020), the Government of India had not announced any economic package beyond the frugal first package targeted at the poor, low-income and vulnerable segments of the population.

That was in March.

In these frenzied times that feels like aeon ago. Quite what has caused the Indian government’s seemingly permanent state of paralysis and stupor can only be a subject of speculation.

Easier to repel and harder to attract employers

There was a misinterpretation or miscommunication by some regarding the guidelines from the Ministry of Home Affairs on reopening of work places.

Rumours circulated that employers were to be penalised if employees tested positive for Covid-19. There was a natural hue and cry.

The twitter handle of MHA attempted to clarify. It worsened matters. The clarification made it appear as though employers would be penalised only if they were negligent and cognisant and had consented!

Eventually, the tweet that provided this ‘helpful’ clarification on negligence and consent was removed. Check out the original tweet here and the final amended tweet here. The matter has been finally laid to rest but, perhaps, the damage is already done.

The matter has been finally laid to rest but, perhaps, the damage is already done.

India is seeking to attract companies purportedly keen on leaving China since the latter has gone out of its way to betray trust, to put its foot into its mouth and computer keyboards. In any case, even before it did all of that, it had become a progressively costlier place to do business in.

Governments may not be able to help sway private sector decisions in its favour but they have the power to turn them away with their actions.

It is important to focus on avoiding doing the wrong things.

The confusion over penalties for employers if employees tested positive is an example of such an avoidable confusion and action.

India’s biggest recent commercial success, the software revolution, did not happen because of deliberate government action. The government had, intentionally or otherwise, created the ecosystem with engineering talent available and Benguluru as a cluster for such talent assembly. Initially, no fiscal concessions and sweeteners were offered nor needed.

Similarly, it must focus on what is within its powers to do, even if the rewards will come only over time. Those decisions involve freeing up higher education, making available electricity to industry at reasonable prices or making it easier for them to source it from cheaper producers, reducing transportation costs by ending cross-subsidy of passenger rail fares through freight transportation costs, etc.

States on their part must make it easier for agricultural land to be reclassified as general purpose land. They could lower stamp duties on property transactions and raise floor space index in buildings.

Fiscal support to the economy: balancing short and medium-term considerations

In the short-term, much focus is correctly on getting the Indian economy, felled by woes in the financial sector and virus, to stand on its feet.

Inexplicably, the government is keeping its fiscal cards close to its chest. It might yet play them in the near future but the damage to confidence and sentiment caused by mounting anxiety and uncertainty could have been and should have been avoided.

It is one of the many guesses that the Indian government’s reluctance to provide fiscal support to the economy stems from its fear of causing a spike in the government’s borrowing cost and weakness in the currency.

Some commentators who have discovered their piety and concern for the poor and others for fiscal prudence make this argument as well. Both of them could destabilise an already fragile financial sector as it would raise borrowing costs all around and render many sectors and businesses unviable causing them to default on their payment obligations.

Some argue that such a scenario would play out only if there is a failure to revive economic growth and fiscal pusillanimity would lead to precisely such an outcome. As with most arguments in economics, it is difficult to establish the superiority of one course of action over another for counterfactual scenarios are impossible in real time.

However, for a country with a young demographic and a potential for economic growth to exceed the cost of capital in the medium to long-term, the cost of excessive caution and prudence would be higher than the cost of excess action now.

This would be so in the medium to long-term even if the short–term costs of excessive fiscal activism appear higher.

One such fear is the fear of credit-rating downgrade. That reputational risk must be accepted and ignored, if it materializes.

Rakesh Mohan, the former Deputy Governor of the Reserve Bank of India, had the right attitude towards them.

In an interview for CNBC TV-18, he is reported to have observed that the credit rating agencies should have been the first ones to be put on the lockdown globally. He is right.

The credit rating agencies did not cover themselves with glory during the 2008 global financial crisis. They have not had to bear any meaningful costs for their behaviour. They are overcompensating now with prompt downgrades for actions taken by governments to support the normal economy whereas they gave governments the benefit of doubt when they bailed out bankers, financiers and stock market investors.

They are best ignored.

In any case, not just the credit rating agencies but the entire architecture of financial markets deserves a burial. If Covid-19 achieved that, it would have compensated for all the suffering it has caused humanity.

That said, there could be other solutions. To the best of my knowledge, Samiran Chakraborty of Citigroup in India has offered one such approach that marries the short-term imperative with medium-term considerations. He suggested a separate Covid budget.

He wrote,

Given the exceptional nature of the fiscal position in FY21, the government could consider announcing a separate COVID-19 budget which would have a timeframe of being wound up in 3 – 5 years and funded directly by the RBI. This would be even more relevant if the government considers that 3 – 5% of GDP additional fiscal stimulus would be necessary to support growth and humanitarian concerns. A large part of the COVID-19 related expenditures could be one-time, limited to FY21 and hence it is possible to wind up the COVID-19 budget once the economy starts recovering.(Source: ‘India Economic View: Covid-19 pushes fiscal to an uncharted territory’, 19th April 2020)

Apparently, the government has entertained the idea.

It should implement it.

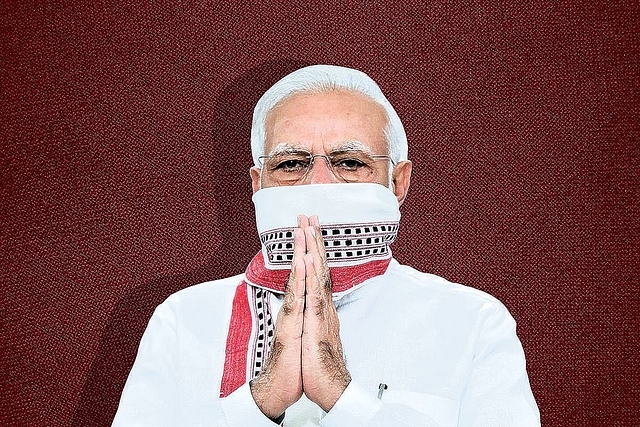

But, one month into the announcement of the first lockdown by the Indian Prime Minister, the abiding impression is that decision-makers in India are showing aversion to risk. They are reluctant to take bolder, unconventional actions because of the fear of consequences.

That is understandable.

But, they should pause and think and accept that others down the decision-making chain would be thinking along similar lines.

Think bankers. They would not want to take risks now by offering moratoriums, re-negotiate loans on softer terms and extend new loans. They are reluctant to face the risk of being persecuted for bona fide decisions. A lynch-mob mentality has taken hold of societies and that feeds into the natural penchant for authorities to find scapegoats for systemic failures and frauds.

So, actions taken by the Reserve Bank of India to provide credit to the economy remain ineffective. The pipeline is broken. The economy will hurt badly, consequently.

Risk aversion and caution will not have saved policymakers from political and economic consequences. Therefore, they might as well be bold and run the risk of failing because the status quo policy stance of caution and risk aversion appears to have a much higher chance of failure.

No better time than now to unleash fundamental reforms

If crises were the best harbingers of reforms (the other way reforms and structural shifts occur is through serendipity), then there could be fewer better opportunities for Indian than the crisis that the Covid-19 epidemic represents. This is the best opportunity to overcome entrenched resistance and push through reforms to the banking sector and to factor markets.

In the banking sector, bad assets should be taken off bank balance sheets so that they can commence lending. Government-owned and private sector banks must face the same regulatory environment.

Third, recommendations of the P.J. Nayak Committee must be implemented. The Union Government can do more. Andy Mukherjee of Bloomberg has some specific ideas on the mechanism for raising funds through asset sales and using the proceeds to build India’s health infrastructure for which he had outlined a plan earlier. A collateral benefit would be that it would provide a template for willing and competent state governments to emulate.

Separately, writing for the same outlet, Shankkar Aiyar had proposed several areas that government’s economic support measures could target. There are very few columnists like Andy Mukherjee and Shankkar Aiyar who propose such specific ideas.

Far from dismissing them as flights of fancy, risk-averse bureaucrats should use the current scenario to pursue many of them. Political bosses must provide them political cover and facilitate implementation to its logical conclusion. Such facilitating bodies could be non-partisan such that political consensus is attempted, if not achieved. Intentions matter in these times as much as action.

Both logic and convenience dictate the search for answers from the government. First, in a democracy, the public feels it has the right to criticise the government since the government is its agent. Second, the government has executive authority, reach and the ability to raise resources through taxation. Third, it is also convenient and easier to criticise politicians than the private sector who are people like us. But, experts must be wary of their certitudes. That is as important for epidemiologists as it is for economists.

Experts are poor at predicting

Many are predicting that India is in for tougher times. Current and prospective stress in the financial sector and India’s stretched public finances vindicate such sagely warnings.

However, now is the time to remember that whatever one says about India, the opposite is equally true. That is, India’s weak points are not figments of imagination nor exaggerations but they are necessarily incomplete. Second, experts must remember the limitations of their predictive power. To be more honest, predictive power is non-existent.

Sir Martin Rees presents powerful evidence of human inability to predict the future or predict the consequences of their recommended courses of actions in the Final Hour:

In 1937, the US National Academy of Sciences organised a study aimed at predicting breakthroughs; its report makes salutary reading for technological forecasters today. It came up with some wise assessments about agriculture, about synthetic gasoline, and synthetic rubber. But, what is more remarkable is the things it missed. No nuclear energy, no antibiotics (though this was eight years after Alexander Fleming had discovered penicillin), no jet aircraft, no rocketry nor any use of space, no computers; certainly no transistors. The committee overlooked the technologies that actually dominated the second half of the twentieth century. Still less could they predict the social and political transformations that occurred during that time.

Just to give a recent example, not too many anticipated that, in these times, Facebook would announce the acquisition of a meaningful minority stake in Jio Platforms. That is a vote of confidence not just in Jio but in the Indian market and, arguably, in the Indian telecom sector too.

Further, India is not alone in confronting the pandemic from a position of weakness. The Eurozone faces an existential crisis. Several other emerging economies and China, in particular, are equally, if not more, vulnerable.

India’s macro-economic strengths such as ample foreign exchange reserves, lower oil price and lack of foreign ownership of financial assets are well known.

Stoicism combined with optimism is a rare asset

More important is India’s unheralded strength is the innate stoicism and resilience of the public in the face of adversity. I was pleasantly surprised to note, from a recent Mckinsey survey, that Indian consumers are far more optimistic than most others of a return to normalcy sooner rather than later.

One may argue that it sets them up for disappointment but usually, they adapt better than pundits predict or wish for. It will be a travesty to undo such positivity with warnings and penal actions soaked in panic.

Finally, that persuades me to throw the ball to the government to play.

In times of crises, society looks for guidance and leadership from the rulers. This is time-tested. Therefore, the onus is on the government to demonstrate clarity in thought and purpose in action.

India began the last decade badly and ended it with more questions than answers. An encore will be a tragedy. India should do whatever it takes to avoid it.

This piece was first published on Prof V Anantha Nageswaran’s blog, ‘The Gold Standard’.