Zero Or Negative Real Rates, Higher Inflation Are What MPC Should Accept To Revive Growth

There is a strong case for cutting rates and letting inflation rise a bit even if real interest rates fall to zero or negative territory.

With the Monetary Policy Committee (MPC) meeting just two days away on 5 December, the big question is whether it will cut rates to continue supporting growth or take fright from rising retail inflation. The Consumer Price Index (CPI) clocked in at 4.62 per cent in October, well above the 4 per cent middle rate that is mandated by the government-Reserve Bank of India agreement of 2016-2021.

Currently, the repo rate is at 5.15 per cent, and if the next retail print is above 5 per cent, a rate cut of even 15 basis points (0.15 per cent) would essentially bring real interest rates (nominal rate minus retail inflation) to zero or even negative territory.

Nobody, least of all the MPC, should worry about this. If three years of high real interest rates did not cause it any loss of sleep, a few quarters of negative interest rates should not worry it too much either. The time to fret about inflation is when the rate crosses 6 or even 7 per cent, and when food and fuel inflation are also on a continuous rise. If the rise is merely due to the return of pricing power to the non-agricultural sector, this is exactly what is needed to revive corporate bottomlines and improve the climate for loan recoveries.

India’s problem has been too little inflation for too long, and we should stop wringing our hands in despair after seeing a few months of resurgent CPI increases. Inflation in the range of 4 to 7 per cent is nothing to cry wolf about. A little higher inflation may, in fact, be good for reviving animal spirits.

Purists will argue that what should matter to us is real interest rates and real income, not nominal rates and nominal income. However, human behaviour is influenced not by real interest rates or incomes, but nominal figures. “The money illusion” – the human tendency to value nominal money more than inflation-adjusted money – is what moves consumer behaviour.

For example, if my income is stagnant at Rs 10,000 and inflation is also zero, I am not better or worse off. But give me a 4 per cent hike and 4 per cent inflation, and I might actually feel much better, even though my net situation is the same as before. I now have more money in my hands – and that always feels better. Few human beings fret about real incomes when nominal incomes can be better.

This is why moderate to slightly high inflation may not be a bad thing for the economy right now, as long as inflation does not get out of hand. The message to the MPC is thus clear: focus on growth, not inflation.

But a rate cut is not without its consequences. Higher inflation also has consequences, both positive and negative, and these must be addressed head-on.

Reality 1: Lower rates benefit borrowers, from companies to governments to home buyers. But they impact savers negatively, especially pensioners.

Corollary: Lower rates thus help the young, who are more likely to borrow to buy cars or homes, and work against the old, who will earn less on their savings, fixed deposits and bonds. Governments and corporates can borrow more cheaply, but at the expense of households.

Reality 2: Higher inflation benefits farmers, companies and businesses, who then get to price their products better. It hits consumers, who have to pay more for products and services. The recent telecom price hike will benefit all cellular services companies, and dent the consumer wallet. Governments also benefit from higher inflation, for this brings in more nominal tax revenue while bringing down the real cost of debt servicing.

When the economy is starved of investment, it does make sense to get consumers to pay a little more to keep telecom companies afloat. If they go under, consumers will have to pay even more when competition dies out and we end up with telecom monopolies or duopolies.

The current political uproar over onion prices is also overblown, for the price rise may be temporary lasting a few months till the next crop comes in. One can hardly shed crocodile tears for the consumer with the right eye, and shed even more crocodile tears with the left eye, since farmers are getting low prices for their produce.

The real issue is not consumers versus producers, but the lack of reform in the agricultural markets, where middlemen skim the cream off both sides, the farmer and the consumer. Shortening the supply chain from farm to fork by eliminating as many middlemen as possible is the answer, not endless subsidisation of the farmer or the consumer – or both.

When it comes to the savers versus borrowers conflict, or old versus young, the answer will probably have to be limited subvention in favour of pensioners and households. We should let bank fixed deposit rates fall where they must in order to revive investment and growth, but equally the old must be offered higher non-market rates for their long-term savings. Some of these instruments already exist in the form of the Senior Citizens’ Savings Schemes, and higher deposit rates for fixed deposits held by senior citizens.

Maybe, when rates are going to go even lower, the government can offer higher subventions to offer higher rates for pensioners in the short term. Post office schemes already pay more than bank deposits, and non-senior citizens can benefit from a shift of a part of their savings to these schemes. Others, who can take larger risks, should try hybrid mutual funds and stocks.

There is no point penalising an economy starved of growth by keeping rates higher than needed, and inflation lower than where they can do some good to nurture the money illusion. Behavioural economics tells us that people must now get a sense that they are getting more money to spend, even if this comes with higher inflation.

There is a strong case for cutting rates and letting inflation rise a bit even if real interest rates fall to zero or negative territory.

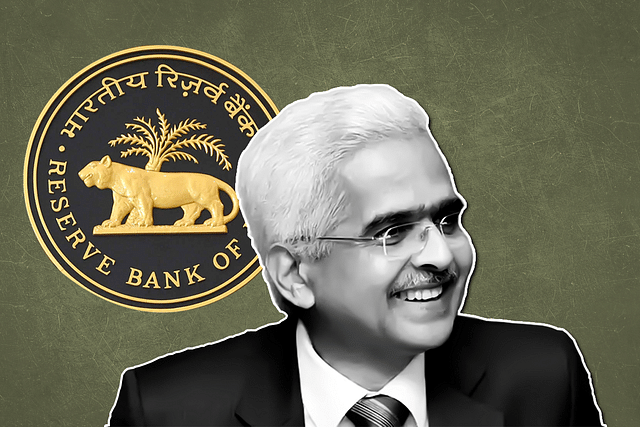

At the last policy meeting in October, Reserve Bank Governor Shaktikanta Das has already indicated that his bias is towards growth, and this is just right. He should ignore the inflation hawks, just as the government should ignore the fiscal deficit Ayatollahs.