Government Firm, But So Are The Challenges

The government has presented a super-tough Bill to fight the problem. The war against black money has to be fought on many fronts simultaneously.

Will the Undisclosed Foreign Income and Assets (Imposition of New Tax) Bill see a ghar wapsi for all those billions of dollars stashed away by Indians in foreign banks?

It seems so, on the face of it. The proposed law is extremely tough and tries to plug all possible loopholes (see highlights here) So both foreign income and assets are mentioned and assets will include shares in any foreign entity. So it’s not just black money that is being targeted but also what this black money has been used for.

The penalties are so harsh that the attempt seems to be to scare people into toeing the line. Chartered accountants, banks and financial institutions could come in the line of fire for helping people conceal their foreign income. Though chartered accountants have not been named, the provisions relating to abetment or inducement could apply to them.

It was inevitable that the government would bring in a super-tough law on black money held abroad. It was being taunted rather mercilessly for not living up to its foolish election promise that it would bring back black money stashed abroad within 100 days and put Rs 15 lakh in every bank account. As everyone knows, the 100-day promise has not been fulfilled and BJP president Amit Shah has himself admitted that the Rs 15 lakh promise was just a poll gimmick. The government’s credibility on this issue was under threat, though the BJP had only itself to blame for building up the hype. So there was an understandable political necessity for the government to bring in what is widely—and not unfairly—being seen as a draconian law.

The optics are great, but will the law deliver on the ground?

The one-time compliance opportunity—a person can disclose foreign income and assets during a particular time window and pay 30 per cent tax and 30 per cent penalty—could bring in a big chunk, if the costs of compliance are less and benefits more than the cost of avoidance. But after that, what?

A lot will depend on the government coming to know of undeclared foreign income and assets. There’s improvement on this front because of the global crusade against black money. There’s far more information being shared between countries than earlier and a growing international consensus about tackling the problem of tax havens. But nothing is foolproof and there will always be outlier countries that will be ready to play host to money on which taxes should be paid in some other country. They may also not be willing to share information.

Remember, even an otherwise law-abiding country like Switzerland was not too keen on sharing information on foreign bank account holders. So if the government does not get information about foreign holdings in cash and kind, how will the stringent provisions be applied on the owners of these? Arun Kumar, the Jawaharlal Nehru University professor who has done a lot of work on the black economy, has never tired of pointing out that the bulk of the wealth held abroad illegally cannot be traced back to the actual owners.

India’s record of stringent provisions delivering results—especially in the case of economic offences—has not been stellar. There are provisions already in place to check the holding of black money abroad—mainly under the Income Tax Act, 1961, the Foreign Exchange Management Act, 1999 and the Prevention of Money Laundering Act, 2002. Sometimes all three Acts can come to be invoked on a single case of violation. And yet those tracking such transactions bemoan the poor record of prosecutions, let alone convictions. National Crime Record Bureau data on money-laundering cases between 2008 and 2012 shows that the fines realized were invariably less than 5 per cent of the fines imposed.

But even while they prove ineffective, strict laws provide immense scope for harassment. This bill also seems to suffer from the same flaw. True, it puts certain safeguards in place—there are provisions for the mandatory issue of notices, opportunities for hearing and appeal, requirement of recording of reasons and passing of orders in writing, time limits for various actions by the authorities, and so on. And yet, there seems to have been a fair amount left to the discretion of the tax officials. Inadequate disclosure of assets will attract a Rs 10 lakh penalty and seven years in jail. But who will decide what “inadequate” is?

So is this proposed law a mistake that should be junked? Not really. It certainly sends out a strong message that India is not going to shrug helplessly any more about the problem of money being spirited away to foreign banks. But the government should not just get this law enacted and leave it at that. There’s a whole lot of other things that need to be done.

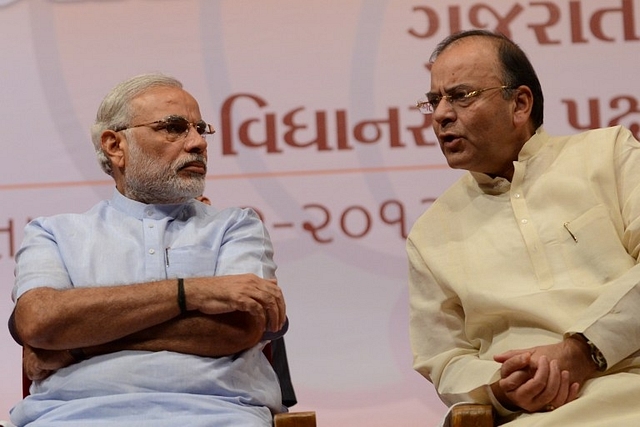

First, there has to be an equally serious effort to get at the black money and gold bars lying in bank lockers across the country. Finance Minister Arun Jaitley promised a more comprehensive Benami Transactions (Prohibition) Bill in the budget session and if the Undisclosed Foreign Income and Assets Bill is not only about optics but a real attempt to tackle the black economy, this should be tabled soon. Again, a quote by Arun Kumar comes to mind—that the quantity of black money held abroad is much less than domestic black money and is also harder to get back. In other words, not only is it easier to tap domestic black money, the hunt will also yield more.

In addition to laws, the government needs to do a whole lot of other things to check the very generation of black money. Attempts need to be made to widen the direct tax net. A majority of the property brokers in the country do not even have a PAN card. The culture of billing is just not picking up, which means there is a lot of unaccounted cash floating around. Jaitley spoke about some measures to tackle this in his budget speech—incentivizing credit/ debit card payments and prohibiting cash payments or receipts of more than Rs 20,000 in property transactions. This needs to be carried forward. Compulsory quoting of PAN in high-value transactions needs to be pushed as well. Chartered accountants will tell you that the Income Tax Act’s 23 chapters with hundreds of sections and sub-sections are both a cause for tax evasion and a haven for tax evaders. This, too, needs to be addressed.

In 2012, the Finance Ministry published a white paper on black money. The paper sidestepped many issues, but one of the more sensible suggestions it made with regard to the way forward was to push reforms in sectors vulnerable to the black economy—the financial sector, real estate, bullion and jewellery, mining, equity trading. The small scale sector too escapes the radar of tax authorities to a large extent because it is part of the informal. There has to be a focused attempt at increasing the size of the formal sector.

The war against black money has to be fought on many fronts simultaneously. That is what the government must make sure it is doing.