‘Charge’ Is The Key To Change In Electric Vehicle Revolution

Government support will be needed to democratise the technology, but it will need to play only the role of facilitator in a public-private ecosystem.

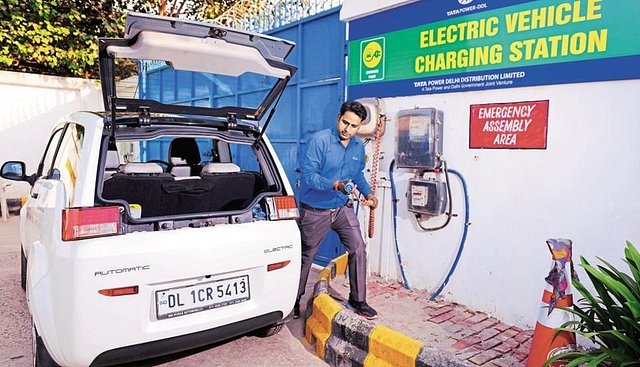

The stated objective of the government to have 30 per cent electric vehicles (EV) by 2030 is an ambitious target given the current state of the EV ecosystem. Advancements in the EV arena will take its own course, and the government should choose to remain neutral to the various kinds of technologies that are evolving to allow them to run their course. An increased volume of EVs will perhaps drive technology to evolve faster. The government can, at best, intervene to make it attractive for manufacturers to produce more and consumers to buy more EVs through a combination of tax incentives and subsidies. However, the most effective state intervention can come by way of facilitating setting up of charging infrastructure, which will form the backbone of any EV revolution.

The charging cost to the end consumer for an EV will have four major components: the electricity tariff, the land cost, the cost of charging infrastructure, and manpower among other miscellany. The tariffs are likely to continue to remain regulated in the foreseeable future through the orders passed by the State Regulatory Commissions (SRCs). But unless SRCs show initiative in allowing “open access” to operators to purchase electricity from the market, things may not work out as expected.

The sum of other costs, and the ability of operators to manage those effectively, particularly the land cost, will decide the ultimate price at which the charging facility shall be provided to the consumer. Till such time EV volumes are low, the cost is likely to be high. In that context, it is possible that setting up of EV charging infrastructure may not be economically viable for operators, and it may require some degree of fiscal or other incentives, including subsidies from the government. The government too does not appear to be averse to the idea of offering subsidies and incentives, but it needs to tread this path carefully.

The most viable sites for setting up charging infrastructure would be existing fuel stations. Since most fuel stations are dealer-operated, dealers will need to be nudged into investing in setting up EV charging infrastructure. It may not be an easy task, given the low returns in the short-to- medium term. The Oil Marketing Companies (OMCs) may be asked by the government to take the initiative and invest in setting up charging infrastructure in both owned as well as dealer-operated fuel stations.

However, such a move may be counter-intuitive for many reasons. Since OMCs are listed companies with a significant public stake, it will be unfair on their shareholders if they are indeed asked to invest in a business that they have no expertise in, and which is, otherwise, a low-return proposition. Also, there is an obvious conflict of interest for OMCs to invest in electric charging infrastructure when they are clearly dependent on conventional fuel for bulk of their revenues.

Public sector behemoths such as National Thermal Power Corporation (NTPCL) or Power Grid Corporation of India Limited (PGCIL) may be asked to invest in setting up of charging infrastructure. However, they too being listed companies will face similar concerns around shareholder value and business profitability. The problem for them will be compounded as unlike OMCs they may also need to invest in acquiring land, or enter into arrangements with thousands of fuel station dealers to set up the infrastructure.

The issue of viability for any player, whether state-owned or private, may be addressed by the government through fiscal incentives and viability gap funding to those setting up the charging infrastructure. This is where foresight will be required to ensure that sufficient competition and capacity in charging infrastructure is developed in India. It will be important that the government is not driven by its socialist baggage to nudge public sector undertakings (PSUs) to take up the task at the cost of shareholder value, or provide fiscal incentives and subsidies to PSUs alone who undertake the task of building such infrastructure.

The incentives and subsidies should be distributed in the most efficient manner to achieve the maximum impact. It will be prudent on the part of the state to allow private players and PSUs alike to participate in any subsidy-driven scheme. An open competition will ensure that players with requisite technical expertise or those who have the ability to bring in the know-how internationally available and their best practices will be able to optimise their costs to set up infrastructure with minimal subsidy support. It will not only ensure that government funds are utilised by those who are best placed to deliver results, but will also create capacity outside the PSU ecosystem.

An open competition in setting up of solar and renewable projects has shown how private sector participation can result in lowering of tariffs, besides creating a bench strength of operators who can deliver such projects in India. A similar approach in promoting EV charging infrastructure is desirable. Private sector may show the way forward in not only managing the cost of charging infrastructure, but also in managing manpower and other miscellaneous costs, which will go a long way in ensuring sustainable and reasonable charging cost to the end consumer.

The EV revolution will need government support, but it will need to play the role of the facilitator, without taking sides. Its involvement will need a sufficient degree of detachment, particularly from the temptations of getting involved in setting up the charging infrastructure, directly or indirectly.