How K T Li Turned Around Semiconductor Industry In Taiwan And Why Modi Needs A Man Like Him In India

Narendra Modi needs a K T Li, the Taiwanese godfather of technology , and a long-term vision to script a manufacturing history for India.

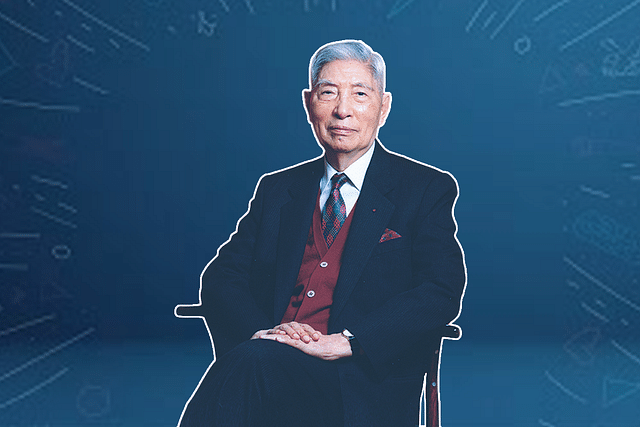

This month as India looks to scrutinise serious contenders to establish Indian semiconductor industry, Taiwan will celebrate the 111th birthday of Kwoh-Ting Li, fondly known among Taiwanese as ‘the godfather of technology’.

Under K T Li’s stewardship, Taiwan transformed its poor agrarian populous into an export-driven manufacturing society. The semiconductor industry takes the lion’s share of the manufacturing exports.

The agrarian skirmishes in the Indian capital present an eerie ‘historic counter-factual’ of what could have been avoided, if we look back at the historic opportunities to establish an Indian semiconductor industry as reported earlier by Swarajya.

This article provides a brief account of two decades of toil by the Taiwanese leadership to establish a thriving semiconductor industry, and an account of its chief architect.

In 1976, K T Li retired as finance minister due to health concerns, and returned as minister with no portfolio. He was entrusted with technological development to chart a history of phenomenal economic prosperity driven by technology. He was instrumental in the creation of Taiwan Semiconductor Manufacturing Company (TSMC), which is today’s leader in pure-foundry business.

Born into a merchant family in 1911 at Nanjing, he majored in physics at Nanjing’s National Central University. He travelled to Great Britain in 1934 on a scholarship to study radioactive substances under the guidance of Nobel laureate Ernest Rutherford.

The second Sino-Japanese war forced him to return to the mainland in 1938 and put an end to his career as a physicist. Li joined Industrial Development Commission in 1953 after 15 years in the Industry. In 1958, he became the secretary-general of the Council for US Aid (an important agency responsible for economic policy in Post-War Taiwan).

He piloted some of the critical legislations namely: land-acquisition and set-up of export-processing zone (EPZ). As finance minister in 1965, Li reformed the tax system. This paved the way for modernising the island’s infrastructure like highways, international airport, power plants and an industrial park in 1970s.

Li was instrumental in setting up the Industrial Technology and Research Institute (ITRI) and Hsinchu Science Park. In the late 1970s, he consulted Frederick Terman (founder of US Silicon Valley) on “How Taiwan could emulate silicon valley’s success?” Terman’s advice to Li was to use skilled Taiwanese immigrants in the US.

Role Of Taiwanese Diaspora

In 1960s, the policy makers in Taiwan started viewing US-educated engineers as a potential asset to transform the economy of Taiwan. In 1966, Taiwan’s Minister of Communications Dr Y S Sun constituted Modern Engineering and Technology Seminars (METS) in collaboration with the Chinese Institute of Engineers (CIE) in New York.

Industry representatives in Taiwan compiled the topics of interest and CIE members in US picked the Chinese engineers in US Industries to travel to Taiwan to deliver the know-how. Li attended these METS seminars.

Pan Wen-Yuan (CIE member) was convenor of METS, who recommended the setting up of a strategic planning group composed of members in Taiwan and US, and tasked with acquiring foreign semiconductor technology. This resulted in the formation of ITRI in 1973.

As an engineer at Radio Corporation America (RCA), Pan persuaded the organisation, which had decided to exit semiconductor industry, to sell its obsolete 7000nm CMOS technology to ITRI.

The Electronics Research Service Organisation (ESRO) — an ITRI subsidiary recruited 40 young engineers (35 from Taiwan and five from the US) and sent them to RCA for a year’s training in chip design, process technology and testing.

In 1978, ESRO fabrication plant produced its first wafers and within a year (1979) they had better yields than RCA.

Dr Y S Sun (now Premier of Taiwan) formed the Science and Technology Advisory Group (STAG) in 1979, a close-knit group of policy advisers, to advise on the technology roadmap, and entrusted Li with the leadership.

Li recruited all the 15 members of STAG from prominent US industries like Bell Labs, IBM and others. These “foreign monks” (as they were popularly known) shaped an industrial strategy which was ambitious and extremely competitive.

They argued that Taiwan had to compete and be the best else its small and medium firms would be vulnerable to Korean or Japanese acquisition. They argued for limited state influence and pushed for private sector and market-driven policies.

For example, even though ESRO financed and incubated semiconductor companies like United Microelectronics Corporation (UMC) and Winbond, they eventually spun off as private ventures.

Taiwanese government built databases of US-based engineers and provided contacts to individuals planning to set up technology businesses in Taiwan. The National Youth Commission sponsored visits by overseas professionals and even financed airfare for professionals returning to Taiwan permanently.

Li’s prize catch among all these overseas recruits was Morris Chang, who was with General Instruments for slightly over a year, having quit Texas Instruments (TI) after an illustrious career of 25 years, rising from an engineer to senior executive. Li invited Chang to preside over ITRI in 1985.

Pure-Play Foundry — An Uncharted Course

After having spun off UMC based on the incremental developments at ITRI on the RCA licensed technology, K T Li asked Chang to draw up a business plan in 1985 for a world-class semiconductor company with goal of competing with Japan and Korea.

Chang went to his drawing board relying on Carver Mead’s writings that detailed that design and technology could be split up. But pure-play foundry was still a theory not put to test due to cost barrier. With no expertise in circuit design, product design or intellectual property, semiconductor manufacturing was the only option Taiwan had, but “what was the business proposition?”

All leading US companies like Intel, TI, Motorola had their own manufacturing units and their chances of outsourcing manufacturing to a distant Taiwan were minimal. But Chang’s short stint at General Instruments helped since he had witnessed many entrepreneurs wanting to set up IC companies but hesitated to take the plunge due to deep capital investments involved in building a wafer fab.

Chang had hoped that a pure-play foundry could enable these design engineers to go ahead and set up their own companies. But it was ‘an uncharted course’ nevertheless.

Birth of TSMC — The first Pure-Play Foundry

In 1987, Taiwan Semiconductor Manufacturing Corporation (TSMC) — a joint venture of Taiwanese government (49 per cent), Phillips (27 per cent) and local private investors (24 per cent) was constituted. ITRI provided the initial lab facilities, personnel and a technology, obtained from RCA and worked on for 12 years, albeit at a small scale with no commercial impetus to keep up with leading industry players like Intel, TI etc.

Hence the technology TSMC inherited was at least a generation and half behind the state-of-the-art in 1987. Initially, TSMC banked on big companies to outsource their production when these companies didn’t have the capacity or when they didn’t want to manufacture or when they wanted to decommission a technology node and move to the next advanced node.

The Dawn Of The Fabless Industry

TSMC meandered through the late 1980s while Chang pitched his vision of TSMC as a pure-play foundry, manufacturing wafers for clients and emphasised on vertical disintegration philosophy (ie, the design and manufacturing of chips can be split) of Carver Mead. This focus on technology pushed TSMC to bridge the gap with the industry production standard.

The beginning of the 1990s saw many small companies starting with LSI Computer System (founded by former General Instruments engineers where, Morris Chang had a short stint). It was the beginning of the era of fabless industry, which is now the de facto model for any new semiconductor company including the leading names like Qualcomm, Broadcom Inc, Nvidia etc.

Venture Capital Industry

Another vital contribution of Li was to create a vibrant venture capital industry in Taiwan. It deepened the institutional support for entrepreneurship and facilitated innovation economy to flourish.

Ta-Lin Hsu (a former IBM executive, a STAG member) went on to set up Hambrecht & Quist Asia in 1986 and Walden International Investment Group (WIIG) was set up by Peter Liu and Tan Lip-Bu in 1987. They were responsible in shoring up investments for companies like Acer, UMC, Microtek etc.

Today, ITRI has assets worth more than $850 million and reported net revenue of over $7 million in 2019. It collaborates with over 80 leading industry and academic partners. Hsinchu Science Park is home to more than 500 companies. It reported in 2019, a total revenue of close to $32 billion, employing more than 130,000 people. TSMC is ranked #1 pure-play foundry with reported revenues of over $25 billion in June 2020.

Saxenian writes in her 1999 essay on “Silicon Valley’s New Immigrant Entrepreneurs”, emphasising on the role of governments and diaspora communities.

“Of course transnational communities work within the institutional and economic contexts of their home countries. The actions of government agencies and the structure of existing industries can hinder as well as facilitate their entrepreneurial efforts.”

She goes on to contrast Taiwan’s story with that of India’s. “While there are thousands of highly skilled Indian engineers and entrepreneurs in Silicon Valley, for example, few have chosen to return to India to start businesses. Most cite the inadequate state of the physical infrastructure and the cumbersome bureaucratic regulations as significant limitations on opportunities for domestic technology growth.”

This observation is two-decade old, and it still holds true (even partially). As India attempts to kick-start its semiconductor manufacturing (ie FabIndia), Modi needs his Li and long-term vision (greater than 10 years) to script a manufacturing history for India and rehabilitate its faltering agrarian human capital.