Total Deposits In Accounts Opened Under Pradhan Mantri Jan Dhan Yojana Cross Rs 80,000 Crore

Data from the Ministry of Finance shows that the total deposits under the Pradhan Mantri Jan Dhan Yojana (PMJDY) has crossed a total of Rs 80,000 crore. Deposits into Jan Dhan accounts saw a spike post the November 2016 devaluation of high value currency notes.

Post demonetisation in November 2016, deposits increased from around Rs 45,300 crore to Rs 74,000 crore with people depositing devalued Rs 500 and Rs 1,000 notes. However, deposits slowly dropped before picking up steam in March 2017. It then went up to Rs 73,000 crore in December 2017 and Rs 78,400 crore last month.

The number of Jan Dhan account holders too has seen a rise from 25.5 crore account holders in November 2016. The figure now stands at 31.4 crore in April 2018. A 2016 report by PricewaterhouseCoopers (PWC) India said that 187 million (18.7 lakh crore) Jan Dhan accounts were opened in 2014-15 alone.

India’s financial inclusion scheme has won it accolades from the World Bank. The World Bank’s Findex Report 2017 said that around 55 per cent of new bank accounts opened were from India.

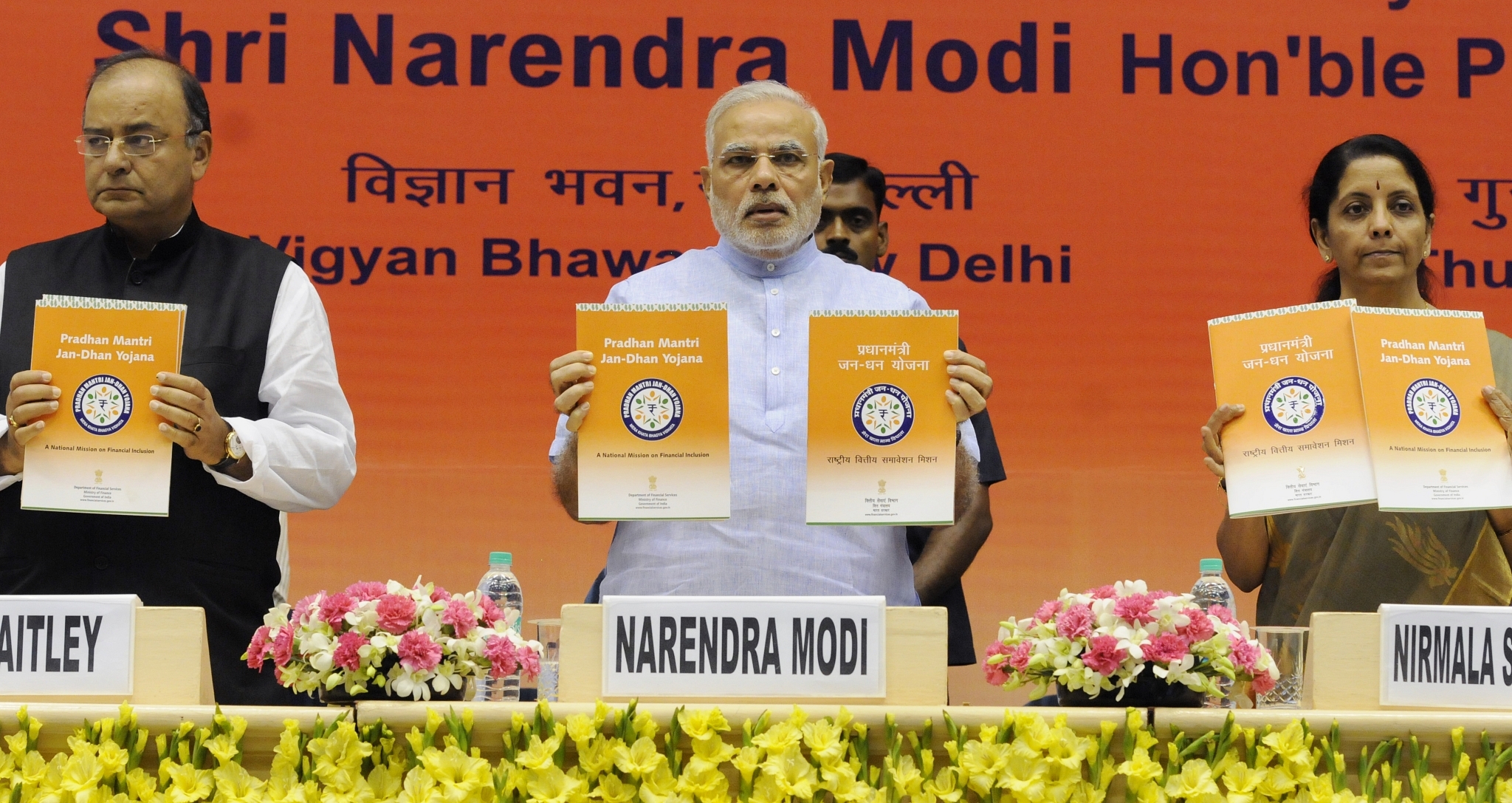

Launched in 2014, the PMJDY offered no-frills zero balance accounts to those who didn’t not have bank accounts in India. In 2015, it was recognised by the Guinness World Records for opening 18 million bank accounts in a one week period in 2014.