‘Vivad Se Vishwaas’ Deadline Further Extended For Companies To Settle Tax Disputes Without Paying Penalty

The government has further extended the deadline for settling tax disputes under the Vivad se Vishwaas scheme without paying any interest and penalty to 31 December, 2020 from 30 June, 2020.

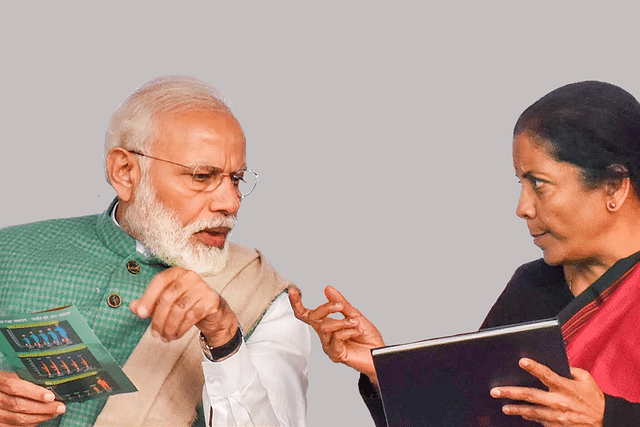

This was announced by the Finance Minister Nirmala Sitharaman while giving details of the first set of economic relief package to counter Covid-19 disruptions.

With this, the scheme scheduled to close on 30 June, 2020 is now extended for another six months for settlement of any dispute without attracting any penalty or interest.

As per the original scheme, the tax dispute settlement under the scheme was to be allowed without payment of any interest or penalty till 31 March, 2020. A penalty of 10 per cent of disputed tax amount had to be paid additionally if the dispute was settled under the scheme after 31 March, but before closure of scheme on June 30, 2020.

The extension has now come to provide more time to taxpayers who are unable to move for settlement due to lockdown announced to check the spread of coronavirus. Many tax professionals had urged the government to extend the scheme as it became effective very late on March 17, giving little time to taxpayers to move a settlement.

(This story has been published from a wire agency feed without modifications to the text. Only the headline has been changed.)