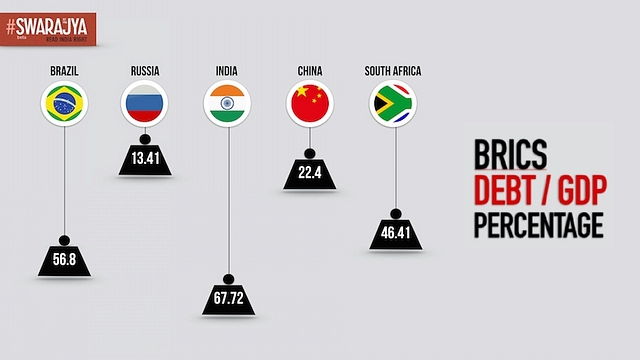

The Debt Burden Of BRICS

The graph below shows debt-GDP ratio of BRICS nations. This is simply the ratio of a country’s borrowings in relation to what it produces. It provides investors an important perspective on the nation’s financial stability. A country that fails to pay back its debt, including the interest payments, is considered as having “defaulted” – an event that causes a fright-and-flight response among both foreign as well as domestic investors (who fund the country’s growth) seeking a safe destination for their investments.

For developing countries seeking high growth, it is therefore important to consistently maintain a lower debt ratio. But given that these countries also typically see higher government spending in infrastructure and subsidies (which eventually requires more borrowing), the goal of maintaining a reasonable debt-to-GDP ratio becomes a rather arduous goal. India has the highest debt ratio among the BRICS nations (at 67.72%), mainly on account of the higher spending path pursued by the UPA post the 2008 global recessionary period.

Care must be taken that any future decline in this ratio comes through a consistent reduction in unnecessary government spending. High inflation, which is not particularly desirable, could also cause this ratio to fall (since inflation eats away at the ‘real’ value of debts – the numerator of the ratio).