‘GST Brought Down Tax Incidence By 10 Per Cent’ : FM Sitharaman Calls GST The Most Historic Reform Of Government

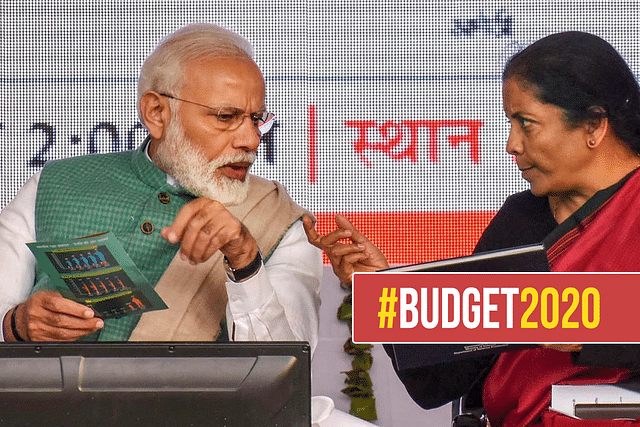

The Budget being presented today is the first budget of the decade. This budget for the year 2020-2021 (FY21) is the second one for the second term of the current PM Modi-led NDA government.

Finance Minister Nirmala Sitharaman gave the budget speech in the Parliament. She listed out the priorities of the government in the very beginning:

- Boost incomes, enhance purchasing power through high growth

- Gainful meaningful employment to youth

- Businesses to be innovative, healthy, solvent, with technology

- Fulfilling aspirations of the youth, SC, ST, women, minorities

- Vibrant dynamic economy as well as caring society for the weak, old, and vulnerable

She also state that in its previous term 2014-19, the government brought out a paradigm shift in the governance - a focus on the fundamental structural reforms as well as inclusive growth.

Sitharaman stated that the fundamentals of the economy were strong, and the inflation had been well-contained. The economy had maintained its macroeconomic stability.

She said that a thorough cleaning of the banking system was carried out, and the banks were recapitalised. She also listed out IBC, formalisation of economy as other achievement.

The Finance Minister called GST the most historic reform of the government.

She also paid homage to the former finance minister Arun Jaitley calling him the chief architect of the GST reform, and a visionary leader.

Sitharaman quoted what Jaitley had said at the roll out of the GST, “It will be an India where centre and states will work harmoniously for common goal of shared prosperity. The unanimity of the constitutional amendment and the consensus of the GST council highlight that India can rise above narrow politics for the nations’s interest”.

“With the GST, neither the state nor the centre lose their sovereignty. In contrast, they will pool their sovereignty on decisions on indirect taxes,” she said.

The Finance Minister continued, “GST has been gradually maturing into a tax that has integrated the country economically. It has consolidated numerous taxes, and facilitated formalisation of the economy”.

"It has resulted in efficiency gains in logistics and transport sector. The turn-around time for trucks has been substantially reduced by 20 per cent due to abolition of check-posts after the GST”

“The dreaded inspector raj vanished, and significant benefits were provided to MSME by way of enhanced thresholds and composition limit”

She also stated that the respective tax incident on almost every commodity had come down substantially after the GST roll-out.

“Through substantial rate reductions an annual benefits of one lakh crore has been extended to consumers. It amounts to 10 per cent reduction in overall tax incidence. An average household now saves around 4 per cent of its monthly spend on account of GST rates,” she said.

“During this phase of maturing, GST did face certain challenges. This was natural as transition was daunting. GST council has been proactive in resolving issues during the transition”.

"In the last 2 years, more than 60 lakh new tax-payers added. A total of 40 crore returns were filed, 800 crore invoices were uploaded and 105 crore e-way bills were generated”.

“There were extensive engagements with the stakeholders and a new return system is being introduced from April this year,” she said.