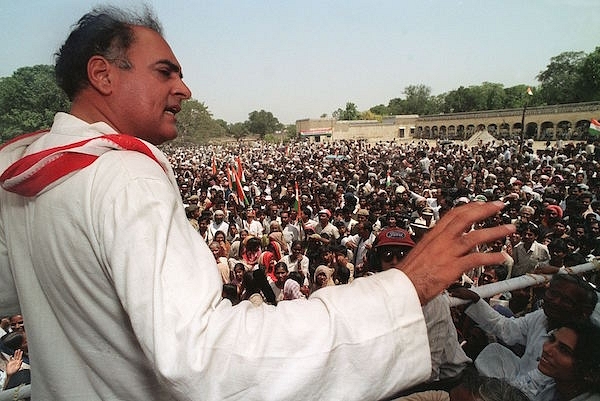

1991: The Real Villain Was Rajiv Gandhi, The Real Hero Was Not Manmohan

Who were the real villains and real heroes of the 1991 crisis?

Should the Bharat Ratna have gone to Rajiv, who wrecked the economy, or to Chandrashekhar, Yashwant Sinha and S Venkitaramanan, who saved it?

For

the last month or so, we have been inundated with eulogies of PV Narasimha Rao

and Manmohan Singh as the men who liberated India’s economy. But this is only

technically true.

Had

Rajiv Gandhi, in a demonstration of utter irresponsibility, not pulled down the

Chandrashekar government in March 1991, the reforms that Rao and Singh are

credited with would have been carried out by Chandrashekar and his Finance Minister,

Yashwant Sinha, in early 1991.

In a

recent interview Manmohan Singh said, as if he was only vaguely aware of what

Chandrashekhar and Sinha had proposed, that he “believed” some such document

was there. As the economic advisor to Chandrashekhar, how could he have not

known? Those were dire times, after all, and everyone who was involved

remembers them vividly.

How

could they not? Thanks to Rajiv’s fiscal recklessness and VP Singh’s political

adventurism since 1985, India had almost run out of foreign exchange and had

been on the brink of a default. It was its worst balance of payments crisis

ever. The government of India was literally running from pillar to post looking

for dollars, and its ministers were being humiliated.

Three

men saved India between January and July of 1991: Prime Minister Chandrashekhar, Finance

Minister Yashwant Sinha and Reserve Bank of India (RBI) Governor S Venkitaramanan.

But

guess who took the credit? Manmohan Singh.

That

is the unvarnished truth. The rest is victors’ spin. And that spin has

successfully hidden a most disturbing fact, namely, that Rajiv Gandhi had caused

an economic disaster. Despite this, the Congress party with its abject

slave-like mentality to the Gandhi family, awarded the Bharat Ratna to him in

1991.

What really happened

Apologists always try to obscure the larger truth in a cloud of small facts. And the largest truth in the case of Rajiv was this: in order to ensure re-election, he made the government borrow excessively from the RBI, which helplessly lent him whatever he needed by printing off the necessary amount of notes. He also refused to either devalue the rupee or go to the International Monetary Fund (IMF) in 1988 for the same electoral calculation. This was a recipe for disaster, waiting only for a political crisis, which came in the second half of 1990.

Manmohan Singh knew how dangerous it was to run up huge budget deficits. As RBI governor between 1982 and 1985, he had told the Maharashtra Economic Development Council:

If we take seriously the objective of accelerated growth in a regime of reasonable price stability and viable balance of payments we cannot assume that the resources which are not mobilised can somehow be made available through expansion of RBI credit. Unless it is clearly understood, monetary policy cannot be expected to operate smoothly and effectively.

Between

1986 and 1989, Singh’s successor, RN Malhotra, made the same point, not once

but a dozen times. Rajiv ignored him, just as Rajiv’s successor, VP Singh, who regarded

deficit financing as a legitimate budgetary source, would. He had once said

that “...deficit financing per se is

not bad” and that “the Indian economy has enough cushion to absorb

substantially higher deficit financing than what the “traditional economic

theories and analysis would permit”.

He then added:

Had I listened to those who advocated a smaller deficit, the economic activity including the government’s anti-poverty measures and public sector investments would have suffered. Let those theories and analysts come and explain where they went wrong.

But

two years later, in early 1987, VP Singh had been dismissed by Rajiv Gandhi

when the Bofors scam broke out. The year 1987 turned out to be disastrous for Rajiv,

politically as well as economically. He decided to spend his way out of his

difficulties.

Malhotra

warned him in early 1987 – before the latter’s political problems had begun to

acquire any seriousness – that money supply growth was getting to be too high.

But Rajiv put it down to the usual fussiness of the RBI.

As a result, between 1987 and 1989, the budget deficit – it would not be called fiscal deficit till 1991 – zoomed, forcing Malhotra to warn in 1988 that: “In the context of the large budget deficits it is difficult to control monetary expansion which, in turn, contributes to inflation.”

Rajiv ignored him even though by now the entire finance ministry was running up storm warning flags. Malhotra’s desperate plea went completely unheeded even after he had pointed to the large current account deficit in the balance of payments.

The RBI’s official history quotes him as saying that the current account deficit

has considerably increased our external indebtedness and sharply raised the debt-service ratio. A reduction in the current account deficit, which is urgently needed, would, however, put pressure on both money supply and prices. Under the circumstances, a substantial moderation of the fiscal deficit has become inescapable.

Rajiv ignored the budget deficit problem because during the first half of his term, he was focused on growth and so ran up deficits as he had been told that the conservative fiscal policies of the past had held back growth. He was determined to break out of the ‘Hindu’ rate.

In the second half, he was focused from mid-1988 onwards on re-election. He regarded warnings about the fiscal deficit, even from his own government, as a nuisance. Indeed, when Bimal Jalan, who was the chief economic advisor and banking secretary, wrote a long note in 1988 explaining the errant ways of the government, far from paying attention to him, Rajiv Gandhi sent him off to the World Bank to ponder over the mysteries of politics and economics.

When Jalan became Finance Secretary during 1990, he did exactly the same thing: he ignored the RBI. Letter after letter from the Governor about deficit and the coming crisis went unacknowledged.

The IMF knew that India was headed for trouble and, in March 1988, Michael Camdessus, the Managing Director, when he was taken by Venkitaramanan to meet Rajiv Gandhi, offered a standby arrangement. Rajiv heard him out but decided not to avail himself of it. Elections, he said, were due later that year and why give another stick to the opposition to beat him with?

In the summer of 1988, Rajiv’s political advisers told him to go the full term and not hold the election that year. Rajiv agreed. So what happened was that he neither took the IMF’s standby arrangement nor did he hold the general election.

Instead, he went on a spending spree in the Budget of 1989, presented by Narayan Dutt Tiwari, which came on top of the 1988 one, which had already decided to throw fiscal caution to the winds. The happened because in February that year, Rajiv had been thinking of holding a general election in October.

The result was that for 1989-90, the deficit climbed to Rs 11,750 crore, 10 times what it had been a decade earlier.

The Rajiv Gandhi era was summed up best in 1993 by two eminent economists from Oxford University. In their classic book on India’s various economic crises since 1964 called India: Macroeconomics and Political Economy 1964-91, Vijay Joshi and IMD Little wrote about the period 1985-90 that:

<i>The current account deficit could have been reduced without cutting public investment only by raising public (particularly government) saving. A different and competing hypothesis is that the current account deficit determined the public deficit rather than the other way round. But until August 1990 there were no unexpected adverse external shocks driving current account deficits. Fiscal complacency was doubtless partly induced by the ease of foreign borrowing, which made it possible to finance large current account deficits. But that surely counts as a policy mistake. De facto, the public deficit may have been the passive element but in appraising policy the right conclusion to draw must be that it should not have been passive. Policymakers were taken in by the apparent ease of commercial foreign borrowing despite the obvious lessons to be drawn from the experience of countries in Latin America... (there was) no excuse for virtual inaction over half a decade.</i>

There was one finance secretary during 1989 who did his best to restrain Rajiv Gandhi: Gopi Arora. A highly intellectual, Left-oriented person, he repeatedly advised Rajiv to at least go to the IMF, if not cut back expenditure. But even he, despite his influence with Rajiv, was unable to counter Rajiv’s logic that he would do everything he was being asked to do after the general election.

VP Singh to the fore

VP Singh became Prime Minister in November 1989 as the head of a very weak government that depended on support from the Communist Party of India (Marxist) (CPM) and the Bharatiya Janata Party (BJP), both of whom refused to join the government. His Finance Minister’s first statement was to tell the world that the treasury was empty.

In the first half of 1990, the government had two chances to solve the looming balance of payments crisis. One was to go to the IMF; the other was to tie up unconventional sources of finance. Finance Secretary Bimal Jalan, who would become the RBI governor in 1997, rejected both options.

But in August 1990, two things happened that precipitated the crisis: Saddam Hussein invaded Kuwait and the BJP launched the Ayodhya temple movement. The first pushed up India’s import bill hugely, and the second put the survival of the government in serious doubt.

So, by September 1990, the world began to get jittery about India’s ability to repay its debts. The credit rating agencies started frowning, and the government decided that they should be comforted with some soothing words.

YV Reddy and C Rangarajan, who were both to become RBI Governors later, were chosen for the task, and they did what they could. But it wasn’t enough because what they told Standard & Poor’s (S&P) missed the point. They told the credit rating agency that India was a politically stable country. But nothing could hide the fact that the government was unstable.

Sure enough, within three months, the government had fallen.

The real dimension of the problem surfaced in the second half of 1990. The trade deficit doubled, and workers’ remittances from the Gulf fell off sharply. International accommodation for turning over loans became harder. Recourse to short-term credit in 1989 was almost $2 billion. The next year it had fallen to less than $650 million.

By the end of 1990, short-term credits in the form of bankers’ acceptances and six-month credits which had been available at 0.25 percent above Libor shot up to 0.65 percent above it and further to 1.25 percent by May. By June, India was borrowing at two percent above Libor. During April-June 1991, the NRIs took out almost a billion dollars. It was not till January 1992 that the outflow was reversed.

By December 1990, the State Bank of India in New York barely had enough to meet the minimum balance required by the Federal Reserve of New York. When the crisis struck, the government had no clue about how much short-term debt had been incurred by Indian entities. What was truly astonishing was that the government had no idea how much its main banking arm, the State Bank of India, had borrowed.

Finally, the BJP withdrew support to the VP Singh government, and the government fell. A new prime minister, Chandrashekhar, was sworn in, this time with the support of the Congress.

He replaced RN Malhotra with one of the unsung heroes of the next three months – S Venkitaramanan, a former Finance Secretary who had played a leading role in Rajiv’s fiscal policies.

He now had to reap as he had sown.

Chandrashekhar steps in

Between January and July 1991, despite having to work with an inexperienced team of officials at the finance ministry, Chandrashekhar, Yashwant Sinha and S Venkitaramanan prevented India from being officially declared bankrupt. It was a virtuoso performance for which they have not been sufficiently recognised.

Indeed, even the RBI’s official history glosses over those six months when India lived from hand to mouth and had to even physically ship its gold to the Bank of England before it got a loan to pay its bills.

But for the gold to be shipped, the Prime Minister, an unsung hero, had to say yes. And he did, without much hesitation. It was a singular act of political courage when the general election had already been announced. Earlier, Yashwant Sinha had gone to Tokyo to beg for dollars. The Japanese Finance Minister neatly dodged him, giving him all of 30 seconds on his way out for another meeting. Eventually, there was no option left but to mortgage gold.

In March, after the Chandrashekhar government had been pulled down by Rajiv – despite having been briefed fully on the economic situation – Venkitaramanan told the government that the banks were not able to raise short-term loans in the international market. In fact, the SBI was borrowing around $2 billion in the overnight market, which was the most expensive money.

The SBI in New York was taking money out from its branches in London, Paris and Frankfurt because some international commercial banks had stopped lending to it. RBI had transferred $250 million to SBI New York and about $80 million to Uco Bank. But this wasn’t going to be enough.

At one point it was even considering, if only briefly, to sell its properties in New York, London and Tokyo to raise money. At another, a well-known international businessman turned up and said he would arrange for a few billion dollars in return for which India would, over the next five years, give him all of its export earnings. A European bank also said it would do the same. All such offers were turned down.

Officials of the finance ministry, meanwhile, were phoning potential lenders in Europe and elsewhere for help. No one would take their calls or even return them. That’s how dire the situation was when the government was saying, ad nauseum, ‘cause for concern but not panic’.

Today, Chandrashekhar is no more and is un-remembered. Yashwant Sinha has become a bitter old man at odds with his own party. And Venkitaramanan is ailing, reluctant to speak about those terrible days. Narasimha Rao is also not given any credit by his party for his singular contribution of dismantling the license raj as soon as he became Prime Minister (though even that had been proposed and laid on the table of the House in the Lok Sabha by the Chandrashekhar government in February 1991).

History and politics can be very cruel to their real heroes.

(This essay is based on the author’s forthcoming book on monetary policy in India since 1835 to be published by Westland).