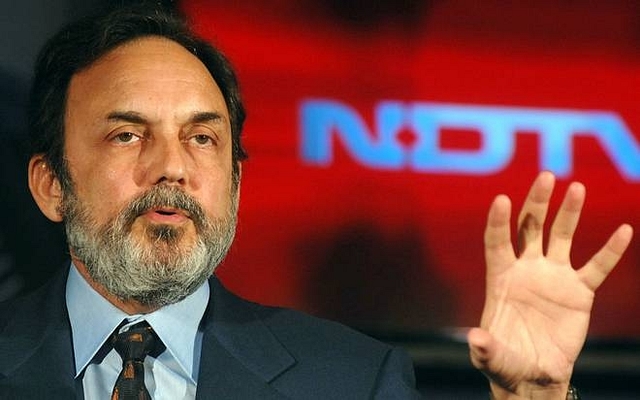

Explained: Prannoy Roy’s Dark Loan Trail And Breach Of Trust

The Roys are accused of a loan default, and executing murky share sale agreements, putting the interests of investors in serious jeopardy.

Now immersed in debt, the news network faces a loss of credibility as well.

Prannoy Roy, co-founder and executive co-chairperson of New Delhi Television (NDTV) along with his wife Radhika Roy, have been accused of carrying out covert financial transactions related to the operations of the network, and are now being investigated for a Rs 48 crore loan default. Dragged into the red, the controlling shareholders of the company had entered into several smokescreen share sale agreements in a serious breach of trust that hoodwinked investors and effectively giving up a significant control of a media network to unknown entities.

While the main case relates to a loan default of Rs 48 crore to ICICI Bank, for more than a year now, the Enforcement Directorate (ED), Income Tax, Delhi Police Economic Offences Wing (EOW) have been raking up Prannoy Roy’s clandestine financial transactions and money laundering in the operation of NDTV, a Stock Exchange Listed company. Radhika Roy Prannoy Roy Holdings Private Limited (RRPR) is cardinal to the string of transactions that were executed from 2007 onwards.

The Roys today face bank/tax fraud and money laundering charges, which the channel has rejected as a ‘witch-hunt’.

The case against the Roys

The Central Bureau of Investigation (CBI) has filed a case against the couple and a private company RRPR (Radhika Roy Prannoy Roy) Holding for allegedly causing a loss of Rs 48 crore to ICICI Bank. As a result, Roy’s Delhi residence was searched by the CBI in the early hours of this morning (5 June). Four other places including Delhi, Dehradun and Mussourie have also been raided.

The case before the Delhi High Court: In January this year, stockbroker and director of Quantum Securities, Sanjay Dutt, who holds 125,000 shares in NDTV, representing a 0.2 per cent stake, filed a writ petition in the Delhi High Court against the enforcement directorate, or the ED, and the directorate general of income tax investigation and other government bodies for not acting on the complaints he filed in 2013 against NDTV and its promoters for violating a number of laws. Along with the government bodies, Radhika and Prannoy Roy are also named as respondents in Dutt’s petition.

In the affidavits filed in response to Dutt’s petition the two agencies told the court that investigations into NDTV and its promoters have been underway since 2011, in response to a complaint by BJP parliamentarian Yashwant Sinha. The documents reveal that the Roys are being probed for violating tax laws and foreign money regulations. However, NDTV has not been charged with any of the violations identified in the documents.

What led to the case?

A vortex of transactions starting in 2007 opened the can of worms for the Roys, when they also seemed to have started losing their control over the network’s editorial policy and business strategy.

1. The Roys bought back GA Global Investments’ stake in 2007: Radhika and Prannoy Roy bought back a 7.73-per cent stake held by another shareholding entity, GA Global Investments. NDTV’s stock was hovering at around Rs 400 at the time, but the Roys bought shares back at Rs 439, which is often the case when shares are bought at a price higher than the market rate when promoters buy back shares for reasons including an aim to strengthening their holding in the company. In turn this sparks an “open offer” as per Indian stock market regulations, permitting other shareholders to sell stake — up to a ordained limit —to the promoters at the same price.

2. The Roys sold stake to Goldman Sachs in 2008: The Roys entered into another deal, in March 2008, with Goldman Sachs to sell the investment bank up to 14.99 per cent of the NDTV stake they held. The deal also entitled Goldman Sachs special rights in the company, including the right to nominate a director on the board. This deal, which probably violated capital markets regulations, was not announced to authorities or shareholders concerned, and the transactions were presented as open-market sales.

3. The Roys borrowed Rs 501 crore from India Bulls Financial Services in 2008: The reckless stock buy-back led to a shortage of money. To correct this, the Roys borrowed Rs 501 crore from India Bulls Financial Services. This loan kicked off a string of borrowing that had trouble and debt staking the Roys to this day.

4. The Roys took a Rs 375 crore loan from ICICI: To repay the India Bulls loan, the Roys took a loan from ICICI, of Rs 375 crore, at an annual interest rate of 19 per cent, against a collateral that made up their entire personal shareholding, as well as that of RRPR, accounting for a total of 61.45 per cent of NDTV’s stock.

5. The Roys borrow Rs 350 crore from VCPL in 2009: To repay ICICI, on 21 July 2009, the Roys took another loan, of Rs 350 crore, from an entity named Vishvapradhan Commercial Private Limited (VCPL) on bizarre terms. The loan, sourced from Mukesh Ambani’s Reliance Industries, was routed to VCPL through a subsidiary. The terms of the agreement signed between RRPR and VCPL stipulated that the Roys divest a significant portion of their personal stock in NDTV and transfer it to RRPR, raising its total shareholding of the network from 15 per cent to 26 per cent. Then, control of RRPR was effectively handed over to VCPL. Radhika and Prannoy sold their shares to RRPR at a questionable Rs 4 per share when the market price was more than Rs 130. Why? An explanation would be sale at market price would have fetched the Roys substantial profit that in turn would have attracted huge taxes, which they were keen to avoid. After the Roys’ shares were transferred to RRPR, NDTV received Rs 350 crore from VCPL, which they used to repay the ICICI loan.

The RRPR-VCPL deal spree

The Roys didn’t stop there. On 9 March 2010, the Roys together transferred an additional 3.18-per cent of their personal stake of NDTV, to RRPR, at Rs 4 per share, taking RRPR’s total shareholding in the company to 29.18 per cent. VCPL then paid Rs 53.85 crore more to RRPR, with the total loan to NDTV topping Rs 403.85 crore. The deal gave VCPL the right to convert the loan into 99.99 per cent of RRPR’s equity which would mean complete ownership. This also meant VCPL could officially take over RRPR at any time it wanted with or without repayment of the loan.

Under the agreement, RRPR was to have three directors, one of whom was to be appointed by VCPL. NDTV could not sell or raise further equity, file for bankruptcy, or do anything that would affect RRPR’s shareholding, without VCPL’s consent. These conditions ensured the Roys no longer had any control over RRPR, which owned nearly one-third of NDTV’s stock; effectively their control over NDTV itself was seriously weakened.

During the quarter ending 31 December 2016, NDTV had reported a consolidated revenue loss of Rs 18 crore following a fall in advertising revenue. Stalked by financial losses, the channel had put its assets on sale. Incidentally, the CBI raids on the Roys home come on a day the broadcaster was taking its English business news channel NDTV Profit off air.

NDTV, primarily a left-leaning television news channel, was launched by the journalist couple in 1988. Prannoy Roy shot to fame with the news programmes, The News Tonight and The World This Week. The poised moderator, a specialist in election coverage, broke government-run Doordarshan’s monopoly over television news coverage. The company, which went public in 2004, however had to in later years fend off stiff challenges from rival channels, some of them led by former employees. Financial crisis got the better of the network and it even resorted to layoffs. Now, the debilitating crisis has grown to monstrous proportions over the series of financial transactions that the Roys have carried out from the mid 2000s.