Lessons On How To Lose Middle Class Support From Jaitley

The government has promised to consider demands for a partial rollback of the proposal to tax 60 per cent of withdrawals from provident fund and a ceiling on employers’ contribution but made it clear that PPF will continue to be tax exempt

The government on Tuesday notified imposition of infrastructure cess of up to 2.5 per cent on passenger vehicles, which was announced in Budget 2016-17. But the note is silent on 4 per cent levy on big diesel SUVs and cars (mostly purchased by the upper class)

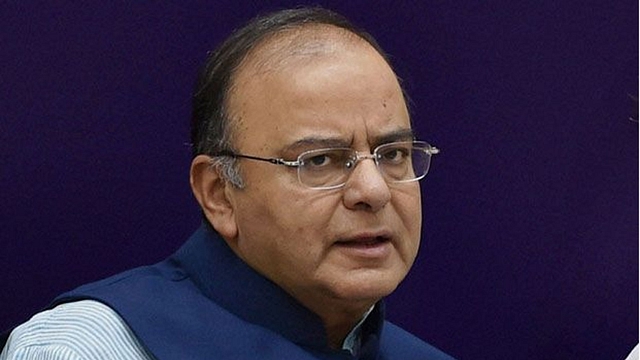

Even in a stuporous condition very few would commit a mistake of taxing provident fund, and to think of that this kind of error of judgement came in a well thought-out budget is inexplicable.Whatever damage controlling the government is dishing out on provident fund taxation proposal, it is clear that one can learn from Finance Minister Arun Jaitley on how to lose middle class vote bank. To his credit, Jaitley is not known to winning direct elections.

Meanwhile, under attack (most vicious on social media), the government has promised to consider demands for a partial rollback of the proposal to tax 60 per cent of withdrawals from provident fund and a ceiling on employers’ contribution but made it clear that PPF will continue to be tax exempt.

The government said it may reduce the burden of tax owed on provident fund claims at the time of retirement. Only interest earned on 60% of the contributions to the Employees’ Provident Fund (EPF) after 1 April may be taxed. At present, withdrawal from EPF is entirely tax-free.

Jaitley on Wednesday hinted that he might blunt the impact of tax. “There have been some reactions when debate comes up in Parliament, I will give the government’s response as to what decision we finally take,” Jaitley said in his post-Budget interactions with trade chambers.

“The intention is not revenue generation. That is not principal intention here,” Jaitley said.Commenting on the intention behind the move, the finance minister said that from last year onwards he had been repeatedly saying that we want India to become an insured society which gives pension to its retired citizens.

He also explained that EPFO has around 3.70 crore members, about 3 crore of which have earning capacity of Rs 15,000 or below. For them, there is no tax liability.

“It is only private sector employees on whom there is an impact. And the object was that if to meet your various commitments you can withdraw up to 40%, you need not pay tax. The balance is converted into annuities, you get a regular pension and you don’t pay tax,” he said.

This is intended to incentivise people in the private sector to use it as a kind of pension and to disincentivise those who would otherwise indulge in consumption of that fund.

But the fact that the budget announced an amnesty scheme for undeclared money with host of incentives to declare black money, did not go well with the middle class. The class divide was too much to digest.

This kind of class distinction or discrimination is very apparent in the notification on cess being imposed on the cars.

The government on Tuesday notified imposition of infrastructure cess of up to 2.5 per cent on passenger vehicles, which was announced in Budget 2016-17. But the note is silent on 4 per cent levy on big diesel SUVs and cars (mostly purchased by the upper class).

Vehicles using petrol, LPG or CNG fuels with engine capacity not exceeding 1,200 cc and length less than 4,000 mm will attract cess of 1 per cent, the Central Board of Excise and Customs said in notification.

It further said a 2.5 per cent cess has been imposed on diesel vehicles with engine capacity not exceeding 1,500 cc and length not exceeding 4,000 mm.

The notification was, however, silent on the 4 per cent infrastructure cess on “other higher engine capacity and SUVs and bigger sedans”, announced by Jaitley in the budget.

The opposition, especially the Left, loves this overt class discrimination. Seizing the confusion, the trade unions have called for a strike next week (March 10).

Rejecting government’s contention that proposed tax on EPF withdrawals was aimed at moving toward pensioned society, trade unions today (Wednesday) said retirement fund body EPFO which has over 5 crore subscribers already provides pension under its social security scheme.

EPFO runs a comprehensive scheme which has all components -- provident fund, pension and insurance,” All India Trade Union Congress Secretary and an EPFO trustee D LSachdev said. “They (government) are trying to create market for pension products offered by insurance companies in the backdrop of government raising FDI in the sector to 49 per cent from 2 per cent,” he added.

RSS-backed Bhartiya Mazdoor Sangh President B N Rai described Jaitley’s contention as “lameduck argument”. He said, “There is Employees’ Pension Scheme, 1995 run by EPFO which provides for pension after the age of 58 years to its subscribers.

Then where is the need for encouraging pension.” Rai argued that “there is no provision of taxing EPF withdrawals in the EPF & MP Act. It is neither law nor practice. On what basis government want to tax EPF withdrawals? It will amount to double or triple taxation.” Trade unions are up in arms against Jaitley’s budgetary proposal to tax part of the EPF withdrawals.

cc