Jaitley Calls GST Revolutionary, Moily Says ‘One Nation, One Tax’ Is A Myth

The four supplementary Bills to implement the much-awaited Goods and Services Tax (GST) have been taken up for discussion, consideration and passage by Lok Sabha today (29 March).

The four supporting GST legislations are the Compensation Law, the Central-GST (C-GST), Integrated-GST (I-GST) and Union Territory-GST (UT-GST).

The C-GST Bill makes provisions for levy and collection of tax on intra-state supply of goods or services, the I-GST deals in taxation of inter-state movement of goods and services, while the UT-GST covers taxation in union territories. The Compensation Bill has been drafted to give a legislative backing to the centre's promise to compensate the states for five years for any revenue loss arising out of GST implementation. A long seven hours have been allotted for the discussion on the crucial Bills.

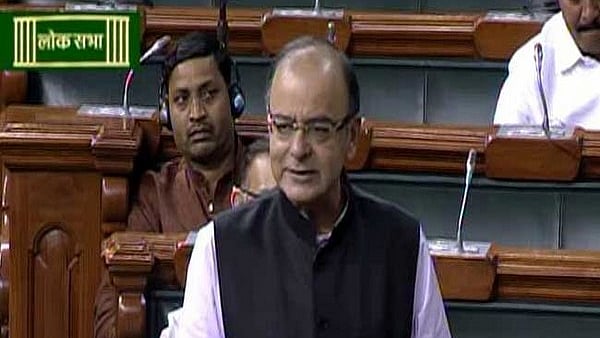

Moving a motion in Lok Sabha, Finance Minister Arun Jaitley hoped that all the related Bills would be passed with consensus.

Calling the GST a revolutionary Bill, the Finance Minister said it would remove the multiple taxation system and thereby would benefit all.

Jaitley said the GST Bills are based on the principle of shared sovereignty and that the government wants to pass these landmark tax reforms through consensus.

“States have pooled in their sovereignty into the GST Council and the centre has done the same,” he said.

The Finance Minister said, “Twelve meetings of the GST Council were held to make it a process based on consensus and recommendations.”

Participating in the debate, Congress leader Veerappa Moily said the exchequer has lost lakhs of crores of rupees due to the delay in rolling out the GST.

“But what you have brought today is not a game changer, but only a baby step,” he said.

Moily said, “There are too many tax rates… One-nation, one-tax regime is only a myth.”

Also Read: NaMo And Jaitley Deserve Bharat Ratnas If They Pull Off GST; The Difficult Bits Lie Ahead