Business

Amazon Versus Reliance: A Big Retail Win On The Cards For Ambani And Future Group

- It must be noted that the current regulations do not allow for Amazon to take over the bankrupt Future Group and Future Retail.

- Thus, by objecting to Reliance’s takeover, Amazon is only trying to ensure that the piece of the pie it cannot have, no one else can either.

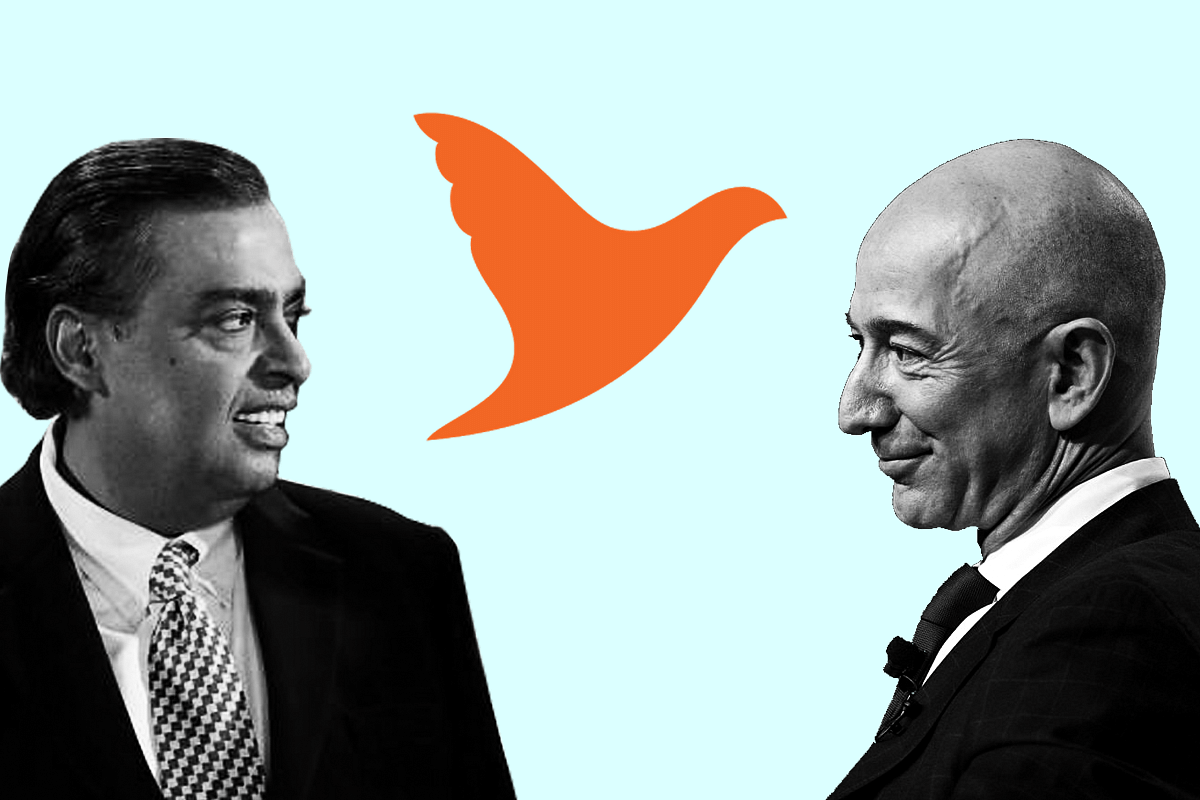

Mukesh Ambani (left) and Jeff Bezos (right)

For those who have been following the case, the Amazon-Future-Reliance tug of war appears to be ongoing for eternity. The premise of the case was fairly straightforward. The bankrupt Future Group was to be taken over by Reliance, to further its retail muscle, in the middle of the pandemic.

However, Reliance’s biggest competitor in the Indian market in online retailing, Amazon, protested against the takeover, citing the 2019 deal it had signed with Future Coupon Private Limited.

The deal gave the American conglomerate a 49 per cent stake in Future Coupons, the promoter firm of Future Retail.

In its deal with Reliance, Future Group was selling its retail, wholesale, logistics, and warehousing businesses to the Reliance Group. The highlight of the deal, from the Reliance perspective, was getting ownership of the retail chain ‘Big Bazaar’, fashion and clothes supermarket chain ‘Brand Factory’, and other retail units, thus furthering its invincibility in the Indian market.

However, after a legal battle that has transcended the Singapore Arbitration panel, several tribunals, and the apex court back home in India, the light at the end of the tunnel could, perhaps, be near, ushering a win for Mukesh Ambani’s Reliance Retail.

It must be noted that the current regulations do not allow for Amazon to take over the bankrupt Future Group and Future Retail. Thus, by objecting to Reliance’s takeover, Amazon is only ensuring that the piece of the pie it cannot have, no one else can either.

Last week, India’s antitrust body, the Competition Commission of India (CCI) stated that Amazon’s 2019 deal with the Future Group was to be in abeyance until it had the complete information on the $200 million investment by Amazon in Future Coupon Private Limited.

The CCI also slapped Amazon with a fine of Rs. 200 crore for not disclosing the complete information and intentions about its investments in the Future Group.

For Amazon, this means they can no longer proclaim strategic authority over the assets of Future Retail, thus allowing for Reliance’s takeover.

In its hearing, the CCI concluded that Amazon had chosen not to disclose their true intentions for the investment in Future Coupon. CCI stated that Amazon wanted to control Future Retail through Future Coupon, thus misleading the CCI.

While the statement from CCI does not irrevocably cancel the deal between Amazon and Future Coupon, it thus dents the case of the former to a greater extent.

The Future Group, at the behest of Reliance Retail, is expected to use the recent developments to further its case. Already, it is being reported that Future Retail will approach various courts and tribunals including the Supreme Court, National Company Law Tribunal, and also the Singapore International Arbitration Centre (SIAC), citing the latest statement by CCI, and stating that there is no basis for the cases filed by Amazon.

The move has been anticipated in the markets as well where shares of Future Retail surged by as much as 20 per cent even when there was a 'bloodbath' on Dalal Street.

The 2019 agreement ended up being the Achilles heel for the Reliance-Future deal because the deal between Future Retail and Amazon included a provision for Future Retail’s products to be a part of Amazon’s new retail plan.

Tapping into the strong brick-and-mortar network of Future Retail which has over 1,500 stores in India, Amazon wanted to introduce two-hour deliveries in selected cities.

As per some reports, the deal also gave Amazon a ‘call’ option, enabling it to exercise the option of acquiring all or a part of the Future Coupon’s promoter, Future Retail’s shareholding in the company, within 3-10 years of the agreement.

For both the companies, the Future Group fiasco also matters in the larger scheme of things where Amazon and Retail shall be joined by the Tata Group and Walmart in gaining supremacy over India’s retail sector.

By late 2020, Amazon’s online marketplace in India had close to 0.7 million sellers. With the company adding close to 20,000 sellers in the preceding months, the growth has been steady and significant.

Jeff Bezos, however, wants to onboard more than 10 million sellers by 2025 with an aim to dominate the largest free market on the planet.

On the other hand, Reliance Retail, with 45 subsidiaries which include Reliance Fresh, Reliance Digital, Reliance Footprint, Hamleys, JioMart, Netmeds, and Urban Ladder, is already emerging as the leading player in India, given its elaborate network in rural India.

While Reliance, with more than 11,000 stores, leads Amazon’s network when it comes to traditional retail, it has also strengthened its e-commerce platform, JioMart, after a flurry of investments across 2020.

Reliance Retail Ventures raised close to $6.4 billion from Silver Lake, KKR, Mubadala, Abu Dhabi Investment Authority, GIC, TPG, General Atlantic and Saudi Arabia’s Public Investment Fund.

Reliance will also look to challenge Amazon in the grocery business, given Mukesh Ambani has already announced an outreach programme around the launch of JioMart, stating that the digital transformation would not only help 120 million farmers but also 30 million small merchants, 60 million small and medium enterprises.

Clearly, Amazon won’t go down without a fight, but with CCI putting the 2019 deal into an abeyance, there is little the American giant can do.

For Ambani, facing protests from traditional retail distributors and store owners, a much-needed victory may well be on the cards.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest