Business

Anil Ambani Is Right. Telecom Is Headed For A Triopoly And RCom Is Marked For Extinction

- The reason why we may end up with a triopoly in telecom is not Jio’s muscle power, but the huge investment needs of its main rivals in order to retain their customers.

- When Airtel and Vodafone-Idea start reinvesting in the business, the RComs and Tatas will get elbowed out.

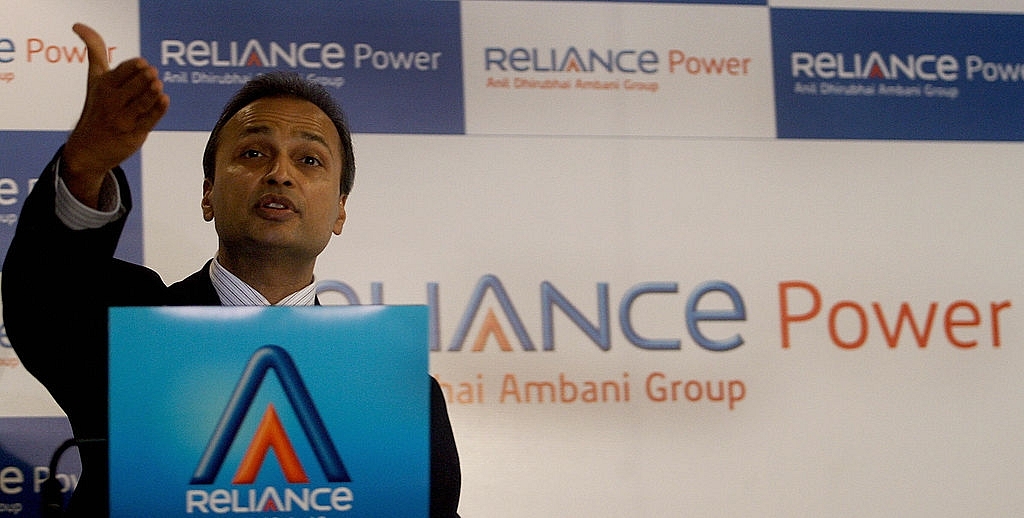

Anil Ambani addresses the media in Mumbai. (PAL PILLAI/AFP/Getty Images)

Anil Ambani, whose Reliance Communications (RCom) is on the ropes due to an overload of debt, has warned that the telecom sector is on the verge of becoming a monopoly. He is right. In recent months, we have seen Sistema and Aircel merging with RCom, Telenor selling off to Airtel, Vodafone and Idea seeking to merge, and even Tata Tele is looking for an exit.

Mint quotes Ambani thus: “I am sure they see things that allow them to write off large amounts of money and exit India. It cannot be the power of the market that is forcing them to leave but it has got to be from other dimensions of the sector which is forcing them to leave. If customer is supreme and consumer is king, can we afford to be an oligopoly, a duopoly or a monopoly?”

Good question, but his analysis is a bit off. It is, in fact, the nature of the telecom market that is forcing many of the incumbents to flee. In due course, India’s telecom industry is likely to be reduced to a triopoly, with Airtel, Vodafone-Idea and Reliance Jio being the last ones left standing. The government-owned BSNL-MTNL combine can remain in the fray, but only if the taxpayer is willing to keep them on life-support forever.

The problem with Anil Ambani’s statement is that some sectors are natural monopolies. Telecom is one of them. This is because of the network effect. The worth of a telecom company gets enhanced only if very large numbers are on it, and once large numbers are on the same network, it is not easy for them to exit without losing the advantages of easy connectivity. Telecom economics, given high spectrum and network maintenance costs, favours monopolies. Abuse of monopoly positions can be kept in check by having a strong regulator. But oligopolies will be the norm.

RCom and Tatas are the next candidates marked for extinction in telecom. Not because they cannot technically scale up, but because they don’t have enough cash and/or the appetite to invest endlessly in a sector where they can ultimately become a member of the oligopoly themselves.

India’s telecom sector had so many players until recently, largely because of corruption, which allowed spectrum to be sold cheap to multiple operators, enabling them to enter the industry without adequate capital. Or riding someone else’s capital, based on spectrum-based share valuations.

In a technology-driven world, market power and profits belong to two more P’s: platforms and pipes. Google, Amazon, Facebook, Apple and Alibaba are platforms. They are so huge and have so many users across their main and mini-platforms, that app-developers, partners and associates build their own businesses around them. When you are a platform, you collect your tithe from all people using it. Few people feel the pinch, as the money collected from any one user is low or even free. Who, for example, pays for Gmail or Android? Google makes money from the ads placed on these platforms, or companies that want to use these platforms for commercial purposes.

Pipes are the next big thing in monopoly. Reliance Jio is a big threat to rival telecom operators not because it provides better voice and data services, but because it owns the pipes (optical fibre cable and telecom tower networks) that carry voice and data across hundreds of miles in India. It can offer “free” voice or low-cost data since it owns the pipes, and using them costs it nothing in the short run. When it completes laying its pipes, it will have invested more than Rs 250,000 crore in building them – and the investments may well continue indefinitely, though at a slower pace than hitherto. The vast bulk of Jio’s investments went not into marketing or customer acquisition, but into building the pipes (including towers).

When you own the pipe, your revenues come from collecting tolls on traffic passing through it. Which is why Jio is soundly placed to take pole position in the industry.

In contrast, consider what its rivals did. In order to stay capital light, they outsourced their backend networks, billing systems and other services to the IBMs and Ericssons of the world, leaving them owning only their customers. Their value comes from the customer data they own, not the pipes or towers they laid. They opted for reaping their profits earlier, instead of investing for the long term, where pipes earn tolls endlessly. On the contrary, given their huge debts, incurred in purchasing high-cost spectrum from the government, they have had to sell their own pipes and towers. RCom can stay afloat only if it can sell its towers company. In future, a large part of the pipes to profits will be owned by specialist tower companies.

While this strategy allowed first-mover telecom companies to turn profitable quicker, it also means that if they want to stay in the business for the long term, they will now have to start investing more in networks, cables, technology and towers. Reliance Jio did the opposite: it used the huge cash streams available from its refining and petrochem businesses to bankroll the pipes, and it is now sitting pretty. Consider this: even Google, owner of one of the world’s biggest platforms, will be using Jio pipes to do business in India.

The reason why we may end up with a triopoly in telecom is not Jio’s muscle power, but the huge investment needs of its main rivals in order to retain their customers. When Airtel and Vodafone-Idea start reinvesting in the business, the RComs and Tatas will get elbowed out.

The moral of the story is this: you can be asset light, but long-term power and profit in the technology business depend on creating near monopolies in platforms or pipes.

This is a lesson for government, too. By virtue of its power to make the law, government owns several big platforms and pipes, including Aadhaar, the biometric ID, the railway network, and IRCTC, which is India’s most profitable e-commerce platform by virtue of its monopoly in railway e-ticketing.

If commercialised, these are billion-dollar platforms, on which government can collect not only huge disinvestment valuations, but also regular annuities from business growth.

If I were in government, I would leverage these platforms to not only improve the ease of doing business, but also earn crores from leasing them out. Full privatisation is not required.

Aadhaar, once the privacy concerns are strongly addressed, will be a huge enabler in any business that needs ID authentication. By charging just Re 1 per authentication, the government can earn crores every year from telecom, banking and insurance companies alone. And they will pay willingly, for the cost of KYC done physically is 50-100 times more per authentication. Aadhaar is the first billion-plus user platform that India fully owns.

The Indian Railways are the next big platform-cum-pipe the government owns. You own the track; there is no need for you to run freight and passenger traffic inefficiently. Lease out the network and railway platforms for multi-modal transport and tourist services, and the railways will be immensely profitable. Lease out the land you already own to lay optic fibre cables and water pipes power lines, and you earn even more money. If the government still wants to run cheap passenger services, it can do so by cross-subsidising some fares from the revenues earned from leasing out tracks, land and platforms.

Ditto for the IRCTC. The logical thing to do is to keep 51-75 per cent in government hands, and acquire a well-run e-commerce firm like Makemytrip or Snapdeal or even Flipkart, and give Amazon a run for its money on everything from ticketing to e-commerce. It will be a multi-billion-dollar platform, substantially owned by the taxpayer, and generating several hundred crores in profits every year. If it manages to dominate Indian e-commerce, it can spread its wings in the rest of South Asia and Africa.

This will need Railways Minister Piyush Goyal to face down the unions or buy their assent by giving them money for jam in the shares that will be divested. But using government-owned platforms for profit is a win-win for India and Indians.

We have to own the platforms and pipes that create monopoly wealth. Mukesh Ambani will own one of them. Other private sector innovators may create other platforms that they can own. Isn’t it fair that the long-suffering taxpayer owns the ones we have already created using her money?

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest