Business

China's Largest Chip Maker YMTC To Make A Comeback Amidst US' Export Curbs

- YMTC has been testing local tools for a while and is now more certain about depending on domestic suppliers for replacement, say reports.

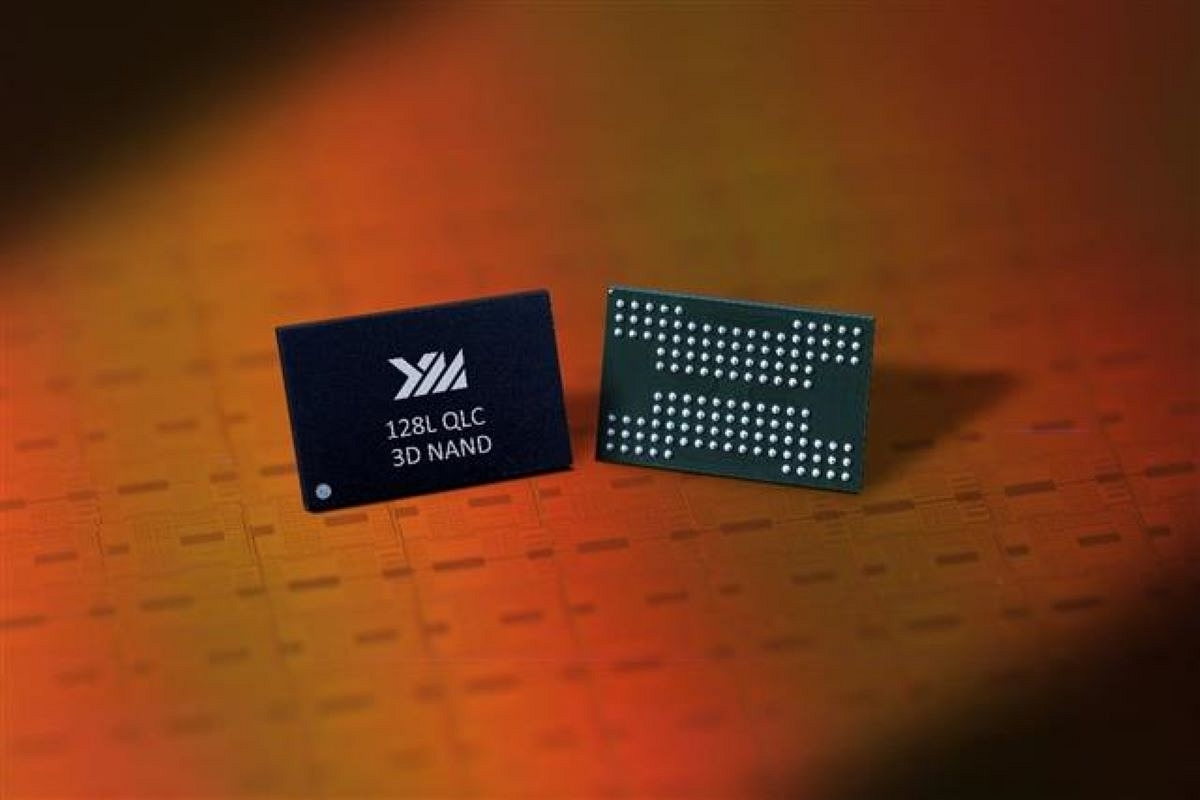

YMTC expects to open a new fab towards the end of 2024 to regain competitiveness with its main competitors in Korea and the US. (Image credit: YMTC).

China's leading memory-chip maker, Yangtze Memory Technologies Corp (YMTC), plans to start production at a new plant as soon as next year.

This move is intended to help sustain Beijing's ambition of achieving self-reliance in semiconductors amidst severe US export restrictions.

Washington's export restrictions on advanced chip-making equipment in October 2019 initially halted the construction and outfitting of a cutting-edge fabrication plant in Wuhan, central China, that is being built alongside a chipmaker's existing fab.

In 2022, YMTC was to supply 3D Nand memory chips to Apple. The latter, however, had to reassess the decision, given the pressure from the senators, and also because of YMTC’s closeness to the Chinese government.

As per some reports then, YMTC was also a supplier to Huawei, thus further aggravating the concerns around privacy and security.

It was also in violation of the US export control laws that barred companies with American technology to work with Huawei.

As per a report in the Financial Times, YMTC has been testing local tools for a while and is now more certain about depending on domestic suppliers for replacement. The second half of 2024 is when the new plant is expected to start operating.

The company's reduced reliance on foreign chip equipment makers is a setback for Washington's export control aims to impede China's progress in making advanced chips.

YMTC expects to open a new fab towards the end of 2024 to regain competitiveness with Samsung and Micron, its main competitors in Korea and the US.

In 2021, the company had a 5 per cent global market share in memory chips, compared to just 1 per cent in 2020, as stated by Yole Development research firm.

Engineers plan to use equipment from US suppliers, taken from an older factory downsizing production, to fill empty slots on the production line.

Beijing considers the company crucial to developing its domestic semiconductor industry and has offered more funding to restructure production lines and test new equipment.

YMTC has received $7 billion from government-led investment vehicles, including the main National Integrated Circuit Industry Investment Fund, since February's updated company records due to new export controls.

At YMTC, a state-backed investor stated that the company is China's top memory chip player and that the government won't let them quit easily.

The new fab's ability will be tested when it ventures beyond its current production of 128-layer 3D Nand flash memory, which is two generations behind leaders like Samsung, SK Hynix, and Micron, to produce advanced 196-layer and 232-layer chips.

In October 2022, the US Commerce Department, under the Biden administration, announced a set of sweeping instructions, aimed at disrupting China’s manufacturing dominance in the supply chain sector.

The Biden administration announced that it would impose restrictions on 31 Chinese companies, research institutions and related groups effective 21 October, effectively blocking their ability to obtain core US technologies.

The Commerce Department claimed that the latest export control moves were intended to halt shipments of chips and chip-making technology of potential use to China, in its military build-up and bid to dominate key industries.

The Biden administration added China's top memory chipmaker Yangtze Memory Technologies and 30 other Chinese entities to a so-called ‘unverified’ trade list.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest