Business

Facebook And Jio: The ‘X’ Factor That Drove India’s Godzilla To Tie The Knot With Global T-Rex

- The X factor driving the two together is Ambani’s debt and Zuckerberg’s desire to make Facebook’s platforms the default choice for Indians.

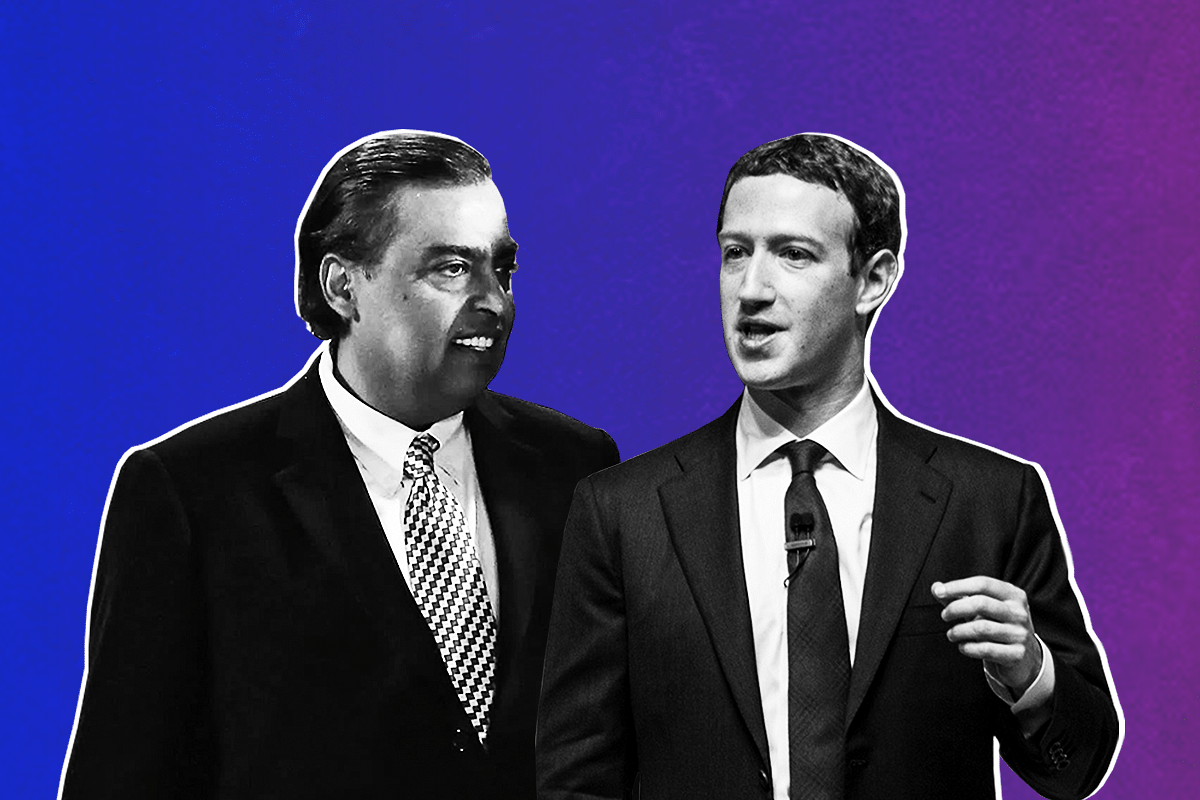

<em>Mukesh Ambani and Mark Zuckerberg</em>

The Rs 43,574 crore Facebook deal to buy a 9.9 per cent stake in Reliance Jio’s parent entity, assuming it gets the necessary regulatory approvals, will be the biggest marriage of pipes and platforms in Indian history.

Jio controls the largest network of telecom pipes funnelling internet content to Indian homes (it had 370 million data users as of December 2019), while Facebook has access to 700 million Indian users between itself, WhatsApp and Instagram.

Formally, the investment values Jio Platforms, the parent unit of Reliance Jio, at Rs 4.62 lakh crore, far ahead of rival telco Bharti Airtel’s market valuation of Rs 2.73 lakh crore and limping Vodafone Idea’s Rs 11,379 crore.

Jio Platforms owns not only the Jio telecom unit, but also OTT (over the top) digital mini-platforms like JioSaavn (music), JioMart and Ajio.com (e-commerce), and JioCinema (movies).

The key synergy driving this massive deal is the ability of both partners to bring the power of the now-ubiquitous WhatsApp instant messaging platform (with 400 million users) to power Reliance’s ambitious plans to network India’s millions of small kirana shops to function digitally and boost small, localised delivery businesses and related micro-payments.

Jio also hopes to preside over another happy marriage between big offline retail (Reliance Retail) and India’s growing online retail industry now dominated by the likes of Amazon, Walmart-Flipkart, Big Basket, and Paytm Mall, among others.

If the marriage works, and WhatsApp facilitates the induction of offline micro-stores (kiranas) into this multi-channel strategy through an in-built ordering and payments platform, the Jio-Facebook partnership will be a potent challenge to the existing dominance of Amazon and Flipkart in online retail, and Kishore Biyani’s Future Group which runs the Big Bazaar offline superstores.

It is no wonder that Amazon and Future Group have been seeking to work out a similar offline-online synergies through a deal to let Amazon buy a stake in Future Group.

The name of the retail game is omni-channel selling, where the idea is to gain access to a customer by offering her any delivery channel of her choice at a price that suits her. Already, customers check products like mobile phones offline for features, and then order them from cheaper online stories.

When the marriage between offline and online fructifies and becomes more seamless, the customer will be able to not only compare prices, but choose the delivery mode most suitable to her. She can, for example, order from Amazon and collect it from a nearby Big Bazaar, if that suits her; or she can pay for groceries through WhatsApp and ask the local kirana store to deliver the stuff at home at a time of her convenience.

However, while the potential synergies are obvious, there are two X factors driving the high-value Facebook deal to pay so much for a mere 9.9 per cent stake in Jio Platforms.

Two questions are worth asking: why is Mukesh Ambani so keen to let an 800-pound digital gorilla into his tent? Ambani is not someone who likes other big boys wandering into his game. And what made Facebook see value in paying so much for so little ownership?

The X factor that made it worthwhile for Reliance is this: debt reduction. For some time now, Reliance Industries, which has gross debt of over Rs 3 lakh crore on its books, has been seeking to lower its debt through asset sales.

Ambani’s stated goal is to make Reliance net debt-free by March 2021. This means he has to retire debt worth around Rs 1.5 lakh crore in the next 11 months, the rest being balanced by cash and liquid asset equivalents already on Reliance’s books.

But two big assets sales - the sale of the tower and fibre assets to Brookfield for around Rs 25,000 crore, and another to sell a 20 per cent stake in Reliance’s oil and refining business to Saudi Aramco — are stuck in regulatory quagmire. Even with regulatory approvals, the Aramco deal may not go through easily given the current state of the global oil market.

A third idea, to list Reliance Retail for a huge premium, will have to wait till the Covid-19 market mayhem ends, and there is no easy way to forecast when that will happen.

In this scenario, a Rs 43,574 crore cash inflow from Facebook is just what the doctor ordered for making Reliance’s debt profile significantly better. This is Reliance’s X factor that makes the deal worth the effort.

But what is the X factor pushing a cash-rich global tech giant like Facebook towards a minority stake in Jio Platforms?

Given the current stock market valuation, Facebook could have bought a larger chunk in Airtel for the same money, or even bought Vodafone Idea (with over 300 million customers) for around Rs 6,000 crore for a 51 per cent stake (though that comes with debt and thousands of crores of dues owed to the government). But that kind of deal would have faced fewer objections from either the government or banks, both of which are worried about the cost of bailing out Vodafone Idea.

There could be two reasons driving the strategy from the Facebook side.

One is the fact that Mark Zuckerberg has made little headway in getting WhatsApp approved as a payments platform in India. The sticking issues are its encrypted nature, which the government does not like, and data localisation, which the government insists on.

Also, most payments platforms fear WhatsApp for its near ubiquity on Indian smartphones, which would make it simple for most users to use it as the main payments for most purchases. When both shopkeeper and customer have WhatsApp on their phones, and when peer-to-peer payments can easily be done and verified on the platform, most users could easily switch from, say, Paytm to WhatsApp.

Secondly, Facebook failed in its effort to push its “free internet basics” idea, which the telecom regulator rejected in 2016 on the ground that it violated “net neutrality”.

Facebook not only lost face, but a chance to convert its social media platform into something even more ubiquitous in India. Free internet on Facebook’s terms would have been a bargain most Indians would have been willing to accept.

From Facebook’s side, the unstated X factor tilting the balance in favour of Reliance Jio is not just the market leader’s pipe into many homes, but the possibility of Ambani using his considerable leverage with policy-makers to get Facebook and WhatsApp through a future crack in the regulatory door.

Yes, there is huge synergy between Facebook’s ambitions and Mukesh Ambani’s. But the X factor driving the two together is the latter’s debt and the former’s desire to make its platforms the default choice for Indians in many things they do: from messaging to payments.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest