Business

Factoring Ukraine And Taiwan, China Dumps US Treasury Holdings

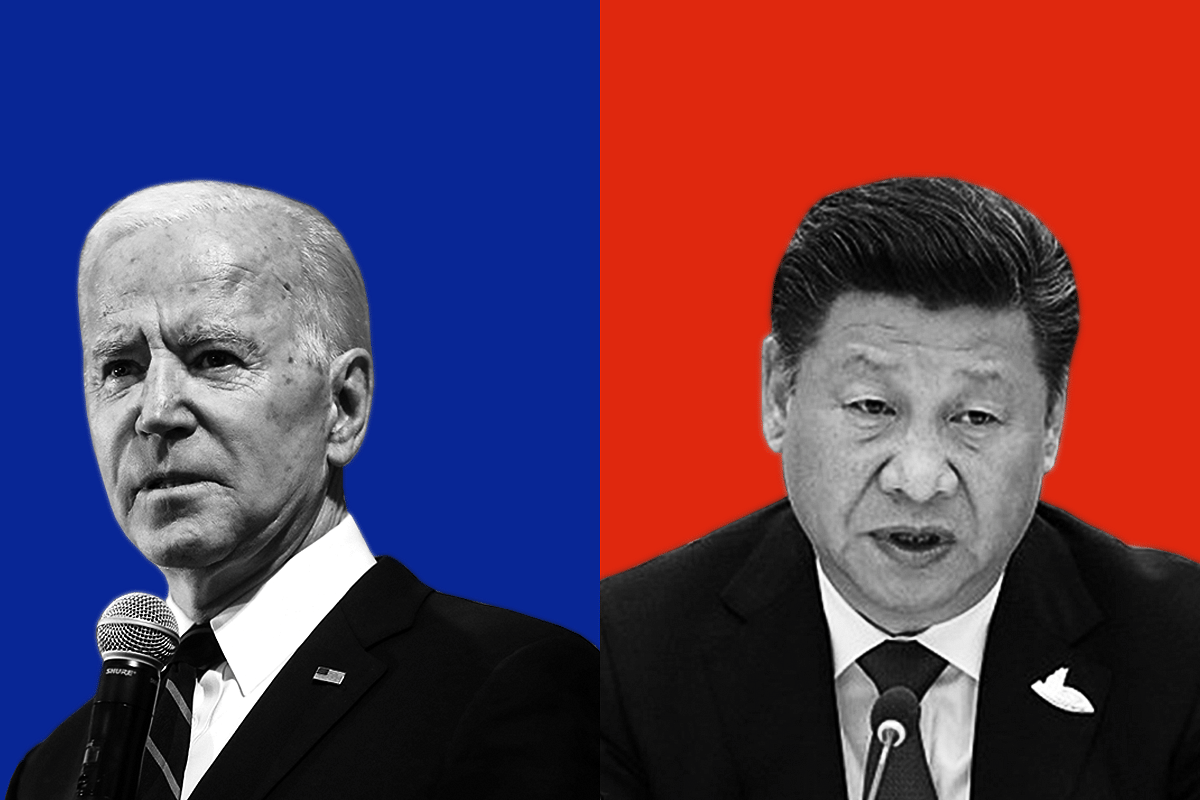

Joe Biden (left) and Xi Jinping.

Amid a trade war with the United States, China's holdings of the US government debt have touched a new low in over a decade as Beijing scales back its investments due to concerns over possibility of Russia-style sanctions if it goes ahead with a military offensive to unify Taiwan.

Beijing's holdings of the US treasury securities, a government debt instruments issued by the Department of the Treasury to finance government spending as an alternative to taxation, fell below $1 trillion for the first time since 2010 in May this year.

The tally stood at $980.8 billion at the end of May, shrinking by $22.6 billion from April's $1003.4 billion and falling 9 per cent over six straight months of declines. It further dropped to $967.8 billion in June but saw a marginal increase in July to $970 billion, US Treasury Department data released earlier this week showed.

China was once the world's largest holder of Treasurys, in which it invested a big chunk of its massive current account surpluses.

However, Beijing slid to second place behind Japan in 2019 as its holdings have been falling since 2018 amid a trade war with the US that has expanded beyond technology to touch finance as well.

The scaling back of treasury holdings is also the part of China's effort to reduce its dependence on the dollar. Further, US efforts to deny Russia access to dollars, including freezing its foreign currency reserves, after Moscow's invasion of Ukraine may also be playing a role.

In April this year, China's Finance Ministry and the People's Bank of China met with domestic and foreign banks' executives to discuss how to protect its overseas assets in the event of a US-led sanctions campaign spurred by a Taiwan contingency, reports Nikkei Asia.

In the discussions, a government representative reportedly mentioned the possibility of diversifying dollar heavy holdings into yen and euro denominated assets.

As of 2016, around 60 per cent of China's foreign currency reserves were in dollars. Beijing's gold holdings have not changed much since September 2019, indicating that it may be replacing Treasurys with yen and euro assets.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest