Business

Hits And Misses Of #StartupIndia

Here are the key hits and misses of the policy announcement in the #StartUpIndia event.

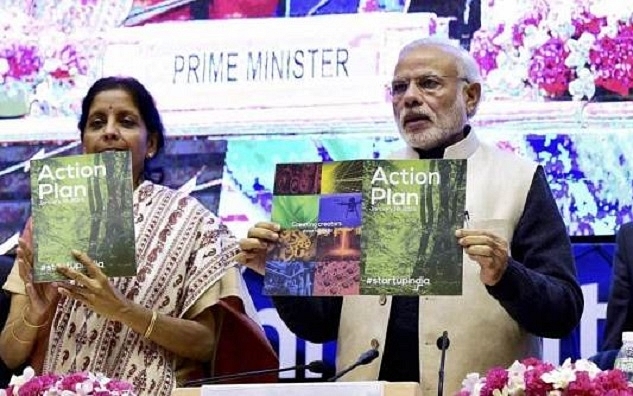

At the much-awaited #StartUpIndia event in New Delhi on 16 Jan 2016, Narendra Modi announced a slew of Policy decisions to an enthralled audience comprising several high profile ‘unicorn’ startups of India, VC/PE/Angel investors and entrepreneurs.

As the applause settles down and the full policy document is carefully reviewed, one can’t help observe that despite a promising start, the initiatives fall short of some of the key expectations from the entrepreneurs, though it addresses most of the concerns of the investor community. Here are the key hits and misses of the policy announcement:

Hits

- The biggest hit is the ushering in of the phrase “Start Up” in the policy lexicon of the Government, unlike the apathy of the past! At least today we have definition for Start-up, and a clear policy direction from the highest authority to view them as job and wealth creators.

- The next and equally big hit is the earnest steps taken in this policy to create an ecosystem for Start-ups – Startup India Hub, Startup fests, Incubator Challenge, Industry/Academia partnership, roping in private sector talent in incubators, replicating the success of IIT Madras Research Park, etc. are all excellent moves towards building a robust ecosystem for startups! As they say, “Silicon Valley is not a geographical location, it is a state of mind!” (no pun intended). If these initiatives help build that state of mind across India, that would a great achievement indeed!

- Third hit is the relaxation of public procurement norms by eliminating minimum turnover/track-record requirement. Though well-intentioned, the effect of this on Startups remains to be seen as the wordings in the policy “… Startups… have to demonstrate requisite capability to execute the project as per the requirements…” can be interpreted very widely by each PSU. In fact, several startups avoid dealing with PSUs not for want of pre-qualification, but the undue payment delays which large cos can absorb but startups cannot! Any move to address issue would have complemented this policy decision well!

- Self-certification is a pet theme of Modi, and seeing this initiative in Startup policy is good; however, the list is too short. 6 labour laws and 3 environmental laws listed there are too few to cheer up the entrepreneurs! Inclusion of indirect taxes would have done that trick! Most startups take a few years before they are harassed on ESI / PF / Gratuity/Contract labour etc. Hence this is not too big a relief as of now. Hope the list will be expanded over a period.

- The Ease of Doing Business initiatives such as fast-tracking patent examination, fast track exit of failed business are excellent moves. But these are as much relevant for all businesses as much as they are for Startups. Hope the treatment meted out is uniform, and swift for all!

Misses

- The major focus of this policy, particularly with regard to funding support and incentives, is aimed more on organized investing community such as Venture Capital firms and Incubators rather than on entrepreneurs

- For instance, exemption from capital gains on property sale is available only for investors who invest in Incubation funds. While this move is welcome, a much needed incentive would have been to make this concession available for entrepreneurs who may be risking their personal wealth to sustain a Startup.

- The next big miss in this policy is the discrimination against angel investors who invest directly in startups, as against those who invest through approved Incubation funds. This is a big impact item because, for every one investment by an Incubation fund, there are typically 100 other angel investments that happen through direct investment. The policy document has completely overlooked this class of investors, who are much larger in size, but probably less vocal.

- For instance, a sore point among several start-ups is the provisions of IT Act Sec 56, which determines whether investment is made above Fair Market Value and hence taxable in the hands of the Startup. While earlier Budget exempted Venture Capital funds from this provision, current policy has exempted Incubation funds, but not direct angel investors. Ideally, this exemption should have been made available for every investor – individual or institutional – with caveat for fraudulent practices which was the trigger for introducing this clause.

- The provision for exempting capital gains from property should also have covered investors who invest in Startups directly (rather than thru an Incubation fund).

- The third biggest miss is the Credit Guarantee Fund announced in this policy. The amount announced is Rs. 500 crores per year, which is woefully short of the actual requirement! Access to credit is the single biggest challenge faced by several small and medium enterprises, including start-ups. Addressing this challenge would involve significantly higher commitment from the Government. To put things in perspective, China has over USD 150 billion in outstanding credit guarantee for SMEs, in contrast to less than USD 3 billion in India. The current allocation is too small to bridge this wide gap!

- The current policy has no mention of ESOP, which is a critical component of survival and a valuable currency in the hands of the Startups. The existing ESOP guidelines are too restrictive – does not allow ESOP for promoters, for advisors / mentors etc. – and the startup policy was an excellent platform to address this anomaly. Hope this will be addressed separately in the budget!

- The announcement of Rs. 10000 crore investment in fund of funds of Startups in the next 4 years is a twin edged sword, and unless handled in a professional manner, can quickly precipitate into a scam of corruption and cronyism. By the way, why should a government make equity investment in private sector which is fraught with market risks? This same amount could have been leveraged multiple times through a credit guarantee mechanism, which will have a significantly higher multiplier effect.

- The income tax rebate for 3 years for start-ups is also an ill-conceived move. Very few start-ups would generate profits in the first 3 years of inception! Adding Inter-ministerial Board approval for obtaining this tax concession introduces more layers of bureaucracy for the entrepreneur to deal with!

In balance, the policy is a good start but doesn’t go the full length it intended to. The policy initiatives are aimed more at addressing the concerns of the institutional investor community (which is good) but not the concerns of the entrepreneurs. Hope the upcoming budget will address some of these concerns!

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest