Business

Reliance vs Amazon vs Tata: World’s Biggest Retail Battle Begins In India

- Following Amazon’s array of services, Reliance and Tata are now looking to create a super app modelled on the lines of WeChat in China.

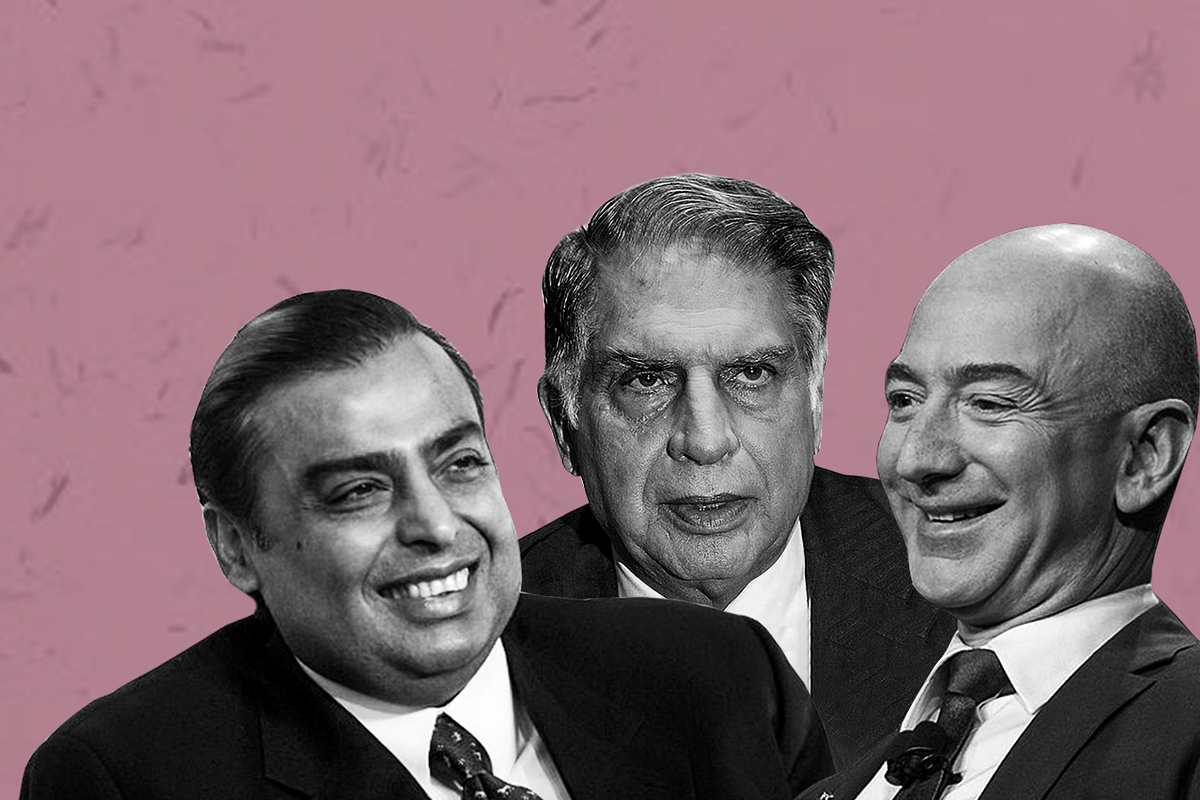

Mukesh Ambani (left), Ratan Tata (center) and Jeff Bezos (right)

India’s retail battle is now underway, and at stake is the nation’s retail industry valued at $883 billion in 2020 and estimated to grow to $1.24 trillion by 2024 and $1.75 trillion by 2026.

Following Amazon and Reliance, Tata Group, in recent weeks, has been on an acquisition spree. Earlier this week, it was announced that Tata Digital would buy a majority state in the digital health company 1MG. Interestingly, this investment follows Reliance Retail’s acquisition of Netmeds in August 2020 and Amazon’s launch of its digital pharmacy in Karnataka.

Tata Group, in April this year, acquired BigBasket, thus flexing its muscles against Reliance’s JioMart and Amazon Pantry.

Following Amazon’s array of services, Reliance and Tata are now looking to create a super app modelled on the lines of WeChat in China. This super app is supposed to serve as a digital retail extension to the other services offered by these conglomerates through their stores across many cities in India.

From a retail perspective, Amazon and Reliance are already leaps and bounds ahead of the Tata Group.

Amazon, with its e-commerce offerings, is already the biggest online marketplace in the world.

By late 2020, Amazon’s online marketplace in India had close to 0.7 million sellers. With the company adding close to 20,000 sellers in the preceding months, the growth has been steady and significant. Jeff Bezos, however, wants to onboard more than 10 million sellers by 2025 with an aim to dominate the largest free market on the planet.

On the other hand, Reliance Retail, with 45 subsidiaries which include Reliance Fresh, Reliance Digital, Reliance Footprint, Hamleys, JioMart, Netmeds, and Urban Ladder, is already emerging as the leading player in India, given its elaborate network in rural India.

While Reliance, with more than 11,000 stores, leads Amazon’s network when it comes to traditional retail, it has also strengthened its e-commerce platform, JioMart, after a flurry of investments across 2020. Reliance Retail Ventures raised close to $6.4 billion from Silver Lake, KKR, Mubadala, Abu Dhabi Investment Authority, GIC, TPG, General Atlantic and Saudi Arabia’s Public Investment Fund.

Reliance will also look to challenge Amazon in the grocery business, given Mukesh Ambani has already announced an outreach programme around the launch of JioMart, stating that the digital transformation would not only help 120 million farmers but also 30 million small merchants, 60 million small and medium enterprises.

However, the deciding factor for the dominance of either Amazon or Reliance would be the Future Group deal.

After the launch of JioMart last year, in the middle of the Covid-19-forced lockdown, Reliance made the next big move by acquiring a cash-starved Future Group. In the deal, the Future Group was selling its retail, wholesale, logistics, and warehousing businesses to the Reliance Group.

The highlight of the deal, from the Reliance perspective, was getting ownership of the retail chain ‘Big Bazaar’, fashion and clothes supermarket chain ‘Brand Factory’, and other retail units, thus adding more muscle to Reliance Retail, furthering its invincibility in the Indian market.

Following the announcement, Amazon, in October, accused Future Group of breaching an agreement with them. In 2019, Future Retail had signed a deal with Amazon where the latter acquired a 49 per cent stake in Future Coupons, the promoter firm of Future Retail, in a deal of nearly Rs. 2,000 crore.

So, within the Future Group, what is at stake for both Reliance and Amazon?

Amazon, clearly, had its sight set on the Future Group’s retail business, around 1500 stores, which would have supplied it with the brick and mortar ammunition to take on Reliance’s physical presence in the market. Losing Future Group to Reliance would leave Amazon far behind in the physical retail space.

Further challenging Amazon, Reliance has introduced an array of services for its super app last year.

These services include Jio GigaFiber, Jio Cinema, Jio Music, Jio TV, Jio HealthHub, Jio News, Reliance Digital, Jio Engage, Jio Cloud and Jio Switch. Apart from the services already provided by Jio, in the future, the services could extend to education, logistics, food, farming, fashion, dating, professional networking, and so forth. Collaboration with Facebook and Google via Reliance Jio will also strengthen the overall Jio ecosystem, aiding the growth of its retail arm.

In the midst of this fierce battle, Tata Group has been quietly emerging as a potential dark horse.

Acquisition of BigBasket was an obvious step to venture into the retail space for Tata Group. Last year, during the lockdown, against Reliance JioMart’s 400,000, BigBasket was registering close to 300,000 orders per day. Amazon and Grofers had around 100,000 orders each per day.

BigBasket has also been actively working with farmers. Through their farmer connect programme, launched in 2016, the company has simplified the supply chain in order to ensure the quality of the fresh produce.

This has helped farmers raise their incomes by 10-15 per cent. The company, by 2019, had 30 collection centres across the country. Today, it sources 80 per cent of the fruits and vegetables directly from the farmers, thus taking the middleman out of the equation.

Amazon, like BigBasket and JioMart, has already been working with farmers.

In 2019, Amazon was already running a pilot project in Pune to source fresh produce directly from the farmers under its farm-to-fork initiative.

The idea was then to sell the products through Amazon Pantry and Amazon Fresh. In 2017, Amazon made a $500 million investment in the food and grocery segment in India after approval from the government.

Amazon has also been working overtime to onboard kirana stores to strengthen its e-commerce segment. In April 2020, Amazon India announced an investment of $1.3 billion to onboard 5,000 local kirana stores across 100 cities.

Barring BigBasket, CureFit, and NetMeds, the Tata Group plans to integrate its other subsidiaries for the super app.

These would include consumer durables, financial products and telecom. The shopping app Tata CLiQ, grocery e-store StarQuik, and online electronics platform Croma could also be integrated within the app. Tata already has a prominent online presence with Tanishq jewellery outlets, Titan, Star Bazaar retail stores, Taj Hotels, and Westside — a clothing brand.

For Amazon, Reliance, and Tata, the numbers justify the expansion exuberance. In the final quarter of 2020, a pandemic year, India’s consumer spending in the retail sector was almost $290 billion. The online grocery market alone was worth more than $3 billion in 2020.

The share of traditional retail in the overall market is expected to fall from 88 per cent in FY19 to less than 75 per cent in FY21, as per estimations. However, organised retail and e-commerce are expected to go from 9 per cent to 18 per cent and from 3 per cent to 7 per cent for the same period, indicating a significant shift towards digital retail.

Walmart, another player in the retail sector, will also emerge with time as a tough competitor to the Big Three. For now, it is between the three conglomerates to fight it out in a market of 1.3 billion people and a sector valued at close to $1 trillion.

The consumers are in for a treat.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest