Business

The Future Of Future Group Is Tense; Default On Past Loans Hits Its Present

- While the group owes lenders more than Rs 20,000 crore, Future Retail owes banks almost a third of the total amount — Rs 6,287 crore.

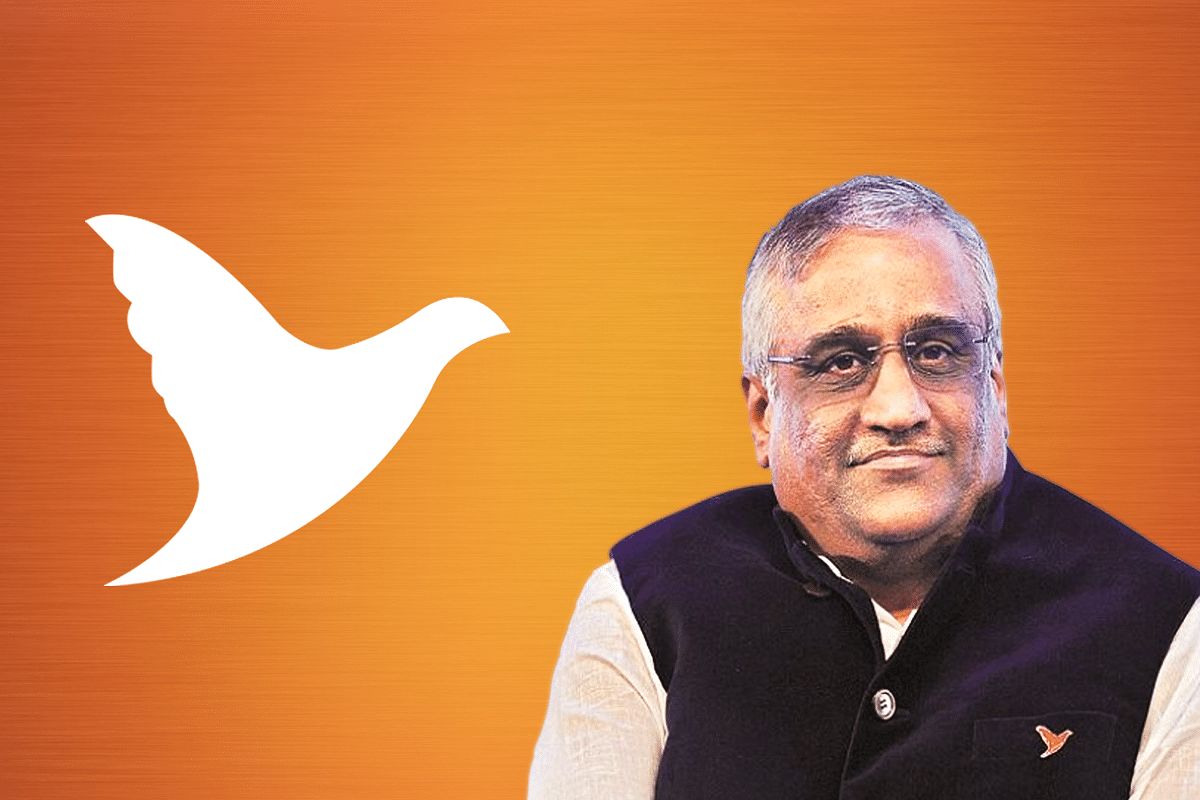

Kishore Biyani, founder, Future Group.

Future Group’s troubles have no end in sight as the company battles several issues on the legal and business fronts.

On Sunday, January 2, the group announced a downgrade of its credit ratings by CARE Ratings after the group company Future Retail defaulted on principal repayments worth Rs 3,495 crore.

Banks have been on the edge as the company, which is among the largest physical retailers in India, felt the impact of the pandemic.

While the group owes lenders more than Rs 20,000 crore, Future Retail owes banks almost a third of the total amount — Rs 6,287 crore.

Pandemic Affected The Retail Business Adversely

Future Group is no stranger to financial turmoil as it operates in an asset-heavy space that requires heavy capital expenditure and the incurrence of debt.

Just after the pandemic began, a consortium of 28 lender banks had agreed to help Future Group recast its debt as the company suffered from financial troubles.

Future Retail, for instance, saw its revenues drop from around Rs 20,000 crore in financial year 2019 (FY19) to Rs 6,300 crore in FY21.

Other group firms, Future Enterprises and Future Supply Chain, entered into a loan debt programme as well. Under the restructuring plans, lenders would waive off some charges and defer payments.

After the moratorium period of 19 months, Future Retail had to make its first instalment payment on December 31, 2021.

However, with the default, banks must now provide for at least a quarter of the loans in their books as per the Reserve Bank of India’s guidelines. This provision would be higher than a provision made for a normal non-performing asset as the debt recast has failed to serve its purpose for Future Retail.

Legal Troubles Continue For Future Group

A major issue that has grabbed headlines in recent times is the fight between Amazon and Future Group over the sale of Future Group’s assets to Reliance.

Over the years, Future Group has built up well-known outlet networks such as Big Bazaar, Central, and other retail stores. Further, the group has invested in warehousing capacity, logistics, product sourcing, and other segments as well.

As a result, the group’s assets still remain highly valuable.

Reliance Retail has been expanding its physical operations rapidly, despite the pandemic, as it looks to become the dominant player in India’s rapidly growing retail sector.

It has also focused on developing its online platform to sell grocery, clothes, and other items as well. Not only is it looking to dominate the business-to-customer ecosystem, but the business-to-business ecosystem as well.

Reliance had struck a deal with Future Group to buy Future Enterprises Limited for Rs 24,713 crore in a slump sale. Under the deal, Reliance Retail venture would acquire the retail, wholesale, logistics and warehousing businesses from the Future Group.

The retail and wholesale ventures would be transferred to Reliance Retail and Fashion Lifestyle Limited, while the logistics and warehousing businesses would be controlled by Reliance directly.

However, Amazon, which had bought a 49 per cent stake in Future Coupons, an unlisted entity, has been looking to thwart the deal. The United States-based e-commerce giant has alleged that by selling the assets to Reliance, a competitor, the Future Group has breached the contract.

For Amazon, the sale of the Future Group to Reliance would make it even more difficult for it to carve a space for itself. Reliance already dominates the physical retail space in India with more than a 40 per cent market share.

Amazon has subtly suggested that such episodes could indicate that India does not have a strong enforcement mechanism in place, allowing companies to breach contracts without having to face any consequences.

The battle has seen several twists and order reversals so far, with the companies fighting cases both in India and abroad.

Future Groups Highlights Potential Bankruptcy Risk

According to Future Group, if the sale to Reliance does not go through, the business would have to be shut down, resulting in job losses for thousands. Therefore, according to the Future Group, the sale of assets to Reliance is of utmost importance.

Recently, the Competition Commission of India (CCI) ruled in favour of the Future Group and said that Amazon had hidden several facts when it had first acquired the 49 per cent stake in Future Coupons.

According to the CCI, Amazon has purposely misled the Commission about the purpose of acquiring a stake in Future Coupons, suppressing the ulterior motive of strategic alignment and partnership with Future Group.

Through the stake, Amazon allegedly got its “foot in the door” until the time when foreign investment laws were relaxed and the acquisition of multi-brand outlets was allowed.

For Future Group, the sale of its assets is extremely important. However, Future Group is not the only beneficiary of a sale of its assets, or other support to the business.

Indian banks stand to benefit from the move as well, with almost $ 3 billion outstanding for the entire group. Even if Amazon does win against Future Group, it is unlikely to be able to take over the multi-brand retail outlets, as the sector has several rules for foreign players.

In contrast, Reliance can easily takeover the group without being bound by rules. Whether the Future Group can sustain itself until the legal battles are concluded remains to be seen.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest