Commentary

The continuing relevance of Dandi

There’s a sound moral and economic case for tax evasion in India, argues Ranjan Sreedharan, and yes, he’s serious.

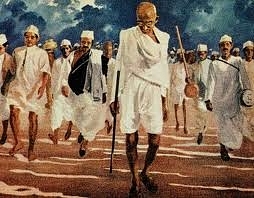

Without being a history person, my own sense is that Mahatma Gandhi’s 1930 march to Dandi was more symbol than substance. The act of refining salt from seawater without paying the tax the colonial government had imposed on the activity could not, by itself, have been more serious than jumping the red light at a traffic stop. I suspect it was the symbolism behind the act—images of a subjugated people rising up to resist unjust taxes—that was unsettling to the British. Dandi is now one of the memorable chapters in the story of India’s non-violent struggle for independence. It is history.

Or is it?

Here’s a thought. Is there more to Dandi than its secure perch in India’s history? Can Dandi hold a lesson or two for us even as we are now a democracy with a freely elected government? In other words, a question verging on the sacrilege! Have we, the people of India, come to a point where we are better off evading taxes than paying them?

I believe it’s a question not to be dismissed out of hand. Consider the evidence.

Begin with the question, why do we pay taxes? We pay our taxes because in return for sacrifice of private good, there is the assurance of social gain. When I pay tax I lose a part of my legitimately earned income but I am happy to do it (or pretend to be happy) because the country gains. This bargain rests on the assumption that income retained in private hands is all about personal gain whereas income sacrificed as taxes to the government is about social gain.

Here comes the minefield we must tread carefully.

What if we come to a point of dysfunction in our government where the social gain from the marginal income handed over to the government pales in comparison to the private loss we bear? I lose when I pay my taxes but because all that money is going down the drain, no one else gains a thing. Clearly, at this extremity, I am better off when I don’t pay my taxes because at the least I stand to gain whereas the alternative has no one gaining anything. A country fallen into the hands of thieves—a kleptocracy—would be a perfect illustration. The conventional wisdom about one’s duty to pay taxes goes out of the window. But, am I suggesting this is the example relevant to India? Not quite.

For all of India’s acute problems with a governance deficit, it would still be an exaggeration to claim that all our tax money is flushed down the toilet. Here’s an alternative argument.

Start with a closer look at the assumption that private income is all about private gain, with nothing for society. Bring into the picture how India’s recent experiments in big government have been hugely wasteful. Consider how sharply we have veered in the general direction of kleptocracy in recent years. Recall that in 2010, the Indian government managed to lay its hands on a bonanza from the auction of 3G and broadband spectrum. The amount was a staggering Rs.105,000 crores and, literally, it was manna from heaven.

Among India’s left-liberal commentariat, a popular pastime is to pick an amount from the Union Budget figures relating to revenue foregone by way of concessions to the corporate sector. This is followed by back of the envelope calculations that typically work out the number of rural schools, hospitals, roads etc. that could have been built had this money not been signed away. The conclusions are always mindboggling, on lines similar to “every rural household across India could have been given access to safe drinking water if only the government would stand up to these fat cats.”

With so many of us continuing to lack access to schools, hospitals, drinking water etc., I thought I’d find out what happened to all the 3G money. Apparently, about 65 percent went towards funding subsidies. Most of what remained would likely have gone towards meeting salaries, interest payments and the leakages integral to government spending in third world countries. At best, a tiny fraction would have found its way to rural schools and hospitals.

Our government has acquired a gargantuan appetite for money accompanied by an all-too- common talent for wasting it all. The more we feed it, the more that goes to waste. It calls to mind the comparison that Ronald Reagan drew between government and the alimentary canal of a baby — big appetite at one end, no responsibility at the other.

And that sums up the dark reality for the Indian taxpayer today. For every additional rupee of tax they pay, the chunk that disappears down the drain is disproportionately large. The positives to society flowing out of the balance that remains in hand would be less than if the money had remained untaxed. Because, when money remains with the taxpayer, he does not park it under his pillow anymore. These days he would rather spend it, invest it, or deposit it into a bank. Follow the trail and you’ll find the positives far outweigh the anaemic good that comes out of India’s sarkari spending.

We are now face to face with a seemingly perverse conclusion; the taxpayer who under-reports his income today is doing a service to the future of our country. Please note: I am not even getting into that Pandora’s Box of working out the real and lasting harm done when money “well-spent” on misguided welfare and faux-employment programmes undermines initiative, breeds dependence and emasculates an entire generation.

An alcoholic wasting his money is one side of the equation; the other side is the damage to his health, a far bigger cost. If you know someone who has an alcohol problem, would you ply him with still more to drink? We know for certain our government is addicted to extravagant, populist spending. Is it wise to put even more money into its hands?

In the answer lies the moral and economic case for tax evasion in India today.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest