Economy

Budget 2022 Is Unglamorous, And That's Good News!

- No populism! The budget focuses on infrastructure creation to pave the way for investment, employment, and human development.

No populist announcements in the Union budget 2022

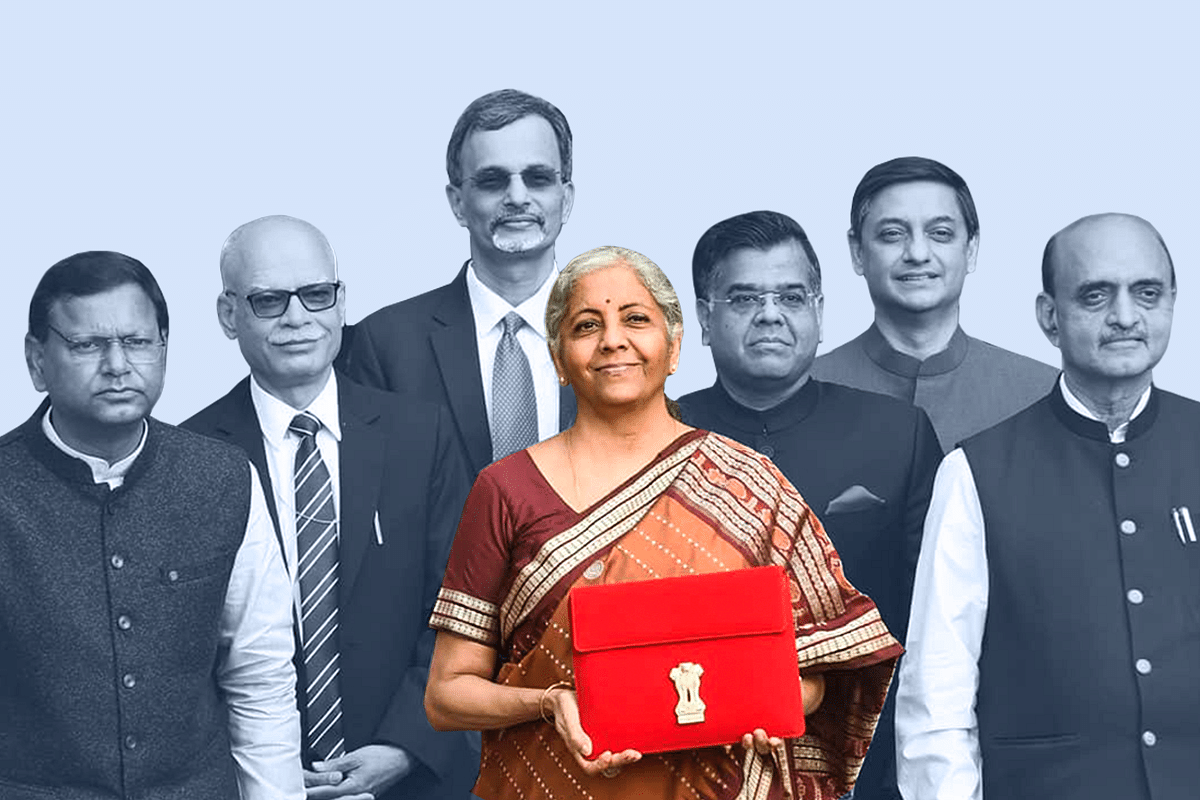

A crisp 90-minute presentation without any populist announcements, like cash handouts, that many expected, but with a clear focus on social and physical infrastructure creation and helping states through interest-free loans to be a part of the journey — this is the sum-up of Finance Minister Nirmala Sitharaman’s budget presentation this year.

And that’s exactly what it should have been. This writer pointed out last week that fiscal situations, potential inflationary pressures, and global uncertainties offer little scope to splurge. The government has already announced big-ticket programmes and it is time to implement them. As it turned out, the budget stuck to that principle.

Infrastructure and Job Creation

The primary focus area of this budget has been the efficient implementation of transport, transit, and digital infrastructure projects, with a special emphasis on PM Gati Shakti to ensure optimal utilisation of resources.

The Rs 100,000-crore three-year interest-free loan window opened to states (over and above the existing borrowing windows) to undertake capital investment under PM Gati Shakti will encourage the building of allied digital and physical infrastructure to make central capital expenditure more useful.

India suffers from a high logistics cost-to-GDP (gross domestic product) ratio (14 per cent) as against 7-8 per cent globally. The sharp focus on efficient infrastructure creation will go a long way in closing the gap and improving the core competence of both manufacturing and services, thereby helping attract investment, which is the primary enabler of employment.

The pandemic led to structural changes in the world economy, which is impacting employment generation potential. In India, the introduction of the GST (goods and services tax) and UPI (unified payments interface) digital payment interface are bringing about very sharp changes.

A look at the high-frequency data in Economic Survey 2022 will reveal that organised sector employment has been increasing probably at the fastest pace. This is in sharp contrast to the high 8 per cent urban unemployment pointed out by the Centre for Monitoring Indian Economy.

To understand the catch, one must also look at the sustained rise in average monthly GST collection, which was the highest in January 2022, and the parallel popularity of UPI payments.

Between January 2019 and December 2021, the UPI payment volume increased nearly seven times. During this period, ATM cash withdrawals remained stagnant or had been in decline.

Cash circulation in the economy went up during 2020 due to lockdowns. This was a global phenomenon. But, as in 2021, cash circulation remained stagnant despite economic recovery.

The bottom line is that the Indian economy is formalising at a rapid pace. Efficiency is improving and it will have parallel displacements in the low- or semi-skilled job market. Automation is rising in the corporate sector and will probably peak this decade as the great investment rush begins.

Unlike in the past, the government cannot offer any quick-fix solutions to employment generation. Infrastructure rush and the rush of private investment in the manufacturing and services value chain and skill development are the only solutions. The higher the level of investment, the greater will be the job creation potential. The budget is facilitating that.

It must, however, be underlined that the goal to enhance capital expenditure by 35 per cent will depend in a big way on the success of asset monetisation and disinvestment and of privatisation programmes already announced by the government.

The Finance Minister didn’t give any details on the progress on the asset monetisation front in her speech. She, however, talked about the progress in divestment of government stake in Neelachal Ispat, LIC IPO, and so on.

Health and Drinking Water

Though less discussed, the Modi government made a tremendous contribution to India’s social sector over the last seven years.

Swachh Bharat made India open defecation free. Ayushman Bharat created an ecosystem for affordable health care in the private sector apart from helping millions to access quality health care. Sustained focus on rural electrification and availability of quality power through schemes like Saubhagya, and near-universal access to cooking gas changed lives.

Successful implementation of these social sector schemes, particularly rural electrification, was a major reason behind the re-election of the Modi government in 2019. In 2024, the government will seek re-election based on the success of two major schemes, universal affordable housing and access to tap water (Jal Jeevan Mission).

The budget presentation underlined the allocation of nearly Rs 1.10 lakh crore in these two schemes during 2021-22 and 2022-23. The PM housing scheme alone is provided with Rs 48,000 crore.

Rolled out in August 2019, the Jal Jeevan Mission aims to provide safe drinking water through individual household tap connections to all 19 crore rural households by 2024. As of 2019, only 3.23 crore (17 per cent) rural families had tap water connections.

The Economic Survey pointed out that an additional 5.5 crore households have been provided with tap water connections since 2019. The Union budget 2022 promised to offer individual tap water connections to another 3.8 crore in 2022-23, thereby enhancing the coverage to almost 66 per cent of rural households.

Meanwhile, fresh initiatives are undertaken in the health sector. The roll-out of the National Digital Health Ecosystem will be a watershed development.

Digital registries of health providers and health facilities and a unique health identity will go a long way in addressing the known maladies in the sector and protecting citizens from malpractices. The health insurance penetration and coverage may witness unprecedented growth.

Regulatory Changes

The budget proposed many regulatory changes. Three of them are worth mentioning here.

First, allowing taxpayers to update their income tax returns within the next two years is a welcome move. It will reduce litigation and increase voluntary compliance.

Second, earnings from cryptocurrency trade will finally be taxed.

Third, the removal of customs duty exemptions on a wide range of items.

Selective duty exemptions are a carry-forward of the licence-permit raj and broadly a result of the corporate-politics nexus. The Finance Minister did well to remove them.

However, a selective increase in duty on umbrellas, etc, was against this principle. It is understood that the decision was taken to protect small domestic manufacturers.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest