Economy

Campaign Against Black Money: Modi Govt Plugs Indo-Mauritius Tax Treaty Loopholes

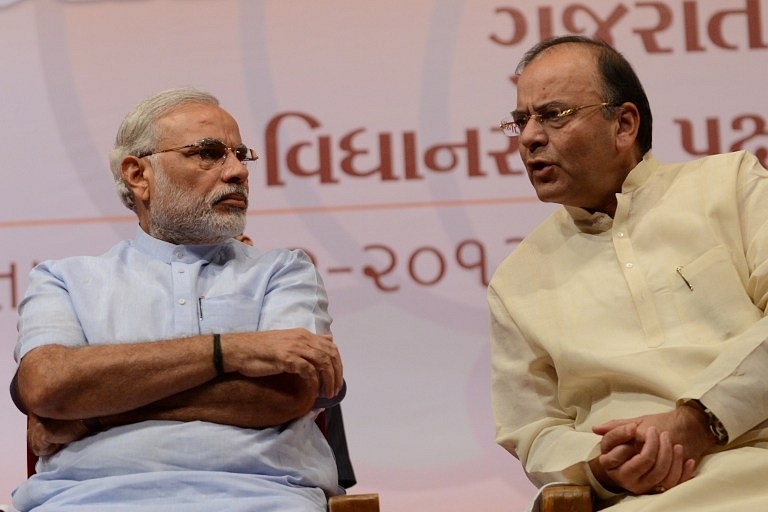

Narendra Modi And Arun Jaitley

It redounds to the credit of the Modi

government, particularly its Finance Minister Arun Jaitley that it has ended

the three-decade-old farce called Indo-Mauritius Double Taxation Avoidance

Agreement (DTAA).

In 1983, India bartered away the country’s interests presumably for saving and promoting its crooks in the name of attracting foreign investments via the island nation.

Normally, capital gains tax earned by selling shares in Bombay Stock Exchange, for example, is taxable in India as it is an Indian income. But the treaty assigned the right to tax this income to Mauritius. And Mauritius in a manner of double take quietly abolished capital gains tax in its country post-haste thus playing dog in the manger to the hilt. Those in the know say that the Indian government was not backbitten but was played footsie with by the Mauritius government wink-wink nudge-nudge. Be that as it may.

The Modi government on Tuesday (10 May 2016) righted this patently inequitable regime by grandfathering its benefits. Shares of Indian companies purchased after 1 April 2017 will suffer short term capital gains tax in the hands of residents of Mauritius at half the rate normally applicable to Indian residents till 31 March 2019 and at par with the rates applicable to Indian residents come 1 April 2019.

This would be a small feather in the cap

of the Modi government on the black money front as it would end round-tripping

of Indian black money into India via Mauritius. It is common knowledge that bulk of the money

flowing into India via Mauritius belongs to Indian politicians and

businessmen.

But the world of black money is not worried because if the Mauritius door is shut, others are open in Tunisia, Panama, Seychelles, etc. G-20 and other initiatives should similarly carry its war against rogue nations completely so the peace-loving nations can feel secure against the scourge of black and illicit money.

And in the fight against black money and

money laundering, there is an elephant in the room - chartered accountants. Lawyers in juxtaposition emerge like saints

because while lawyers get acquittal of crooks through legal sophistry and

exploitation of loopholes, it is the chartered accountants who are complicit in

financial crimes of their clients. In

other words, a lawyer emerges on the scene after a crime is committed and his

client caught whereas a CA is a guiding spirit behind a financial crime

itself. It is he who studies the

loopholes in law as well as the greener pastures albeit thousands of miles

abroad and whispers wisdom into the ears of his client. In fact, the Panama papers, as well as, the

Tunisian connection in the Agusta scam bear ample testimony to the insidious

role played by the CAs. Time has come

for national governments to wake up and stop indulging the professionals.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest