Economy

Central Banks Around The World Had Set The Stage, But RBI Wasted Its Chance

- Everyone was hoping for a rate cut today. But once again, the RBI presented disappointment.

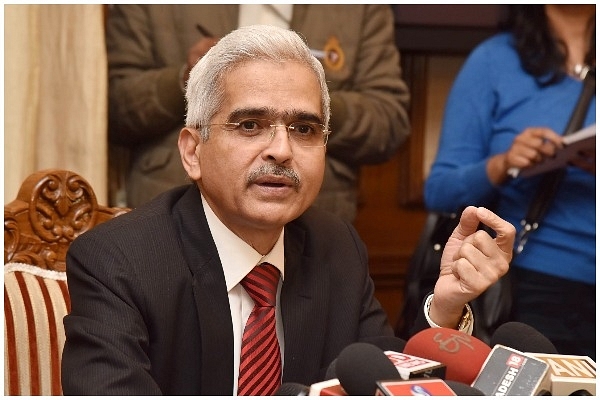

RBI Governor Shaktikanta Das (Wikimedia Commons)

One is disappointed with the recent announcement by the Reserve Bank of India (RBI) which has gone for another Long Term Refinancing Operation (LTRO) rather than announcing a rate cut as they want to wait for the MPC meeting.

Although, the governor pointed out the possibility of announcing a rate cut even before the MPC.

This suggests that there is no necessity for an MPC meeting for a cut. This raises the question-why hasn’t the RBI cut rates along with announcing the LTROs?

If at all a meeting was indeed needed, it could have been over a conference call or even a phone call. At times like these, we cannot afford to be indecisive and the RBI must rise up to the occasion.

The RBI governor has repeatedly stated that he’s willing to do whatever it takes but has so far acted short of doing whatever it takes.

This is only denting the RBI’s credibility at a time when the institution needs it the most to ensure efficacy of its decisions.

On the global scale, between last night and today, we’ve seen major central bankers slash interest rates aggressively, including the Federal Reserve which has taken the rates to zero.

It is important as a development for the simple reason that we’re looking at proactive monetary masters who are trying to contain the economic implications of Covid-19 disruptions.

With nearly 43 rate cuts since 2020 by different central bankers of the world, out of which 20 have been in the month of March alone, there are three important issues here that need to be explained.

1. Economic Time and Financial Time

Professor Larry Summers has summed up the problem associated with Covid-19 in an intuitive manner where he suggests that economic time and financial time are progressing at a different pace.

That is, while economic activity is stagnant, the financial liabilities continue to remain such as rent payments, interest payments etc.

This has severe implications for small and medium firms along with those in the vulnerable sections of the population that may not have adequate savings to absorb a shock in their cash-flow due to the disruption in economic activity.

French economist, Professor Oliver Blanchard, too, has summed up the problem in a similar manner as he’s asked for a fiscal intervention to deal with the problem in his latest blog.

2. Impact of Rate Cuts

Regular readers are aware of this author’s thoughts that resonate with what Professor Blanchard has been arguing for the US. That is, it is time to get the big guns out; we need a fiscal stimulus package.

However, it is important to remember that firms in general have built up debt over the preceding years and therefore, given that financial time continues, lower rates could result in lower financial liabilities which can to some extent reduce the financial burden.

Moreover, lower rates can also open up fiscal space for governments which can then be used for scaling up the expenditure on healthcare systems to address the public health emergency.

Two key issues that are important is that the crisis is no longer a simple supply shock. It has spread and become a demand shock where people are scared to gather in places.

A consequence of this is that non-essential consumption has taken a major hit. Maintaining liquidity at lower cost is essential to keep the financial system functioning which is important for the purpose of ensuring stability.

We’ve witnessed significant volatility in capital markets, bond markets and in forex markets over the last couple of weeks and while markets may continue to be volatile, rate cuts send a strong signal that central bankers are committed to act even though they have limited space.

This is precisely why we’ve witnessed even conservative central banks such as RBI try some unconventional monetary policy measures such as LTROs.

It appears that central bankers have decided to do whatever it takes to avoid a re-run of 2008 crisis and the coordination between them is significantly better.

3. What more is needed

At the global level we do need a proactive fiscal response which is coordinated to ensure that there’s a strong policy response which is put in place to deal with the problem. Direct fiscal action as argued by this author in the past is critical in such a situation.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest