Economy

CPI And WPI Are On Different Planets: Why Monetary And Fiscal Policies Must Align

- The case for detailed discussions between the monetary and fiscal arms of the government has never been stronger.

- Independence of monetary policy is not an end in itself.

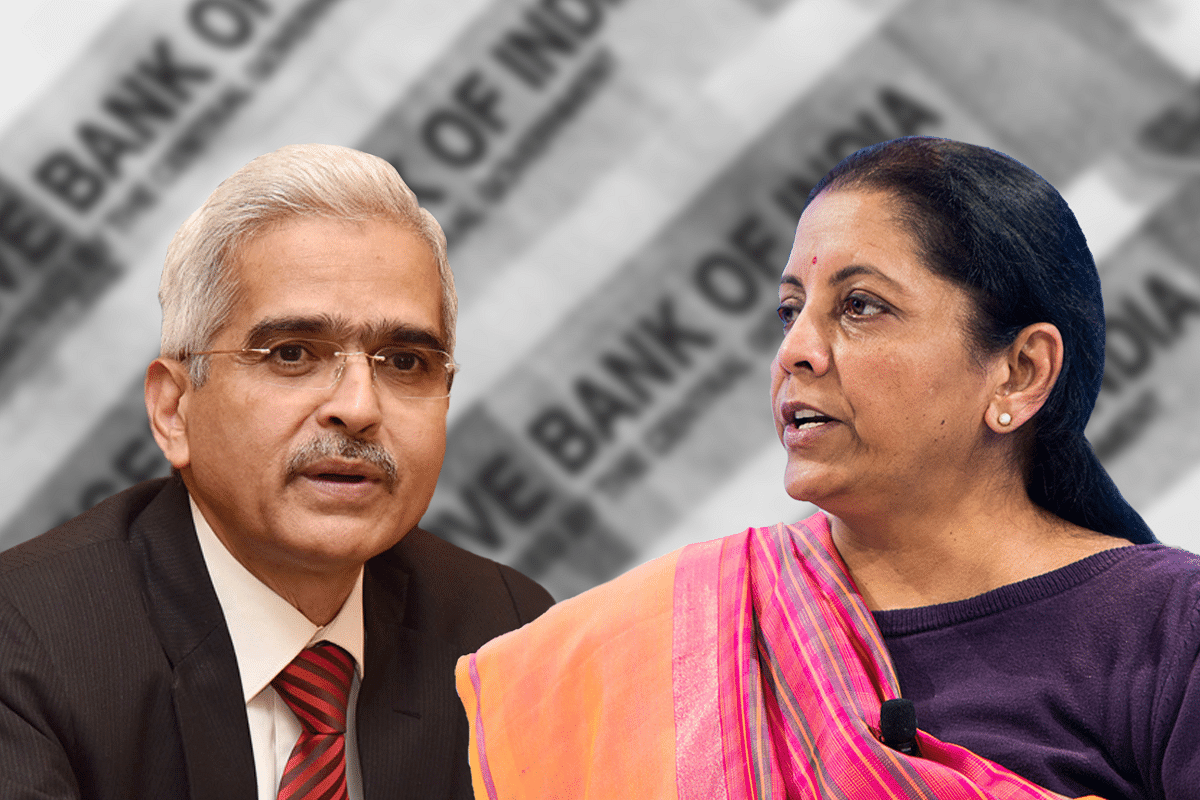

Finance Minister Nirmala Sitharaman and RBI Governor Shaktikanta Das.

Monetary policy is often about the partially blind leading the way, mostly by looking into the rearview mirror.

The US Federal Reserve, which quite obviously has to deal with inflation by looking at past data, raised interest rates by 0.25 per cent at its recent meeting. It indicated that it might raise or hold rates in September, depending on data. It’s like telling the world “I don’t know what I will do next”.

India’s Monetary Policy Committee (MPC), which sets rates in India, held rates in June, but indicated that policy would remain tight since inflation remains higher than the mid-rate of 4 per cent. In June, retail inflation, as captured by the Consumer Prices Index (CPI) was higher at 4.81 per cent, against 4.31 per cent in May.

The immediate question is whether the MPC will hold or raise rates at its next meeting in August.

But we must ask a more pertinent question: can any decision by the MPC really work by looking at just CPI data?

In June, while CPI went up, driven by rising food prices, the Wholesale Prices Index (WPI) was actually pointing in the other direction — disinflation or even deflation.

For the third time in as many months, its steepest fall since 2015 in any one month, the WPI fell to -4.12 per cent in June, from -3.48 per cent in May.

Since the MPC’s inflation target is focused on the CPI, one can presume that it will be watching retail inflation like a hawk, but not wholesale inflation. But is this right? Why should wholesale inflation, which is what gets impacted more by monetary policy, be ignored in the interest rate policy?

There could be three reasons, whether they are stated or left unstated.

One, the WPI, which has a lower weightage in food and energy, is not representative of the burden faced by India’s poor, and hence is worth ignoring.

Two, the government and the MPC are worried that WPI may not be well designed, since it is a poor approximation of a producer prices index, which is what needs to be contrasted with consumer inflation.

Three, since retail inflation is what counts for politicians (consider the loud screams over tomato prices), the CPI it will be.

But here’s the problem: if producers are seeing pricing pressures coming down on the input side, but are unable to maintain or raise sale prices, sooner or later it will impact profitability either positively or negatively. It will be positive if input prices fall faster than output, and negatively if it is the reverse.

Secondly, if the key drivers of retail inflation — food and fuel — are both administratively driven, how can monetary policy do any good? It is the fiscal side that must act — and often does.

This is why rice exports are being banned, and the Centre has refused to release rice from buffer stocks — both for state governments that want to distribute more free rice (Karnataka) to their voters, and for blending into ethanol.

The simple point is this: it is not a great idea to let one price (CPI, in our case) determine monetary policy. Nor is it a great idea to let monetary and fiscal policies remain independent of one another.

The case for detailed discussions between the monetary and fiscal arms of the government has never been stronger. Independence of monetary policy is not an end in itself.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest