Economy

Debt Dynamics: Why The Government Must Be Lauded For Ensuring Macroeconomic Stability

- Most countries will witness a higher fiscal deficit and debt to GDP ratio and take a longer time for these indicators to revert back to the pre-Covid levels.

- In contrast, a measured approach will help India get back to a stable set of macro-fundamentals a lot quicker.

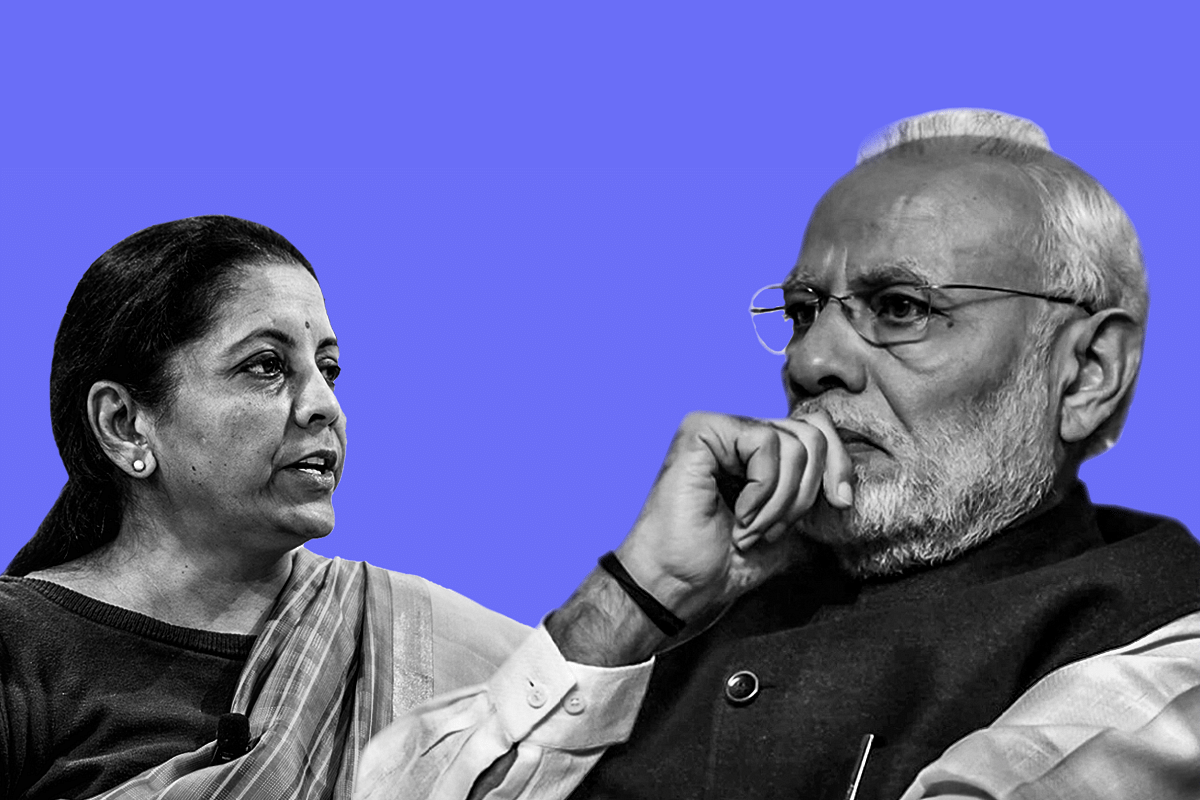

Prime Minister Narendra Modi with Finance Minister Nirmala Sitharaman.

While many of the economic issues are technical and often not of interest to most people, there is an understanding amongst some with regards to the importance of keeping deficits and debt levels low.

Most people, however, forget that the appropriate measure of either deficits and/or debt levels is when compared as a ratio to the level of economic activity in a country.

There has been a growing call for fresh rounds of stimulus – including from the opposition benches as it disregards the extent of fiscal support provided by the government.

The argument, however, is based more on political interests rather than on the economic situation.

However, many economists and experts too argue that there is fiscal space available should the government wish to provide further support to the economy.

Indeed, there is fiscal space available with the government considering that there has been an increase in domestic savings and that this increase is likely to continue as households remain cautious going forward.

The increased savings make it possible for both the private sector and the government to borrow to finance investments. For India, domestic savings are important given that we are reluctant to borrow from external sources.

However, the important thing to keep in mind is that there will be a sizable expenditure even on the procurement and distribution of the coronavirus vaccine which would be substantial.

Moreover, there is far too much uncertainty with several countries going for a fresh round of lockdowns. This makes it important to preserve some firepower for fresh rounds of stimulus that may be required in the coming financial year.

It must be noted that India’s fiscal response to the pandemic has been extremely measured as a bulk of it was focused on using whatever fiscal space was available with the intention of maximising its impact.

That is, the approach was to put money in areas which have the highest fiscal multipliers. A good example of this was to direct fiscal expense to rural areas even as the economy was under a lockdown so that the rural pickup could assist recovery of manufacturing activity in select sectors such as FMCG etc.

The important point here is also that the fiscal response to the pandemic, unlike the 2008 fiscal response is based on temporary fiscal expenditures. The cautious approach undertaken is perhaps an outcome of the experience of the post 2008 stimulus which led to a permanent drag on the fiscal deficit leading to deterioration in our overall macroeconomic stability culminating in the taper tantrum episode of 2013.

Broadly there are two components here, first is the automatic stabilisers which operate due to lower tax collections even as government commits to its fiscal expenditure that will expand the deficit. The second is the additional fiscal expenditure by the government to provide a stimulus to the economy. A major part of the fiscal response is the former rather than the latter.

The advantage of a temporary fiscal expansion is that as economic activity normalises, the expenditures would gradually be normalised.

Further, an expansion in economic activity would automatically reduce the fiscal deficit measured as a per cent of gross domestic product (GDP) and total outstanding debt as a per cent of GDP. Thus, a temporary fiscal expansion makes it possible for the government to get back to its path of fiscal consolidation in a prudent manner.

While we are looking at India, let us also look at the fiscal expansion by other emerging markets which has been more in the form of higher expenditures, some of it permanent in nature. As economic activity normalises, so does tax collections.

Thus, the automatic stabilisers as the name suggests act automatically and help get back to the fiscal consolidation path. In contrast, higher expenditures will have to be reversed by the appropriate government.

The fundamental point here is that most countries will witness a higher fiscal deficit and debt to GDP ratio and take a longer time for these indicators to revert back to the pre-Covid levels.

In contrast, the measured approach will help India get back to stable set of macro-fundamentals a lot quicker.

It is, therefore, important to understand that strong macro-fundamentals are important as they provide the government with adequate space to respond by expanding the expenditure as and when needed.

It may well also be the case that the post Covid world could be one with higher levels of public debt and lower levels of cost of debt in the form of low coupon rates (interest rates) offered on government bonds.

The macroeconomic handbook in such a case is likely to be rewritten. However, we must appreciate the commitment by the government towards ensuring stable macroeconomic fundamentals.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest