Economy

For Your Help: Demonetisation FAQs

- The simple and the not-so-simple questions surrounding demonetisation

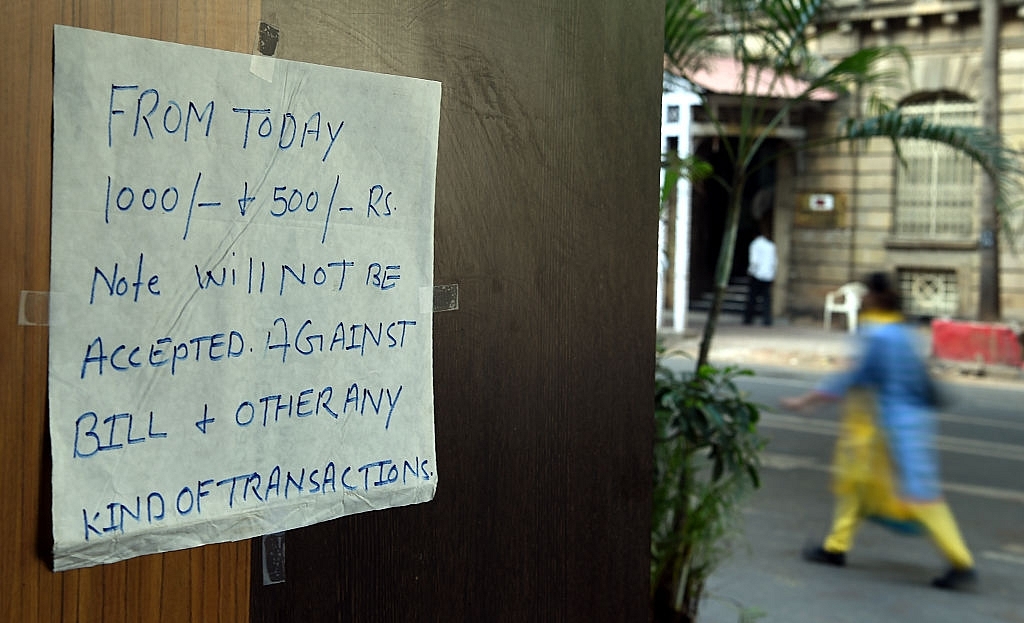

Demonetisation (PUNIT PARANJPE/AFP/Getty Images)

1. What is demonetisation?

Demonetisation, in simple terms, is the process whereby a particular currency- wholly or any of its denomination- ceases to be a legal tender. Once a currency ceases to be a legal tender, it can either be converted into a legal tender by a fixed date. Failing the date, it lapses into a piece of paper with no monetary value.

2. What comprises the currency and what does it represent?

Currency is issued by the central bank and the central government of the country in the form of coins and paper notes. At any point of time, currency notes represent the promise of the central bank to pay to the bearer of the note the amount mentioned on it. Hence, the total value of notes in circulation – is the liability of the central bank of the country.

3. What is the Reserve Bank of India and its role?

Reserve Bank of India or RBI is the central bank of the country and is responsible for the monetary and banking operations in the country. On the monetary side, RBI’s Issue Department is responsible for issuing the currency; while all the banking operations are managed by the Banking Department.

4. What did Narendra Modi announce on 8 November?

As per the decision taken by the Narendra Modi Government vide notification under Sec 26(2) of RBI Act, bank notes of Rs 500 and Rs 1000 ceased to be the legal tender. This effectively means that - no one holding bank notes of Rs 500 and Rs 1000 can use such notes for any financial transaction except those mentioned in government’s notification.

5. What will happen to notes of Rs 500 and Rs 1000 held by the common man?

Everyone holding currency notes of Rs 500 and Rs 1000 will now have to convert their currency notes into legal tender i.e. notes currently in circulation before 31st Dec 2016. The process of conversion will be as follows-

· Deposit their existing notes of Rs 500 and Rs 1000 into their respective bank accounts.

· Convert their existing notes of Rs 500 and Rs 1000 to the notes currently in circulation subject to a limit of Rs 4,000 per person.

· Use their existing Rs 500 and Rs 1000 notes for the purposes as mentioned as exceptions in the government notification issued from time to time.

6. What should I tell a commoner asking- “can I withdraw my money from the bank”?

Of course, you can withdraw your money as long as it belongs to you. However, due to the unprecedented quantum of currency note ceasing to be the legal tender (almost Rs 14.30 Lakh crores), government has imposed limits as mentioned below-

· Rs 4,500 per day from ATM of any bank

· Rs 24,000 per week from your own bank account

The above limits are in addition to the facility for Over the Counter exchange of Rs 4000 from any bank. These limits will be reviewed from time to time and are currently applicable until 24th November, 2016.

7. What was the total amount of currency in circulation and how much of it is of Rs 500 and Rs 1000 denomination?

RBI's press release of Nov 4, 2016 had reported that total “currency in circulation” as on 28th Oct 2016 was Rs 17,013.8 billion. As per available estimates, 86% of the total currency in circulation i.e. Rs 14,631.9 billion is held in denomination of Rs 500 and Rs 1000. Hence total approximate amount of currency that ceased to be legal tender on the night of 8th November 2016 was Rs 14,631.9 billion.

8. What will happen to Rs 14,631.9 billion worth of currency that ceased to be the legal tender?

Before answering this question, let us understand the process of issuance of the currency by RBI. As mentioned earlier, RBI’s issue department is responsible for the distribution of notes throughout the country via designated bank branches, also called chests. When money is deposited into the chest, it leads to credit of the commercial bank’s account while any withdrawal leads to debit. In other words, the net withdrawal from chests means expansion of currency while deposits into chest mean contraction.

“Currency notes in circulation” represent the component of the money supply and is the primary driver of total money supply in the country.

In view of the notification dated 8 November 2016, the total outstanding amount of currency as represented by bank notes of Rs 500 and Rs 1000 will now have to be tendered back to RBI for conversion to legally acceptable tender. As explained above under Point 5, the tendering process (open until 31st December, 2016) will comprise of following three options-

· Deposits into banks

· Incurring of expenses for the specified purposes

· OTC Conversion facility as available to individuals.

The demonetised bank notes remaining untendered by 31 December 2016 can also be tendered directly to RBI’s specified branches at any time between 1st January 2017 & 31st March 2017. However, this facility will be available subject to certain conditions and additional documentation requirements as specified in the notification.

9. What will happen to the currency that is not tendered by 31st March 2017?

The currency that is not tendered by 31st March 2017 will cease to be the liability of RBI and will thus represent the gain on the account books of the RBI.

10. What will be the accounting treatment of the gain arising out of non-tendering of bank notes of Rs 500 and Rs 1000 by the last date i.e. 31st March 2017?

An impression is being created by the ex RBI officials and journalists that RBI cannot transfer possible gains arising of non-tendering of demonetised bank notes as per notification dated 8 November 2016. Before arriving at any conclusion, let us look at the concerned provisions of RBI Act.

· Issue department issues currency notes under Sec. 23(1).

· As per Sec 34, total liability of Issue Department is the amount equal to the sum total of the amount of the currency & bank notes for the time being in circulation.

· As per Sec 33(1), Issue department has to maintain assets in the form of gold coin, gold bullion, foreign securities, rupee coin and rupee securities to such aggregate amount which is not less than the total of the liabilities of the Issue Department.

· As per Sec 26(2), on RBI Central Board’s recommendations, the Central Government can declare, any bank notes of any denomination to cease to be a legal tender (except in cases specified in notification).

In view of the above, total amount of the untendered demonetised bank notes (vide notification dated 8 November 2016) as on 31st March 2017 will cease to be RBI’ liability and thus represents a gain on its books.

Now let us analyse if RBI can park this gain as a reserve in the balance-sheet of Issue Department. The answer is an emphatic NO for following two reasons-

· As per section 34, the liabilities side of the Issue department’s Balance sheet cannot be anything other than “Notes Issued” or “Currency in circulation”.

· As per Section 46, RBI can make following contributions only:

o National Rural Credit (Long Term Operations) Fund and National Rural Credit (Stabilisation) Fund

o National Industrial Credit (Long Term Operations) Fund

o National Housing Credit (Long Term Operations) Fund

Further to above, Section 47 of RBI Act mandates RBI to compulsorily allocate its surplus profits to Central Government after making provision for bad and doubtful debts, depreciation in assets, contributions to staff and superannuation funds and for all other matters for which provision is to be made by or under this Act or which are usually provided for by bankers.

Here it is important to note that when RBI prepares its balance sheet, the Issue Department’s and Banking Department’s balance sheet are clubbed together only for presentation purposes but they must match separately. In other words, total assets of Issue Department & Banking Department must tally with the total liabilities of the respective department only. Check the image below-

Hence from above, it is clear that any possible gains on account of non-tendering of demonetised notes is RBI’s profit and will have to be transferred to Central government.

11. Does RBI prepare its Financial Accounts and report any profits?

Yes, RBI prepares it financial accounts for every financial year. RBI’s Financial Year runs from 1st July of every year and ends on 30th June of the following year. RBI prepares its annual accounts as per the provisions of Section 47 of RBI Act whereby it is liable to transfer all its profits, remaining after providing for annual expenses, provisioning of bad debts and transfer to reserves mentioned under Sec 46 of RBI Act, to Central Govt.

12. What was RBI’s profit for previous two years i.e. FY15 and FY16?

As per available annual reports, RBI’s profit from FY15 and FY16 was Rs 658.96 Billion and Rs 658.76 Billion and this profit was transferred to Government of India via dividend as per Section 47 of RBI Act.

To conclude, as the law stands today, RBI’s potential gains from demonetisation will have to be accounted as profits and made over to Government of India as dividend.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest