Economy

How India’s Trade With The World Will Look Like In 2030

- The effort of successive governments to diversify export markets may bear some fruit.

- An HSBC report, India Trade Report says that though the United States and the UAE will remain the dominant export destinations, Vietnam is likely to make an entry into the top-five club, pushing out the United Kingdom.

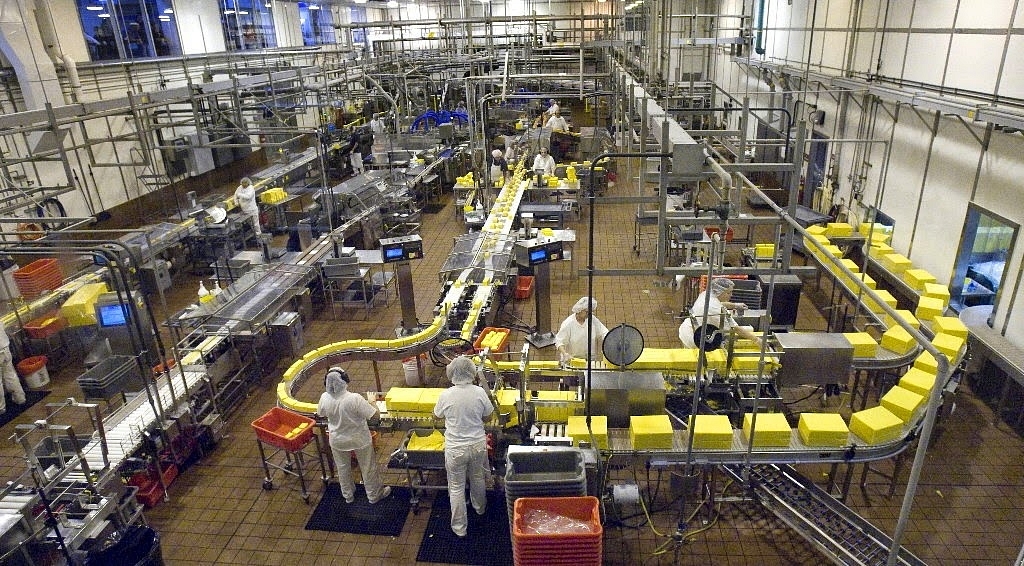

An industrial and transport equipment manufacturing factory

Almost from the time Commerce Minister Nirmala Sitharaman set an ambitious exports target of $900 billion by 2020, the trade scenario has been buffeted by one crisis or the other. The commerce ministry has been maintaining a brave façade, but this report makes it clear that the target is as good as missed.

The only bright spot has been that services exports have been doing better than goods exports and an emphasis on this is what chief economic advisor Arvind Subramaniam has often advocated.

An HSBC report, India Trade Report, is quite optimistic on this front. Working out scenarios for the 2016-2020 and 2021-2030 periods, the report says India’s services exports will more than triple by 2030, taking its share in world services exports to 4 per cent. India’s current share is 3.27 per cent. Services exports, the report says, will grow at 8-9 per cent a year for the next 15 years.

Within the services basket, IT service exports will continue to take up the most space, though this share will go down slightly from 50 per cent in the 2016-20 period to 48 per cent in the 2021-2030 period. However, the share of this sector in global ICT services exports is expected to go up marginally from the current 17 per cent to 18 per cent by 2030.

Two other services sectors that are expected to chip into IT services exports share, according to the report. The share of B2B and other services is projected to increase from 22 per cent in 2016-2020 to 24 per cent in 2021-2030 and that of transport and distribution services is set to grow from 9 per cent to 10 per cent over the same period.

The share of tourism and travel, however, is projected to fall from 13 per cent to 12 per cent between 2016-2020 and 2021-2030. At the same time, the report argues that India could still benefit from the growing global travelling class and medical tourism.

This over-reliance of services exports on just one sector is problematic. There’s growing protectionism even in the services sector and India, which otherwise keeps harking on its strong services sector, needs to focus more on pushing exports of other services where it has an edge.

There’s also not going to be much change in the services exports markets, with the United States remaining the top destination till 2030. The top five export destination will continue to be, apart from the United States, the United Arab Emirates (UAE), United Kingdom, China and Germany, with the United Kingdom and China trading places in the third and fourth position (China displaces the former).

But besides this, the report points to a gradual shift in services exports to emerging markets. Turkey, it says, could emerge as a key services export destination, growing at 11 per cent in the 2016-2020 period, followed by Korea and Malaysia at 11 per cent. Turkey, the report says, will see growing demand for financial and transport services.

According to the report, China will be the top import source even in 2030, supplying industrial machinery and other manufactured goods. This, it says, will be the natural fallout of India’s push to raise the share of manufacturing to GDP to 24 per cent. China, however, will not be the fastest growing supplier between 2015 and 2020.

The report does not, however, indicate if the share of these imports vis-à-vis domestic production will change; that will be an indicator of the success of the Make in India programme. It projects rapid growth in the import of ICT equipment, especially mobile phones and computers.

The composition of India’s goods exports basket isn’t likely to change very much between 2015 and 2030, according to the report. But there could be some shift in shares. Transport equipment and machinery will grow in the 20121-2030 decade at the expense of clothing and apparel and chemicals. This is attributed to India moving up the manufacturing value chain. Mineral manufactures, transport equipment and petroleum products, the report says, will contribute one-third to the increase in exports in 20121-2030.

The effort of successive governments to diversify export markets may bear some fruit. The report says that though the United States and the UAE will remain the dominant export destinations (they will switch places, however), Vietnam is likely to make an entry into the top-five club, pushing out the United Kingdom. (The report goes by export shares of individual countries, hence the absence of the European Union, which is India’s largest export destination as of 2015).

The United States (currently the top export destination with a share of 15.5 per cent) will take second place to the UAE (current share 11.6 per cent) in the 2021-30 decade. The report attributes this shift to UAE being India’s largest market for petroleum products, its role as a regional hub as well as opportunities for collaboration in research and development and technology transfer.

China (current share 3.5 per cent) will push Hong Kong (current share 4.6 per cent) out of the third spot and Vietnam (current share 1.9 per cent) is projected to come into the fourth position. Goods exports to Vietnam are projected to grow at 16 per cent a year in the 2016-2020 period and at 14 per cent a year in the 2021-2030 period. Other fast-growing export destinations in the 2021-30 decade are projected to be Malaysia, Bangladesh and Indonesia.

All this is dependent on the world economy progressing smoothly. The report talks about an alternative scenario where the United Kingdom has a hard exit from the European Union and the United States becomes over protectionist. Since the United States is India’s biggest export destination, any such move would see the value of India’s exports fall by 30 per cent below its potential, the report says. Though it could make it up by concentrating on other markets, especially in East Asia, overall exports could suffer due to a global slowdown.

All eyes, therefore, on what happens in the United States.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest