Economy

In The Final Clean-Up Lap: What More Is Needed To Fix Our Banking System

- After five years of bank clean-up, fresh vulnerabilities seem to appear in the banking sector.

- This shows that governance and regulatory reforms are absolutely essential to the process of cleaning and fixing our financial system.

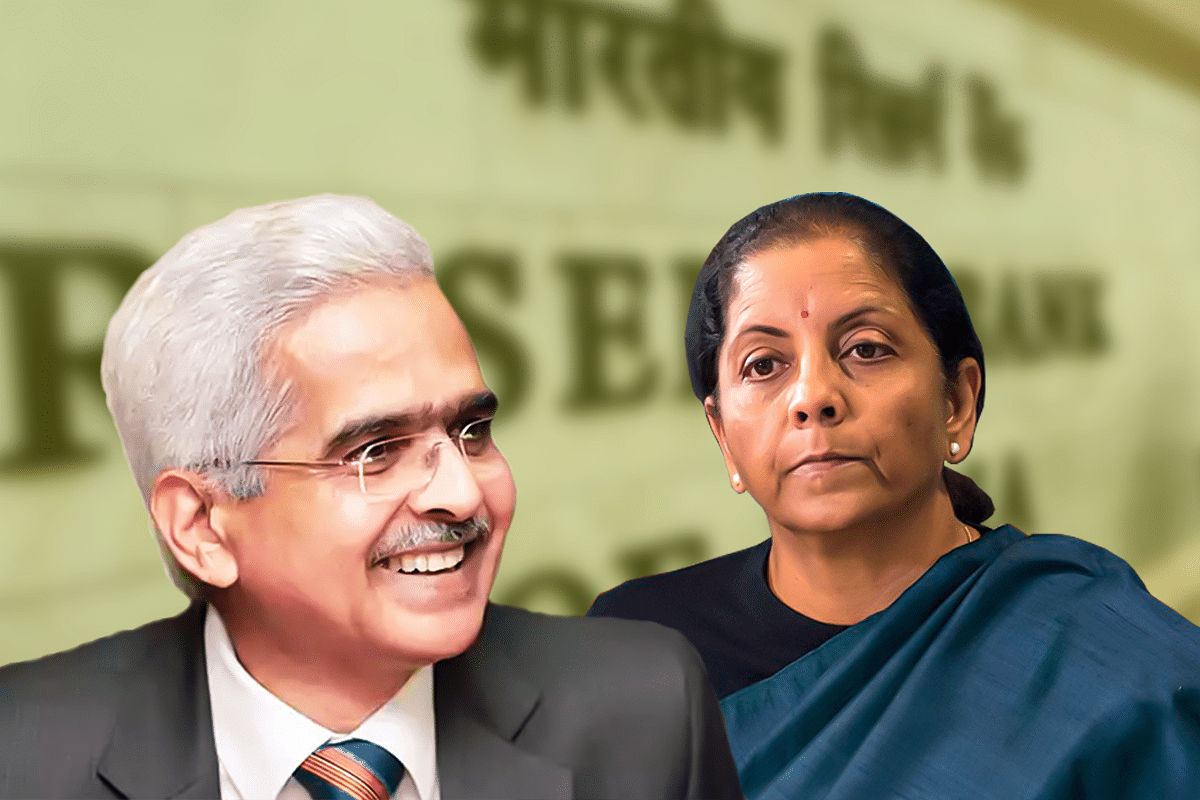

Finance Minister Nirmala Sitharaman and RBI Governor Shaktikanta Das

In August 2018, it was largely believed that India’s non-performing assets (NPA) woes would be resolved by September 2019. This belief was largely because of the success of the Insolvency and Bankruptcy Code (IBC) and higher provisioning by banks to take these stressed assets off their books.

At the aggregate level, indeed NPAs have come down dramatically over the last five years. In fact, we have seen a systematic shift in the banking culture as banks have finally started to recognise stressed assets and provision for them adequately.

This cultural shift is very important as it is a departure from the conventional rollover of stressed assets. The rollover was in many ways a by-product of crony capitalism and there were no downside risks for a big promoter in the event of insolvency. This led to greater amount of risks being taken by some Indian industrialists.

Due credit needs to be given to the government for trying to fix the system by enacting the IBC. Similarly, one must also credit Dr Raghuram Rajan who as Reserve Bank of India (RBI) governor initiated the asset quality review and nudged Indian banks to recognise toxic assets. A systematic clean-up of Indian banking system was indeed required in order to create a strong and vibrant financial system.

It is important to also recognise that the reason why NPAs were recognised during the National Democratic Alliance (NDA) regime was only because of the RBI and government trying to clean up the system. Dr Rajan rightly mentioned in his note to parliamentary committee that a bulk of these stressed assets are loans given during the United Progressive Alliance (UPA) period. Therefore, it is indeed a legacy problem and one cannot be oblivious to this fact.

However, five years post the clean-up, it is only natural to ask questions, more so given the non-banking financial companies (NBFC) crisis that started with IL&FS in September of 2018. Since then, the government has tried to ensure funds flow to NBFCs and credit off-take resumes.

But banks continue to face several pressures as new vulnerabilities emerge. The recent slowdown is by far one such downside risk which is why it is imperative to revive growth to 7 per cent or more. It is very likely that our growth in next financial year would be closer to 7-7.3 per cent, and the necessary steps have been taken by the government in that direction.

A critical issue in the banking sector has been of regulatory lapses and weak corporate governance. The fact that there was ambiguity with respect to RBI’s regulatory powers for the NBFCs suggests significant gaps persisted.

Thankfully, the government has addressed the regulatory concerns with respect to NBFCs but we are still to see an implementation of the recommendations by the P J Nayak Committee. Perhaps, this may be a good time to revisit some of them, especially with respect to public sector banks, their governance and reduction in the shareholding of government in them.

It is imperative that we recognise the need for a strong regulatory structure that strengthens our financial system. This structure should reward performance, enable further growth of the sector while at the same time, impose severe penalties for corruption and collusion.

The fact that PMC Bank had a sizeable exposure to a single firm points at the weakness of our system for checks and balances. The regulators should be pulled up along with auditors of the firm.

Luckily, the regulators have been swift in terms of resolving the crisis and they have already attached sizable assets to recover depositors’ money, but a key question worth asking is how did it happen, who all made it possible for this to happen and most importantly, how do we prevent this from happening in the future?

The clean-up has taken a long time and no modern economy can consistently grow without a strong banking system. It is, therefore, only natural to question the government now to why the system still appears to be broken despite an extensive clean-up? More importantly, what more is needed to fix the system and to do it sooner rather than later?

The answer on what needs to be done is in what former chief economic adviser, Dr Arvind Subramanian had repeatedly argued – a bad bank. It is important to recognise that the cost of not taking these toxic assets out from the books of our lenders is far likely greater than the cost of taking them out. Nobody is arguing to let go of frauds and instances of corruption. They must face prosecution under the relevant sections of the law.

At the same time, the bad bank will work towards recovering whatever value can be recovered from these bad loans, and this could happen either through the IBC process or through asset reconstruction.

The IBC process too seems to be choked due to the high levels of NPAs that are under the process and while IBC is a good idea for a recurring basis to prevent a similar such NPA crisis in the future, it may not offer an immediate solution. The vulnerabilities in the real estate sector and exposure of NBFCs and banks to the sector can be adequately addressed through a bad-bank or an asset reconstruction programme.

The banking system is in the final round of clean-up and the question is no longer about morality or ethics, but it is about a pragmatic solution that can fix the system at least cost and least time. A bad bank would achieve exactly the same.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest