Economy

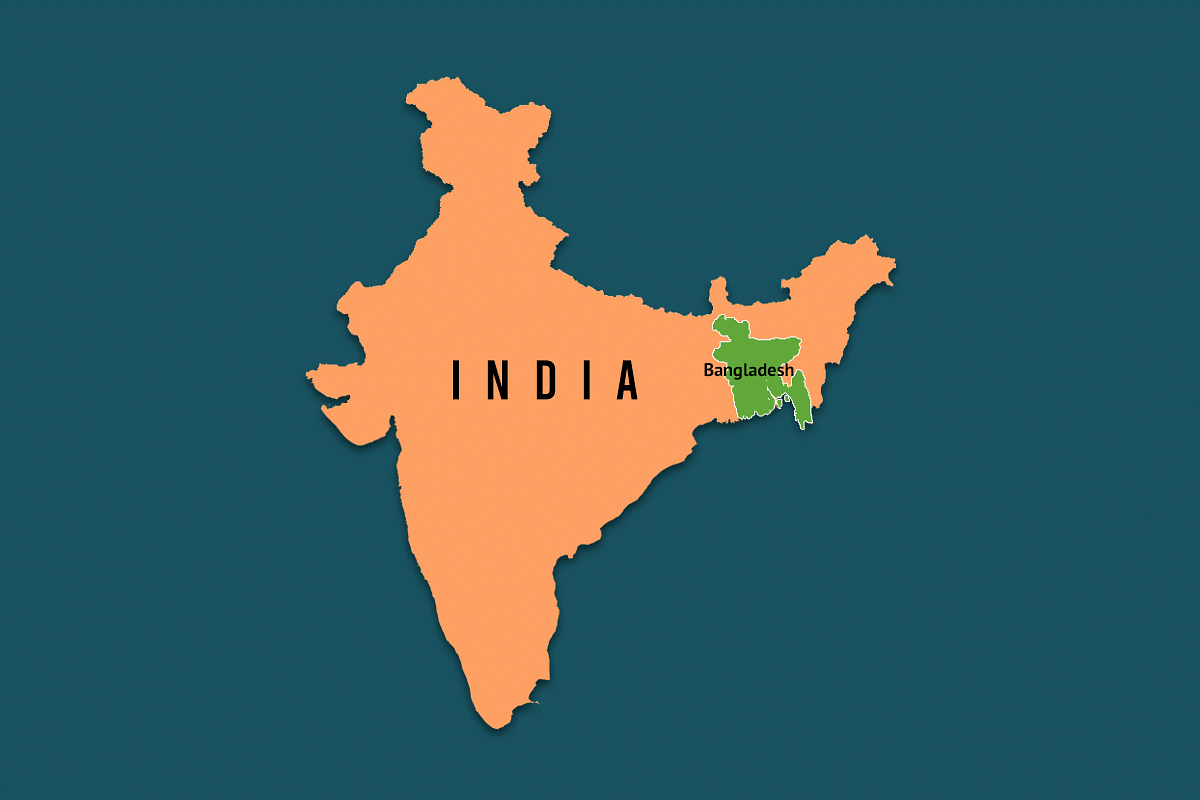

India Vs Bangladesh On Economics — How Frequent Comparisons In The Media Lack Context

- The learning from India and Bangladesh’s growth stories is different from what features frequently, quite unfairly, in the Indian media space.

India Bangladesh Relations

Over the past few years, the Indian media has been obsessed with comparing the economies of India and Bangladesh.

For a while, Bangladesh surpassed India in terms of per capita income. This data point led to frenzied media commentary about how India should have learnt the right lessons from Bangladesh’s meteoric economic rise.

As the world came to be gripped by a pandemic, followed by the conflict in Ukraine, the rough macroeconomic edges of many countries showed up. Bangladesh was one of them.

The Government of Bangladesh had to consider approaching the International Monetary Fund (IMF) to bail the country out of an adverse balance-of-payment situation, aggravated by prohibitive global energy costs.

So, how did a country which was the poster child for economic miracles just before the pandemic had to look towards the IMF for survival?

Especially, how did a country whose strength was exports ended up facing a balance-of-payment problem?

The answers lie in premature proclamations of Bangladesh’s economic miracle.

To be sure, Bangladesh is most definitely a smashing economic success. From a gross domestic product (GDP) of $4 billion in 1960, it hit a high of $416 billion in 2021, about a hundred times rise over 50 years, a strong performance.

The per capita income is touching $2,500, higher than in India. Bangladesh has an annual export base nearing $50 billion, a very healthy 12 per cent exports-to-GDP ratio.

And, yet, these numbers do not paint the full picture.

Bangladesh became an export powerhouse largely as a textile success story. It has remained a one-trick pony, in that its textile exports form almost 70 per cent of the total exports. The sectoral spread has been very poor despite a two-decade runway of export growth performance.

Even within textiles, Bangladesh exports lower-end, low-margin products with little depth of expertise in more complex areas like technical textiles or textile machinery. The successful domination of the low-end global textile market has not translated into significant labour force productivity and associated wage curve shift.

At least, as yet, the success of Bangladeshi exports carries neither width nor depth. This skin-deep growth has been exposed as the inelastic exports — energy, consumer goods, agriculture inputs, and food grains — have become dearer due to the twin inflation events of the pandemic and the war.

Some more digging on textile markets brings out yet another difference between India and Bangladesh’s export situation.

India has 40 per cent share in American textile imports and has been either the first- or second-biggest supplier for most of the recent years. However, when it comes to the European Union (EU), India only has a 10 per cent market share and ranked a relatively distant fourth to sixth, with Bangladesh, Pakistan, and Turkey consistently staying over India.

In fact, Indian textile exports have declined at 5 per cent compounded annual growth rate (CAGR) to Europe over the period 2014-2020.

Why is it that India is able to outcompete its rivals in the United States (US) but not in Europe?

The answer lies in an age-old global trade feature known as the Generalised System of Preferences or GSP.

Members of the General Agreement on Tariff and Trade (GATT) decided to allow for a generalised, non-discriminatory, and non-reciprocal system of tariff preferences to be awarded by some members to others, deviating from the most-favoured nation principle.

The idea was that the richer countries can allow the developing ones to get greater market access through preferential tariffs. The US as well as the EU have run their own version of this programme since the 1970s.

While a member can make adjustments to its programmes, changing recipient countries and product coverage periodically, developed countries keep offering the GSP to the least developed countries or LDCs.

While India has been left out of various GSP categories by some developed members of the World Trade Organization (WTO), the successor to GATT, Bangladesh continues to enjoy the benefits of GSP.

It has led to an 8-12 per cent duty benefit for Bangladesh in the EU markets. For low-end textiles, this is a make-or-break difference as the margin on these products itself may be lesser than the duty advantage with Bangladesh.

Stated simply, India may not be able to compete with Bangladesh for basic textile products in the markets where Bangladesh enjoys GSP benefits, unless Indian value chain participants decide to make no profits at all. This is clearly untenable.

Bangladesh has been marked for graduation out of the LDC status in 2026 by the United Nations. Based on the commentary one reads on Bangladesh, it would appear that a graduation from an LDC to a developing country would instill a sense of pride and confidence.

Yet, since the possibility of Bangladesh’s change in position came to the fore, the country has been fighting in the WTO to retain its LDC GSP benefits.

In the February meeting of the WTO General Council, whose minutes are available in the document “WTO/GC/M/196” on the WTO website, the Ambassador of Bangladesh pleaded on the LDC graduation proposal:

“There are several unilateral LDC-specific GSP schemes where there are procedures available to extend LDC trade preferences to graduated countries for a certain time-period… It is up to the preference-granting members to see how they want to consider the extension of their unilateral LDC-specific schemes to the same Members for a defined period after graduation… What we are calling for is a best endeavour effort.”

This is not a one-off case. Bangladesh has pleaded to retain its GSP benefits for almost four years in the WTO. Members like the US and EU are not too keen to let graduating LDCs operate with GSP benefits.

In fact, India has stood out as a rock-solid defender of LDCs on this agenda as the General Council meetings indicate. India also provides a ‘Duty Free Quota Free’ access to its own markets to all LDCs.

This situation shows that even very high economic growth may not by itself be sufficient to thwart exogenous shocks. The balance-of-payment situation requires macroeconomic management finesse and a large, diversified economy to leverage.

India’s government and the Reserve Bank of India have shown out to use cyclical and countercyclical measures to manage external shocks. India also remains vulnerable to protracted global problems, not as seriously as its neighbours.

From India’s point of view, the ongoing free trade agreement negotiations with the United Kingdom and the EU become important. Once the tariff cuts on textiles and other labour-intensive industries are negotiated, Indian firms will most certainly gain market share — mostly from Bangladeshi firms — in these markets.

Sovereigns can, and should, always learn from each other. But the expectations of learning must be grounded in real data analysis and a well-rounded worldview of relative competitive advantages. This is the learning from India and Bangladesh’s growth stories.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest