Economy

IRS Officers’ Policy Suggestions For Reviving Economy Post Covid-19 Must Be Junked; Increasing Tax Rate Is Not An Option

- Suggesting an increase in tax rates when the economy is going downhill smacks of poor basics. Officials involved in policy formulation should know better.

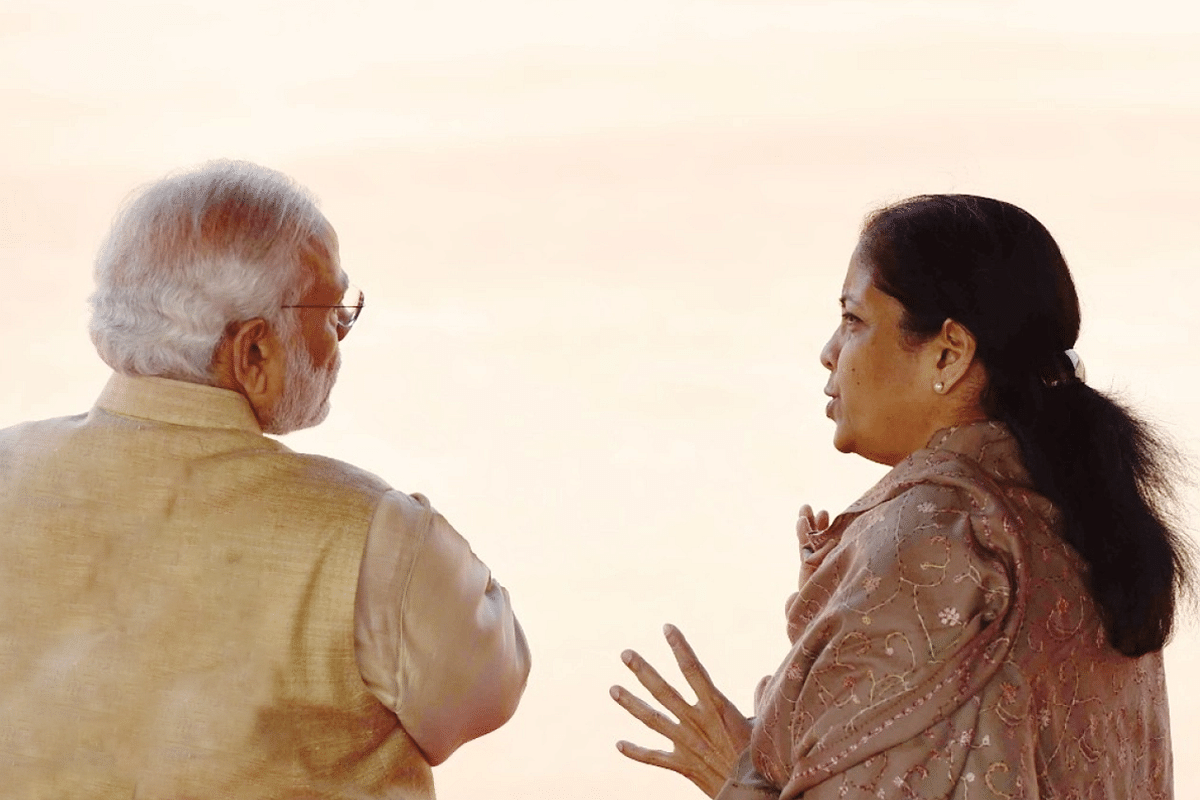

Prime Minister Narendra Modi and Finance Minister Nirmala Sitharaman.

India’s government officials have done an exceptional job at handling the COVID – 19 health pandemic and we have to appreciate the zeal with which officials have been functioning across all departments.

However, overzealous officials at such times tend to go overboard and this is indeed a concern that has emerged after the IRS Association presented its report of suggestions for containing the economic fallout of COVID – 19 pandemic.

At the outset, the report should be junked and those who endorsed it must be held accountable for presenting ideas that would push the country back by decades, if not more.

In a nutshell, the report has outrageous revenue suggestions, while the ones on expenditure are impractical and a consistent reminder of our old macroeconomic playbook.

If India were to follow the expenditure recommendations presented in the report, it will certainly act as a permanent fiscal drag, have limited impact on growth and cause substantial damage to our long-term fiscal consolidation plans.

Increasing expenditure under the Mahatma Gandhi Rural Employment Guarantee Act (MGREGA), cash transfers etc are all fine, but for the kind of programmes proposed, we need adequate revenue, which has to come from economic growth and not increasing taxes. The report, however, proposes to increase taxes.

The morality of our taxation policy has focussed on taxing the rich to the extent that India has some of the highest taxation burdens with a narrow tax-base.

There is talk of higher tax rates for the highest slab, additional cess on incomes beyond 10 lakh rupees and an inheritance tax.

The proposed ideas make sense for a developed country that has a rational taxation structure in an ordinary time.

To my mind, there’s no example of a country increasing taxes during a growth slowdown (in this case a severe economic depression) that ends up well.

The proposed norms reflect the sad reality of India’s obsession with wonky taxation policies that have penalised wealth creation for decades.

There was a start towards gradual rationalisation of tax rates since 2014 and the proposals seem to be undoing the progress that was made over the six years.

Here’s a lesson for the IRS officials who are interested in understanding taxation policy, and to some extent public finance.

Tax collections or revenue mobilisation depends on tax rates, growth rate of income and tax compliance.

To assume that by increasing tax rates, there’s an increase in revenue is too simplistic and untrue.

The 20th September Corporate Tax cut of 2019 is an excellent empirical example of precisely the same concept as it showed the extent of improvement in tax compliance post-the tax cut as the revenue loss due to the tax cut was far lower than what CBDT had originally estimated.

The more nuanced point here is about the purpose of taxation policy and it is to redistribute income.

India, at present, has taxes which are comparable to some of the advanced economies even as the public services provided to citizens are poor compared to even the middle income countries.

This shows the extent of mismatch in our taxation policies and illustrates why we have been unsuccessful in creating wealth.

A good example is that why start-ups like Flipkart are incorporated elsewhere or why is India’s Financial Services outsourced to Singapore?

The point being that our high tax rates have effectively shifted high-value services to other countries and have often been revenue negative.

To then even think of increasing taxes shows the lack of expertise that is prevalent amongst our young and bright officials that would at some point in future also work on formulating taxation policies.

The increase in tax rates, at a time when people are ‘dissaving’, and wealth erosion across assets and cash position has weakened across companies, makes no economic sense.

It will not generate revenue but will certainly dampen economic sentiment and weaken the future outlook.

This, in turn, would result in lower growth and pose challenges for revenue mobilisation that well extend to the future.

To even think of revenue mobilisation through higher direct taxes at such a time is not in our best economic interests.

Sources, however, reveal that the report was an unsolicited set of recommendations from overzealous officials. They add that government considers the report as an act of indiscipline and irresponsible while it may even seek an explanation for the misconduct.

The report is definitely inconsistent with the taxation policies by and large adopted by the government and we should appreciate if indeed the government has taken objection to the ideas suggested by these young officials.

Nevertheless, this episode reinforces the need to include a compulsory module of training on taxation policies driven by empirics to help our officials develop capacity and understand the fundamental concepts of taxation.

To lack this kind of expertise and still be involved in formulation of taxation policies is only going to result in sub-optimal policy choices, which, therefore, necessitates such a module as part of their training.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest