Economy

Jaitley’s ‘Google Tax’ May Hurt Startups More. Here’s What You Need To Know

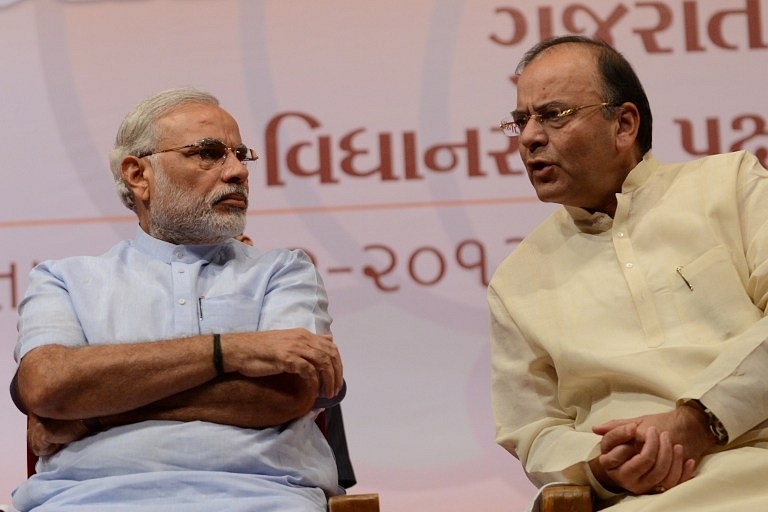

Narendra Modi And Arun Jaitley

A lot of new taxes are coming into force today: Krishi Kalyan Cess of 0.5 per cent will take the effective service tax rate to 15 per cent; one per cent tax will be levied on cash payments of above Rs 2 lakh for goods and services except jewellery; additional tax of one per cent on purchase of cars above Rs 10 lakh will also kick off.

But the most notorious of all is the so-called equalisation levy, or ‘Google tax’. Finance Minister Arun Jaitley had announced the same in his budget speech earlier this year. Internet firms like Google and Facebook who earn a major chunk of their revenue through advertisements don’t pay any tax in India since they are registered outside. They pay tax in the country of their registration. However, the companies that have their local arms registered in India do pay their share of tax.

From today, both types of firms, those who have or don’t have a local arm, will have to pay up. Perhaps, the government thinks that by casting this tax net, it will be able to force these global internet giants to set shop in India - or at least collect some money. Until then, their India clients who pay these companies for broadcasting their advertisements, will have to pay the amount.

The idea is to tax any and every firm that is paid for its service by Indian users. It doesn’t matter whether it has online or physical presence.

Prima facie, one can’t deny a government the right to tax incomes earned in a country. The question is whether this new tax has the potential to do more harm than good. While it will add a few crores to the tax kitty of the government, it will hurt businesses in the short run, especially the smaller ones and budding entrepreneurs.

Why would the government bring in this tax?

Thank the Organization for Economic Cooperation and Development (OECD), a grouping in which India is partner country.

It has recommended to its members and partners that the tax regime should be such that not even a single transaction goes untaxed and suggested the equalisation levy as one of the measures to achieve that objective. Our Finance Minister, who works on the principle of “if it moves, tax it”, perhaps couldn’t resist the idea and lapped it up and here we are. India is the first country to implement this.

How will it impact startups?

Let’s take an Indian company’s example. Yesterday, if it paid Rs 100 to reach 10 people on Facebook, today, it will have to pay Rs 106 to reach the same number of people. It will have to keep bearing this so-called equalisation fee until Facebook opens its local shop here. And startups which, unlike big corporations, don’t have a massive war chest to spend on advertisements will be adversely affected.

How Will It Work?

The onus of deducting and paying the levy will be on Indian clients of the global advertising internet firms. Clients will have to deduct the six percent levy before paying an amount to a global entity. If we make a payment today (1 June) to an international firm, we will have to deduct the appropriate amount and pay it to the government before the 7th of next month.

A penalty of one percent per month will accrue if one fails to pay the tax in time.

If one fails to deduct and pay, in addition to one percent interest, he/she will have to pay the penalty equal to the amount of equalisation levy. However, if one deducts but fails to pay, he/she will have to pay the penalty of Rs 1,000 for every day. The amount of penalty, though, cannot exceed the equalisation levy.

Global advertising firms will make a business decision after weighing their options. So, there is no guarantee that the government’s effort to force firms to open their shops here will work. Advertisers at home are hoping that Facebook, Google et al will bear the extra burden but this may just be wishful thinking.

If they can afford to set shop here, they will do. Otherwise they will keep paying the six per cent levy. But who is to say the cash-strapped government won’t keep increasing the upper limit to milk the online advertisement cow dry.

Based on the report of a committee constituted by the government to tax e-commerce transactions (!), Mint predicts that “the government may expand its scope to cover more services such as downloading of songs, movies and books, online consumption of news, software downloads and online sale of goods and services in the coming years.” So brace yourselves, more equalisation is coming.

The government thinks it has found an innovative way to crack down on internet companies but it is more likely the firms will keep pushing the extra burden to their advertisement and media buyers in India. It should then seriously introspect and ask whether this is not hurting its own people.

Besides, its wish to force companies to come here through such tactics might remain just that: a wish.

Wishful thinking cannot be an alternative to serious policy. The government should know if wishes were horses, we would ride to 16 percent growth. Alas!

Further Reading

Equalisation Levy 6% by Budget 2016 in India - CA Query

Note: Earlier copy of this piece erroneously mentioned India as a member country of the Organization for Economic Cooperation and Development (OECD). It’s not a member but a partner. This has been corrected.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest