Economy

Missing Month Of GST Revenue Largely Responsible For Fiscal Slippage: FM

- After presenting the union budget, Finance Minister Arun Jaitley addressed a press conference at 4pm today (01 February). Here are the highlights:

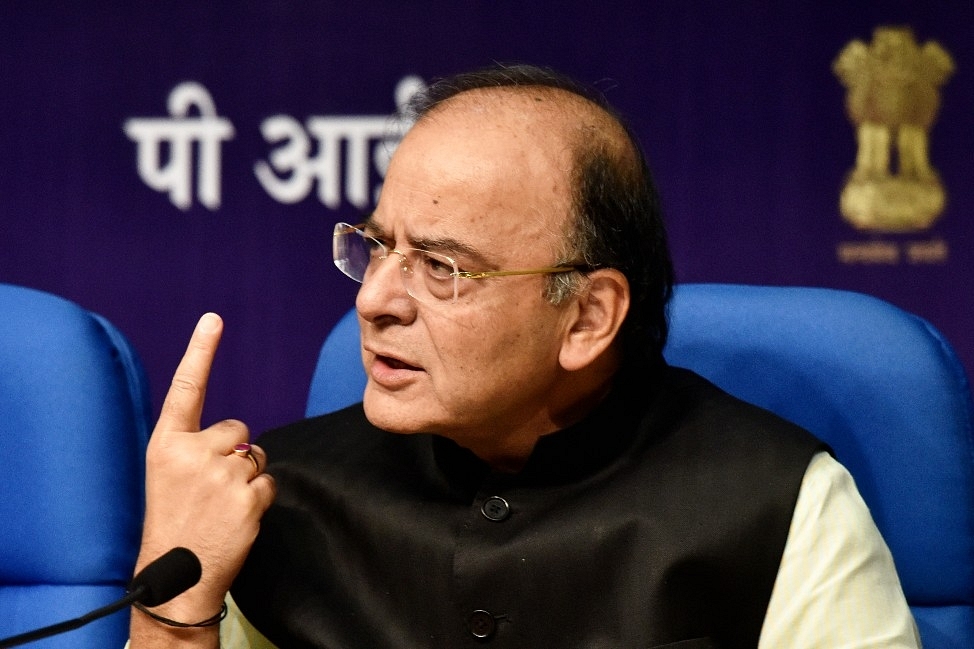

Finance Minister Arun Jaitley (Mohd Zakir/Hindustan Times via Getty Images)

The fiscal slippage, which was widely expected and eventually acknowledged by the Finance Minister (FM) in his budget speech this morning, is largely, on account of one month of missing the goods and services tax (GST) revenue. The GST revenue which will accrue in March this year (2018) will be realised in April, Arun Jaitley said in the post-budget interaction with journalists.

So essentially, the government is working with 12 months of expenditure on only 11 months of revenues. This, plus some other factors such as lower dividends from central public sector enterprises and the Reserve Bank of India (RBI) as well as lower realisation from spectrum auctions have combined to affect the fiscal deficit.

This year, the FM has slipped from the initial target and pegged fiscal deficit at 3.5 per cent of gross domestic product (GDP), which will be brought down to 3.3 per cent next fiscal. In the first year of the NDA government at the centre in 2013-14, the fiscal deficit was 4.4 per cent of GDP. It was brought down to 4.1 per cent in 2014-15, 3.9 per cent in 2015-16 and to 3.5 per cent in 2016-17.

Also, dashing hopes of lower pump prices for petrol and diesel, the finance minister said that although excise duty on both fuels has been reduced by Rs 2 per litre, there will be no change in prices for consumers since excise has been converted into cess. The total incidence of taxes on both fuels therefore remains unchanged.

On the global crude price movement, Jaitley declined to make a comment or a forecast, merely saying that of course there was a price band which was comfortable for the economy. “At present, prices are close to the (upper) limit of this band,” he said. Remember, pump prices of both petrol and diesel have gone up substantially since mid-December, when global crude prices began rising, ruling at all-time highs now.

After the Ministry of Petroleum and Natural Gas had petitioned the Finance Ministry for an excise cut, there were hopes of a reduction in pump prices, but with today’s FM statement, these have been dashed. The officials of the Finance Ministry, who were present at the interaction, also added that not a single proposal in the budget for 2018-19 will stoke inflation.

Long-term capital gains (LTCG) tax: The government has brought this back, at 10 per cent for realisations above Rs 1 lakh but with no retrospective effect. The FM said that the securities transaction tax (STT) also continues along with the new levy because, anyway, it is a minuscule amount and helps the government track stock market transactions. The government collects just Rs 9,000 crore through STT. On LTCG, he said this was the best time to bring in this tax since the purpose of keeping such income outside the tax net – to allow stock markets to grow in a healthy manner – had been achieved. He also said that the markets have reacted maturely to the new levy, which is anyway less than the 15 per cent charged on short-term capital gains tax. The LTGC tax is likely to mainly impact foreign and Indian companies and not so much individual investors. As much as Rs 3.67 lakh crore was being exempted from any tax till now since this is the amount the investors gained by keeping investments in shares for over one year.

Middle Class: To criticism that nothing has been done for the middle class, the FM said that not only has their immense contribution to the country’s taxation base been acknowledged for the first time, but they have also been offered a standard deduction, and a range of benefits have been provided to senior citizens. Even small businesses (MSMEs) have been provided for, as corporation tax for businesses with a turnover of up to Rs 250 crore has been kept at the reduced rate of 25 per cent. The FM also mentioned the previous three budgets where the middle class has, each year, been offered sops so that more income remains in the hands of the salaried class.

Disinvestment: The FM clarified that it wasn’t correct to see the Rs 80,000 crore target for the next fiscal as being lower than the current year’s since the initial target for 2017-18 was Rs 72,000 crore. Remember, the big elephant in the room, Air India, is set to be privatised before the end of next fiscal.

Health: The FM reiterated that the proposed flagship National Health Protection Scheme is the largest such scheme anywhere in the world. Under this scheme, 10 crore poor and vulnerable families (approximately 50 crore beneficiaries) will be covered. The government will provide coverage of up to Rs 5 lakh per family per year for secondary and tertiary care hospitalisation. The FM said adequate funds would be provided for the smooth implementation of this programme but did not divulge the quantum.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest