Economy

RBI Gets The Bazookas Out: Message To Banks Is Lend, Lend, Lend, Lower Rates

- The message to banks and the financial system is this: this is not the time to worry about bad loans.

- This is the time to grow the loan book even if it means taking huge risks with the quality of the lending.

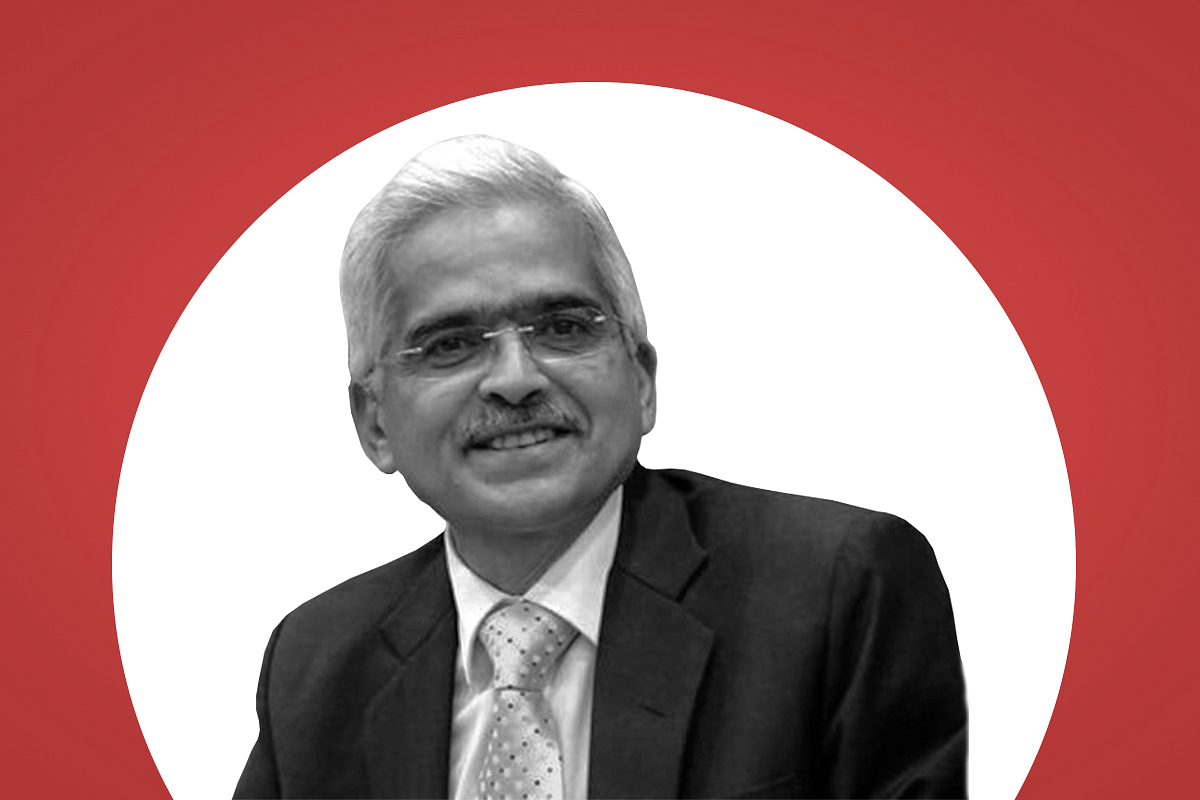

RBI Governor Shaktikanta Das

The Narendra Modi government has brought out the big bazookas now. Three days after locking down the whole country for 21 days to contain the Covid-19 virus, it has now started unleashing massive fiscal and monetary firepower to prevent a financial and economic meltdown.

Yesterday (26 May), Finance Minister Nirmala Sitharaman announced a Rs 1.7 lakh crore fiscal spending programme to reach food and cash to the most vulnerable sections of society, including migrant workers, women and senior citizens.

Today (27 March), the Reserve Bank of India (RBI) Governor, Shaktikanta Das, literally opened the vaults of the central bank to the financial system so that they can go out and lend, lend, and lend.

In one fell swoop, Das has cut repo rates by 75 basis points (100 basis points make one per cent), slashed the cash reserve ratio by 1 per cent to 3 per cent, and opened the floodgates for ensuring liquidity and credit to all segments of society. Together with a massive expansion of its long-term repo operations (LTRO), today’s measures will unleash liquidity worth Rs 374,000 crore in the coming months.

Add the Rs 280,000 crore of liquidity already unleashed earlier this year, what the RBI has done is expand liquidity worth nearly 3.2 per cent of gross domestic product (GDP) in just a few weeks’ time. (Read Governor Das’s full statement here).

If making money available can help us with the pandemic, Das is the right man for the job.

Simultaneously, regulatory requirements have been eased, with term lenders, including home loan companies, being asked to give three months’ moratorium to borrowers. Working capital accounts are being given a similar relief for interest payments due as of 1 March 2020.

This implies that even if a company does not service its loans, for at least three months the account will not be labelled as “non-performing”. Working capital will also be given more liberally with lower margin requirements for the borrower.

The message to banks and the financial system is this: this is not the time to worry about bad loans. This is the time to grow the loan book even if it means taking huge risks with the quality of the lending.

The same message came from the Finance Minister yesterday when Nirmala Sitharaman said self-help groups will be given collateral free loans of upto Rs 20 lakh. Mudra loans will also be ramped up.

The RBI today backed up the lend, lend, lend message by widening the gap between the repo and reverse repo rates from 0.25 per cent to 0.4 per cent. This means the RBI will lend to banks at 4.4 per cent, but accept deposits from them only at 4 per cent.

This means banks are being goaded to go and lend rather than idly park their excess deposits with the central bank. They will also be asked to lend more to companies by buying up commercial paper, thus opening up an indirect line of funding for non-banks and others.

The implications of today’s monetary policy announcements are huge: both deposit rates and lending rates will fall as banks begin to ramp up lending; borrowers will get relief both on rates and repayment periods, and this includes retail borrowers who have to pay auto and home loan EMIs (equated monthly instalments), for upto three months.

The non-bank financial companies will get the kind of lifelines that they didn’t get earlier. They are being indirectly fused to the main banking system.

The RBI’s stellar performance during this time of crisis needs to be commended, for it has managed to extricate the Monetary Policy Committee (MPC) from its narrow-minded focus on inflation and think about growth and other challenges. Governor Das managed to wake up the committee and got them to agree to bring forward the scheduled meeting from 31 March-3 April to 24-27 March – an advancement of a week.

Even better, Das has been able to make the MPC fairly redundant this time around, with many of the steps announced to improve liquidity having an indirect impact on lending rates. He has told the MPC that he can do things they never can, so they had better fall in line.

The RBI, as Governor Das said in his televised address today, is in “mission mode”. It will do whatever it takes to “mitigate the economic impact of Covid-19 and preserve financial stability…. (and) all instruments – conventional and unconventional – are on the table.”

Das also assured the public that bank deposits are safe.

He said:

By public authorities he meant temples, charitable trusts and even state governments, who are busy destabilising private sector banks by withdrawing large amounts of their cash in the pursuit of safety.

This is the closest the RBI has ever come to telling depositors that it stands four-square behind deposits even though the actual amounts insured with the Deposit Insurance and Credit Guarantee Corporation do not exceed Rs 1 lakh per account.

Das’s performance is a telling reminder that India’s central banker needs to have open lines of communication with the Centre and an open mind on issues beyond just inflation. He has already done far better than his globally known predecessors, Raghuram Rajan and Urjit Patel. He is probably the Modi government’s best insurance against Covid-19 becoming a financial pandemic.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest