Economy

Slowdown Is Real, But Economy Is Not In Free Fall, Never Mind What Nobel Laureates Think

- The slowdown is now well-accepted by government as real, and the economy will revive with a lag.

- In the meanwhile, let’s take the words of Nobel laureates with a pinch of salt.

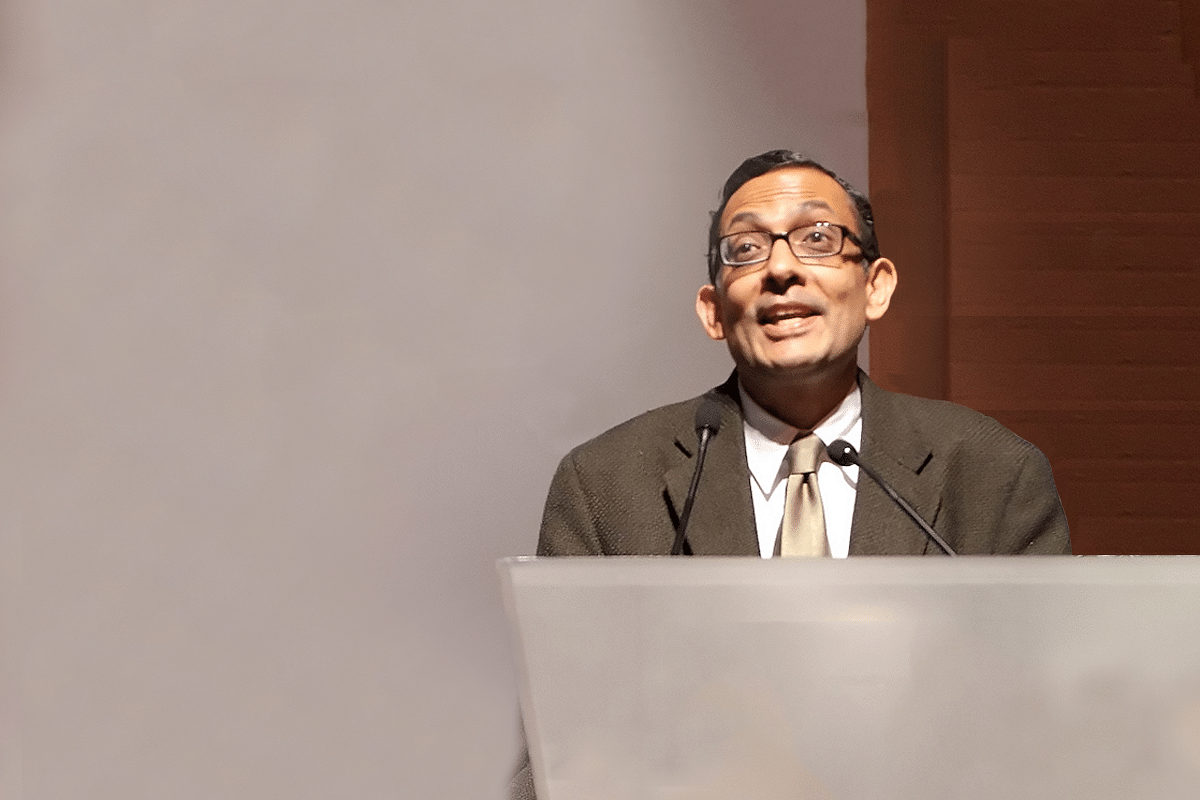

Nobel laureate Abhijit Banerjee speaking at an event.

Hand a Nobel over to someone, and suddenly he becomes an expert in everything. Abhijit Banerjee, joint winner of this year’s economics Nobel along with Esther Duflo and Michael Kremer, was busy pontificating on how the Indian economy is in a “tailspin”, “doing very badly” and “slowing very fast”.

The slowdown has been obvious to anyone who has seen the recent data sets: two quarters of gross domestic product (GDP) rate declines, demand collapses in sectors facing a structural downturn (autos, real estate, construction), the drop in the index of industrial production, and the external trade decline, with exports down 6.57 per cent in September and imports by a massive 13.85 per cent. Goods and services tax (GST) collections in September declined to Rs 91,916 crore.

Banerjee’s observations are no different from a Met office official looking at cloudy skies and predicting rain. Everyone can see that. The problem is in Banerjee’s claim that a 5 per cent GDP number (in the first quarter of this fiscal) is some kind of disaster when deep structural changes are taking place in the global and domestic economy simultaneously.

Contrast Banerjee’s flippant alarmism with global investment strategist Ruchir Sharma’s more insightful statement, that in the context of four ‘Ds’ – deglobalisation, depopulation (lower growth rates in global working age populations), declining productivity and high debt – 5 per cent GDP growth is the new 7 per cent for countries like India.

It is more than likely that after another quarter’s dip in July-September, growth will revive from the October-December quarter. So, the Cassandras can have a field day until February 2020, when the next budget is due and the GDP numbers for the October-December quarter will be revealed.

On the other hand, Revenue Secretary Ajay Bhushan Pandey has predicted that he will meet tax targets for the year. He also rubbished claims that a flawed GST was the reason for the slowdown. He expects the economy to revive in the second half of this fiscal year.

He is both right and wrong. He should not be in any denial that GST needs more fixing, especially in the services area, where there is still a lot of pain. The Indian economy is driven by services, and not manufacturing or agriculture. While agriculture will benefit from more cash injections from the government, manufacturing has slowed for structural reasons despite being a major beneficiary of GST.

In services, GST rates have been too high and too cumbersome, and more work needs to be done. It is all right if automobiles don’t get duty cuts, for the pain can be borne by cash-rich companies, but in services tax rates need to be rationalised, and the compliance regime simplified further. Most services do not use inputs beyond labour, and thus their effective GST rates are higher than for manufacturing which gets input tax credits.

Moreover, the GST regime for services now involves double jurisdiction by Centre and state, while earlier it was only the central excise department. The pain points may thus have increased under GST. This is the sector to focus regulatory and compliance simplifications on.

However, Pandey is right to rubbish claims that flawed GST is the cause of the slowdown. Both Raghuram Rajan and Abhijit Banerjee have blamed GST for the slowdown.

Correlation is not causation, and it is more than likely that GST compliance is a problem for many businesses today because of the slowdown. Taxes pinch more when business is going downhill.

The drop in GST collections of late can also be the result of the slowdown, and not the other way around.

The slowdown is now well-accepted by government as real, and all its recent actions – from corporate tax cuts to letting the fiscal deficit slide – indicate that it is coming to grips with it. Privatisation of blue chips like Bharat Petroleum will bring in new money, thus enabling the budget to stay within reasonable deficit limits without worsening the slowdown.

The economy will revive with a lag, but during this lag, the government’s critics will have a ball hauling it over the coals. The right time for the critics to maul the government is after February 2020. If there is no revival by then, it would be right to target the government for inaction and inadequate action to reverse the slowdown.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest